Year End Processes Webinar12/28/2022 - 11:19:10 AM

by Dorothy Kauffman-Jobira

Online EBMS Training Event recorded on Thursday, December 8th, 2022. To be notified of upcoming webinars, make sure that you join our email community. In this webinar, Dorothy gives us an overview of the year end processes for EBMS users Positions that may find this session helpful: EBMS Admins, Boo...

Read More Electronic E-filing is now Available1/19/2022 - 11:15:29 AM

by Support Team

Ready to file your 2021 W-2 files online? Let's get started! How it works in EBMS: A separate file is created for the Social Security Administration (SSA) and for each state that has a match in File > Company Information [Advanced]. Registration is needed if it is the first time your company is f...

Read More The 2022 Tax Update is Available for EBMS12/30/2021 - 8:54:45 AM

by Support Team

You are now able to update your tax tables in preparation for processing payroll in 2022. Step 1: Install the Tax Update for PayrollThis update can be installed anytime. Other users may be logged in at the same time. Click Install Tax Update below to complete this step. If you have the EBMS Plus Man...

Read More View the Year End Processes Webinar12/16/2021 - 11:16:22 AM

by Support Team

Online EBMS Training Event recorded on Wednesday, December 8th, 2021.This webinar covers year end processes in EBMS including reconciling accounts, verifying balances, utilities, and understanding &using specific year end reporting. Positions that may find this session helpful: Bookkeepers, Acco...

Read More Prepare for Payroll in 202212/15/2021 - 2:53:01 PM

by Support Team

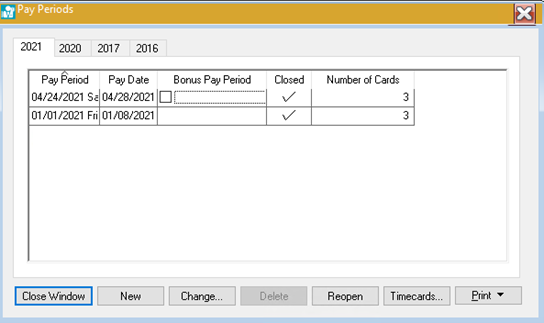

Complete these steps to prepare for payroll year 2022.*Note that this applies only to those using the EBMS Payroll Module 1. Create and process any bonus periods you want to have expensed in 2021 (any bonus pay period with a 2021 pay date).How to Process Bonus Pay Periods2. Ensure that all pay perio...

Read More View the Payroll Webinar11/15/2021 - 10:04:55 AM

by Support Team

Online EBMS Training Event recorded on Wednesday, November 10th, 2021.This webinar covers preparing your EBMS payroll for the end of the year. Positions that may find this session helpful: EBMS administrators, Payroll adminSkill Level: Basic to Intermediate Q&A When using the time track app, how...

Read More Preparing EBMS for the New Year11/1/2021 - 2:11:48 PM

by Support Team

Open Fiscal Year 2022 As we approach the end of 2021 and prepare for 2022, you need to open fiscal year 2022 in EBMS so you can process transactions in the new year. Opening the new year will close fiscal year 2020, however, you will still be able to make transactions in 2021. We recommend running ...

Read More Electronic W-2 Filing is Now Available in EBMS...1/19/2021 - 11:00:53 AM

by Support Team

Ready to file your 2020 W-2 files online? Let's get started! How it works in EBMS: A separate file is created for the Social Security Administration (SSA) and for each state that has a match in File > Company Information [Advanced]. Registration is needed if it is the first time your company is f...

Read More Are you ready for payroll in 2021? 1/5/2021 - 11:00:37 AM

by Support Team

Complete these steps before processing payroll in year 2021.*Note that this applies only to those using the EBMS Payroll module. 1. Create and process any bonus periods you want to have expensed in 2020 (any bonus pay period with a 2020 pay date). How to Process Bonus Pay Periods2. Ensure that all p...

Read More Payroll Tax Update for 2021 is now available!12/30/2020 - 11:05:32 AM

by Support Team

The 2021 Tax Update is Available for EBMSYou are now able to update your tax tables in preparation for processing payroll in 2021. Step 1: Install the Tax Update for PayrollThis update can be installed anytime. Other users may be logged in at the same time. Click Install Tax Update below to complete...

Read More