Account Reconciliation Overview

Any General Ledger account can be configured to be listed on the Account Reconciliation list within

EBMS. Regular reconciliation of balance sheet accounts (assets & liabilities)

are very important to insure the integrity of your financial statements.

Account

Reconciliation Webinar

Reconciling

GL Accounts ERP Support Training

Complete the following steps to reconcile accounts:

Run the system utilities to verify that all EBMS totals are

validated by selecting option from the main EBMS menu. Review

[Main]

Utilities > Maintenance Utility for details on running this

utility and correcting any errors.

Go to

from the main EBMS menu to open the following Account

Reconciliation dialog as shown below

:

Show all the accounts that you wish to reconcile: Only the general

ledger accounts that have the Reconcile

option enabled will show on the Account

Reconciliation list as shown above. Review the Chart

of Accounts > Changing Account Information section for more

details on changing the Reconcile

option.

Click on the Post All Transactions

button to post all financial transactions. Review the Transactions

> Transactions Overview section for more details on posting

transactions.

Identify the account Classification

as shown in the reconciliation list shown above and following the

instructions within the appropriate classification.

NOTE: Verify that the account Classification

is correct if the balance does not reconcile in any of the steps below.

Review Account Classification including

Cash Flow, Reconcile, and 1099 format settings section for more classification

details.

Note that only the balance sheet accounts (assets, liability, and capital)

are listed below.

Account Classifications

The classification list below includes some of the following tags to

assist with reconciliation.

(Combine) vs (Separate): Some classifications are easier

to reconcile if you combine all the financial accounts with the same classification.

For example, EBMS allows the user to create multiple accounts receivable

accounts (AR) within the general ledger. The easiest way to

reconcile AR is to evaluate the totals of all AR accounts as a unit and

then evaluate individual accounts as a second step. Classification reconciliations

with the (Separate) tab may not benefit from a group evaluation.

Accounts Payable: (Combine)

Review the Reconcile A/P Balance section

within AP Transactions >

Accounts Payable Transactions for reconciliation details, balance

information, reports, and other details.

Accounts Receivable: (Combine)

Review the Reconcile A/R Balance section

within [Sales]

General Ledger Transactions > Accounts Receivable Transactions

for reconciliation details, balance information, reports, and other details.

Allowance for Uncontrollable A/R:

These accounts are not managed by the software and should be adjusted

by an accountant or financial staff. Launch the

report by selecting from the

main EBMS menu to summarized transactions by date.

Bank Account and Credit Card Account:

(Separate)

A bank account record should be reconciled regularly with the bank’s

statement. Review the Reconciling

a Bank Account section for specific details on reconciling a bank

account.

Capital Investments and Capital Withdrawals:

(Separate)

These accounts are not managed by the software and should be adjusted

by an accountant or financial consultant. Launch the

report by selecting from the

main EBMS menu to summarized transactions by date.

Cash: (Separate)

Review the Customer

Payments > Cash Accounts, Deposits, and Reconciling Cash section

within the Sales documentation for specific details on reconciling a cash

account.

Costs in Excess of Billings asset account, Billings in Excess of Costs

liability account, and the Work in Process Variance accounts (Combine)

All work in process (WIP) accounts should balance between all WIP accounts.

All WIP financial accounts should only contain transactions created by

the work in process utility. These accounts should not contain any transactions

created by any other source. EBMS will create transactions for either

the Job Complete transactions

or the Percent Complete WIP method.

Review Work in Process

> Processing Work in Process for details on these transactions.

Launch the report from

the menu to list all work

in process transactions.

Match the Year and Month report prompts to the reconcilable

period.

Compare the Billings in Excess and

the Costs in Excess totals to the general ledger balances.

Note that the Work in Process utility must be run after a job is completed

to update any work in process transactions.

Customer Down Payments (Combine)

Transactions are created to this account when a down payment is applied

to a sales order. Note that a payment may be recorded in EBMS as a down

payment if a payment was made to a sales invoice and then unprocessed

to a sales order. See the Customer

Payments > Down Payments section of the sales documentation for

details on this process.

Launch the report from the menu to list the customer down payment amounts.

Set the Down Payments

as of date on the report prompts to equal the end of the period that

is being reconciled. Enable the Show

G/L Reconciliation prompt and click Print

Preview to view the report as shown below:

Compare the Down Payments

total to the Balance of the G/L Account

as shown above.

Customer Gift Cards (Separate)

This liability account is used to record the value of gift cards

sold to customer until they are redeemed. Review the Payment

Card Processing > Gift Cards > Gift Card Overview section of

the sales documentation for gift card details.

- Compare the gift card liabilities from your gift card merchant

account with the balance on this liability account.

Customer Retainage (Combine)

Transactions are created for this account in the customer retainage

within the EBMS job costing tool. See Retainage

> Entering Customer Retainage of the job costing documentation

for details on this process.

