Complete these steps before processing payroll in year 2021.

*Note that this applies only to those using the EBMS Payroll module.

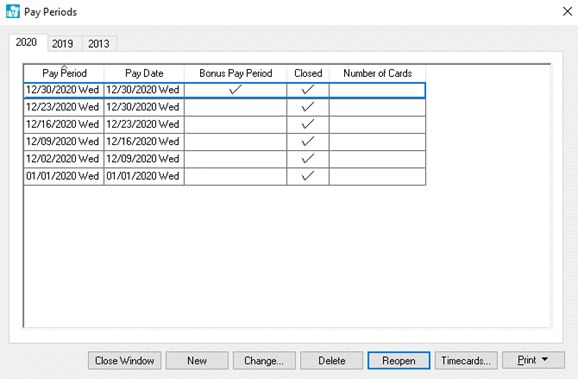

1. Create and process any bonus periods you want to have expensed in 2020 (any bonus pay period with a 2020 pay date). How to Process Bonus Pay Periods

2. Ensure that all pay periods that have a 2020 pay date are completed and closed.

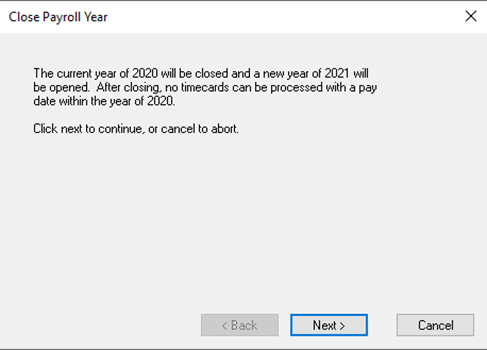

3. Close payroll year 2020 and open payroll year 2021. (Payroll > Close Payroll Year)

4. Install 2021 Payroll Tax Update available now!

You are now able to update your tax tables in preparation for processing payroll in 2021.

5. Print out the EBMS Payroll Checklist for a complete list of payroll year end processes.

Did you order your tax forms yet? Get them on our website today.

If you have any questions or concerns on updating payroll in preparation for 2021, please email us at Support@EagleBusinessSoftware.com or call

717-442-3247 x2.

Kind regards,

Eagle Business Software