Launch the report from the

menu.

Set the Calendar Month

and Fiscal Period on the report

prompts to equal the end of the period that is being reconciled.

Compare the Total Retainage

to the financial account Balance

as shown above.

Depreciable assets, Accumulated Depreciation,

Non-depreciable Asset, Intangible Asset, and Accumulated

Amortization (Separate)

The following steps are only needed if the EBMS deprecation (fixed asset)

module is present. Contact the accountant or financial staff that is responsible

for fixed assets and depreciation to reconcile these accounts.

Launch the from the main EBMS menu. Review the Account

Reconciliation > Verifying General Ledger Balances Utility

section for more details.

Verify that the Month

and Fiscal Year setting on

the utility matches the end of the last open fiscal period

.

The Accumulated Depreciation

and the Depreciable Assets

balances on the left column of the utility reflects the total of all

the depreciation financial accounts. If the either balance needs to

be adjusted be one of the following:

Verify that all deprecation asset accounts in the general

ledger are classified as Depreciable

Asset or Accumulated Depreciation.

Use a journal entry to adjust these depreciation balances.

Review the Journals >

Creating Journal Entries documentation.

If either Depreciable Items

balance on the right column is incorrect then run the following report

within :

Launch the Accumulated

Depreciation Reconciliation reports to list the detailed

Accumulated Depreciation

detail as shown below:

Compare the report Subtotal

for each GL Account Balance

with the total of all the assets within each account group. The

Accumulated Balance must

equal the GL account balance, the annual accumulated amount should

equal the depreciation credits for the same year, and the Previous Years amount should

equal the balance for the beginning of the year.

Launch the Depreciation

Reconciliation reports to list the detailed Accumulated

Depreciation detail as shown below:

Compare the report Subtotal

for each GL Account Balance

with the total of all the assets within each account group. The

Current Balance must equal

the GL account balance, the annual asset amount should equal the

amount of any assets purchased the same year, and the Previous

Years amount should equal the asset value balance for the

beginning of the year. The Difference

should always be zero. If not as shown in the 2nd asset GL group

above, an adjustment must be made.

Inventory and Other Inventory (Combine)

Review the for instructions

to properly manage both perpetual track count inventory and other inventory.

Investments (Separate)

Total value of the investment

- Compare the total value of the investment with the balance of each

asset account. Use a separate software to manage investment

accounts since EBMS does not contain an investment module. Launch

the by selecting from the main EBMS menu to summarized transactions

by date.

Loan Receivable (Separate)

Total value of the loans offered to others

- Compare the total principle amount of the loans given to individuals

or companies with the balance of each loan asset account. EBMS does

not contain a loan management module to amortize or process loans.

Launch the report by

selecting from the main

EBMS menu to summarized transactions by date.

Loans Payable (Separate)

Total value of loans borrowed from a financial institution

- Compare the total principle amount of all loans from financial

institutions, individuals, or companies with the balance of each loan

liability account. All loan payments should debit both the loan payment

account for the principle amount and an interest expense for the interest

payment. Launch the

report by selecting from

the main EBMS menu to summarized loan transactions by date.

Other Deferred Income: (Separate)

This account classification should be used only for unmanaged prepaid

sales. Any down payments managed by EBMS should use the Customer

Down Payment classification. Launch the

report by selecting from the

main EBMS menu to summarized transactions by date.

Other Payables: (Separate)

This account classification should be used only for payables besides

accounts payable, tax payables, loans payables, and any other payables

managed by EBMS. The Other Payable

classification requires manual reconciliation since EBMS does not reconcile

these accounts. Review the Accounts

Payable and Tax Payable

classification for reconciliation details for standard payable accounts.

Launch the report by selecting

from the main EBMS menu to

summarized transactions by date.

Other Prepaid Expenses:

This account classification should be used only for unmanaged prepaid

expenses. Any vendor down payments or prepaid expenses managed by EBMS

should use the Vendor Down Payment

classification. Launch the

report by selecting from the

main EBMS menu to summarized transactions by date.

Other Receivable: (Separate)

This account classification should be used only for receivables besides

accounts receivables, loans receivables, and any other receivables managed

by EBMS. The Other Receivables

classification requires manual reconciliation since EBMS does not reconcile

these accounts. Review the Accounts

Receivable and Loans Receivable

classifications for reconciliation details for standard payable accounts.

Launch the report by selecting

from the main EBMS menu to

summarized transactions by date.

Payroll Payable: (Combine)

The payroll payable account is somewhat simple to reconcile.

The EBMS financial system should only have a single account classified

as Payroll Payable. Open the

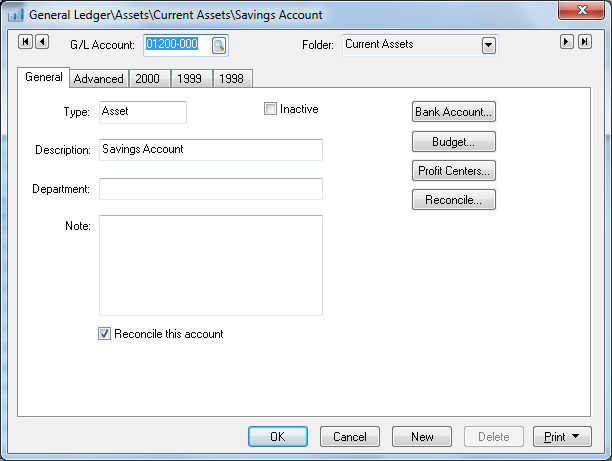

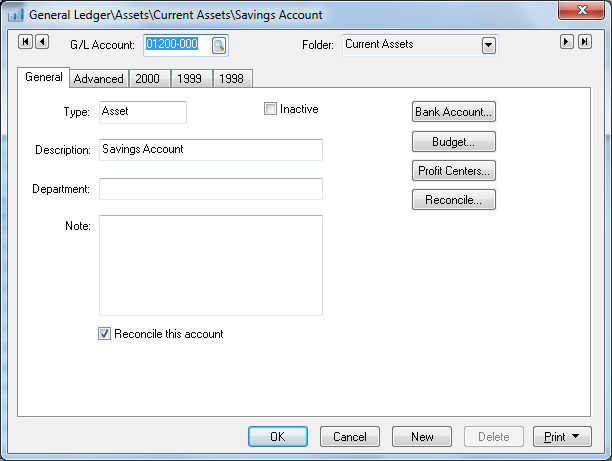

general ledger account as shown below:

The YTD Balance should

equal zero for the current payroll month as well as any future months.

Since the payroll payable account holds the labor that has been performed

and not paid, the Payroll Payable

balance should be zero when the payroll is completed processed. Verify

that no detail lines have been processed for any open pay periods

if this value is not zero. Review the Processing

Payroll > Process Detail Lines Before Payroll is Processed

section of the labor documentation for more details on processing

detail lines or the payroll payable account.

Review payroll payable transaction report options by selecting from the main report menu.

Payroll Tax/Deduction (Separate)

The important step of reconciling individual payroll tax and deduction

liability accounts depends on the payment pay frequency. Reconcile tax

and deduction accounts frequently because of the volume of transactions

that are posted to these accounts. Review [Labor]

Taxes and Deductions > Adding New Taxes and Deductions for setup

instructions. See reconciliation instructions below:

- Launch the report by selecting

from the main EBMS menu.

Note the Debit,

and Credit summary values

as well as a running Balance

amount for each Date as shown

below:

- An alterative way to review monthly values as well as a convenient

way to drill down on each total is to open a liability tax or deduction

account from the

list as shown below:

- The Credit column records

the amount of tax deducted. Since the tax shown above is paid at the

end of each quarter, the January debit amount equals the beginning

balance, and the April payment equals the YTD balance at the end of

March. Use the

reports to list the detailed transactions for a specific month.

Retained Earnings (Separate)

This important setting is used to record the accumulated net income

that is retained by the company. This cooperate term should be used to

classify the account that reflects the net income/loss for the current

fiscal year. The Retained Earnings

account is used within EBMS to record the accumulated net income of a

sole proprietor, the temporary account for a partnership, or the retained

earnings for a corporation. Multiple Retained

Earnings accounts may be used to record funds within a nonprofit

organization. Review the Financials

> Fund Accounts > Creating Fund Accounts section for details

on funds.

Open a financial account classified as Retained

Earnings within the Financials

> Chart of Accounts list launched from the EBMS menu.

Click on the Income / Expense

tab as shown below:

Each income and expense account that has the current retained

earnings account set in the Advanced

tab will be shown on this list. Note that the chart of accounts within

most companies have a single account classified as Retained

Earnings so all P&L accounts would be listed on this account.

Review the advanced tab section of the Chart

of Accounts > Changing Account Information documentation for

details on viewing or changing the Retained Earnings Account setting

within an income or expense account.

Note that the Net Profit /

Loss amount at year end will be added to the beginning balance

of the following year. Use the P&L statement reports (

from the main EBMS menu) to view the net profit and loss for past

years.

Sales Tax: (Separate)

EBMS contains many powerful tools to automate the sales tax calculation

as well as organize the liability accounts to record the amount of sales

tax collected and payments. Review the Sales

Tax > Establishing Sales Tax Rates section of the sales documentation

for instructions to setup and view liability accounts.

The liability accounts classified as Sales

Tax should be reconciled each time a sales tax payment is made.

Review the Sales

Tax > Paying Sales Tax section of the sales documentation for details.

Salesperson Commission (Separate)

Unpaid salesperson commission is recorded in a liability account by

the commission module until the salesperson is paid. Review the Sales

Person Commission > Sales Person Commission Overview section of

the sales documentation for details.

Vendor Down Payments (Combine)

Transactions are created to this account when a down payment is applied

to a purchase order. Note that a payment may be recorded in EBMS as a

down payment if a payment was made to an expense invoice and then unprocessed

to a purchase order. See Vendor

Payments > Invoice or Purchase Order Down Payments for details

on this process.

Launch the report from the menu to list the down payment amounts.

Enable the Show G/L Reconciliation

prompt and click Print Preview

to view the report as shown below:

Compare the Paid total

to the asset account Balance

as shown above.

Vendor Retainage: (Separate)

Unlike customer retainage, vendor retainage is not managed by the EBMS

job costing system. These accounts should be adjusted by an accountant

or financial staff.

Review the Account Classification

including Cash Flow, Reconcile, and 1099 format settings section for

instructions to review the account Classification

options.

The Account Reconciliation list

is also a convenient way to review account balances. Click on the Post All Transactions button in

the lower left hand corner to update balances since transactions do not

show on the reconciliation tabs until they have been posted to the general

ledger.

Steps for Reconciling an Account

Select an account and click on the

Properties button in the lower

right hand corner to open the following dialog.

The Reconcile this account option

must be enabled to include an account on the Account

Reconciliation list.

Click on the Reconcile button

to open the Account Reconciliation

dialog from the Account Reconciliation

list, as shown below:

NOTE:

The last two tab labels will change depending on what type of account

is being reconciled. The naming of the two tabs is based on the account

classification.

See the following for a breakdown of how the

tabs are named based on account classification.

Bank Accounts

will call the tabs Deposits

and Checks.

Cash Accounts

will call the tabs Cash In

and Cash Out.

Sales Tax

Accounts will call the tabs Payments

and Collected.

Payroll Taxes

Payable Accounts will call the tabs Payments

and Withheld.

Accounts with no classification will call the tabs

Debit and Credit.

Statement settings

Set the account Ending Date to reflect the date that

you wish to reconcile.

For example, if you are reconciling a bank account, enter the bank

statement date in the Statement Ending Date field. All transactions

with a date more recent than the Account Ending

Date will be hidden and not be displayed in either tab. If

you wish to display all transactions, set the date to the last date

of the fiscal year. The Account Balance

total reflects the general ledger balance as of the reconciliation

date.

The Beginning Balance should

be copied from the previous reconciliation. Right click on the

Beginning Balance entry and disable the

Read Only option to enter a beginning balance

amount.

Enter the Account Ending

Balance as of the ending date entered above.

For example, if you are reconciling a cash account, enter the total

monies that you have collected but not deposited including cash, personal

checks and credit card payments. To reconcile a payroll tax withheld

general ledger account, enter zero into the statement entry field.

The Account Ending Balance in most situations will not match the Statement

Ending Balance since some transactions may be outstanding. The main

purpose of this window is to reconcile the general ledger balance

with the statement balance by identifying all outstanding transactions.

Go to the second tab (Cash

In, in the example above) and notice the list of debit transactions.

To sort the list of transactions by date, first drag the scroll bar

to the top and click on the Date

column heading. Click on the heading a second time if the dates are

listed in descending order.

The first column on the list is labeled Status. This is a check-mark

column that identifies the transactions that are NOT outstanding

with a check mark.

The total on the bottom right side of the tab

is the sum of all the outstanding transactions. As the transactions

are checked on, the Outstanding Total decreases.

Use the Unselect All and the Select

All buttons to mark the entire list.

Go to the third tab (Cash

Out in the example above) and notice the list of checks. Transactions

need to be switched in the Status

column the same way as the previous tab. As transactions are checked,

the totals on the bottom of the window will be changed.

Explanation of Figures

This amount must be zero indicating that the account reconciles before

processing can be completed. The Process

button will be disabled until the account is reconciled.

A transaction can be voided with the Void

button. Not all transactions can be voided from this window. Typically,

only checks and deposits can be voided.

The Process button will remove

all the marked transactions. The process performs the following items:

Removes all transactions turned ON, leaving only the

outstanding transactions.

The User, Date,

and Time information in the

Last Reconcile area of the

Controls tab is updated.

Click the Source button to view

the source of a transaction. The system will display the source of the

transaction by opening the invoice, journal, payment, or other appropriate

window.

Click the Adjustments button

to insert adjustment transactions directly into the tab. Review General

Adjustments for more details on general adjustments.

The Print button works like

other print buttons and can have reports linked to it to select or reports

can be added by selecting Add Report.

The Wizard button will list

the available wizards for this window and account. See the Reconciling

Checking Account section for more details.