The sales tax rates are applied to invoices and items using an intelligent process rather than requiring the user to manually associate rates to customers, jurisdictions, or items. EBMS associates one or more sales tax rates to be applied to a sales invoice. The tax rate(s) are determined within an invoice using the following criteria:

Shipping address -

The sales tax rate will be determined by the shipping address within

a sales invoice's Ship To tab only if the Ship

Via setting within the invoice indicates that the product is

being shipped. The sales tax for all orders that contains a Shipping Method with a rate type

of Customer Pickup is calculated

using the company address (see explanation below). Go to Sales

> Options, select a Shipping

Method by clicking on the Properties

button, and review the Rate Type

setting. See the Calculating

Freight Charges on Sales Invoice section for more details on the

Ship Via setting.

The city, state, and country taxes are derived directly from the shipping

address entries. The county is determined from the county setting

within the zip code table. Review [Main]

Getting Started > System Options to view or change the zip

code table.

Company location - All invoices that are not being shipped will be charged the sales tax rate derived from the company address. Multiple company locations or divisions can be setup within a single EBMS data set. Review the Getting Started > Company Setup > Company Profiles section of the main documentation to view or change the company address. Review Multiple Locations for instructions to setup multiple sales locations for the same company.

Customer's tax exemption settings: A customer's terms can be set to be exempt from sales tax. Review Configuring a Tax Exempt Customer for details.

Product groups or categories may effect tax rates: Multiple EBMS Inventory Tax Groups are created to facilitate multiple tax rates or exemption rules based on specific product groups. This advanced option allows the software to handle very complex sales tax requirements. Review the Inventory Tax Groups section for more details.

User defined rate: The sales tax rate can be manually set within an invoice. Review the Changing the Tax Rates Within a Sales Invoice section for more details.

Most sales tax rates are based on a percentage of sales. EBMS does include tools to calculate taxes such as fuel taxes or FET taxes based on a flat rate. Review the Calculating Fuel Taxes section for a sample setup of a flat rate fuel tax.

EBMS includes robust tools to calculate and manage various sales taxes using one of the following options:

EBMS also contains the tools to manage and calculated more advanced taxes:

VAT or Luxury Taxes: Review Luxury, VAT, Sales Tax Minimums and Maximums for more details on minimum and maximum settings.

Fuel taxes: Review Calculating Fuel Taxes for more details on setting dollar based taxes instead of percentage rates.

It is important to configure EBMS properly to match the sales tax laws of each state. A company can dramatically increase their chances of audit, fines and repayment if these settings are ignored. Review Origin vs Destination Sales Tax for configuration details.

There are two methods available to handle the payment of sales tax collected to the sales tax agency:

TaxJar sales tax service: TaxJar > AutoFile to review instructions to allow TaxJar to file sales tax returns.

Using EBMS to manage sales tax payments: Review Paying Sales Tax for instructions to calculate the amount of tax payable to the tax agency and generate payment.

See Reviewing Tax History to view the sales tax history for a specific tax rate or jurisdiction.

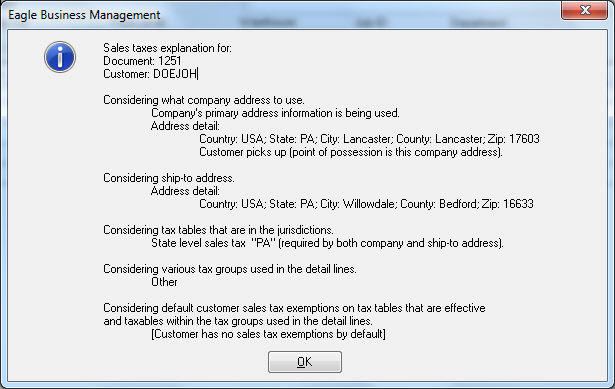

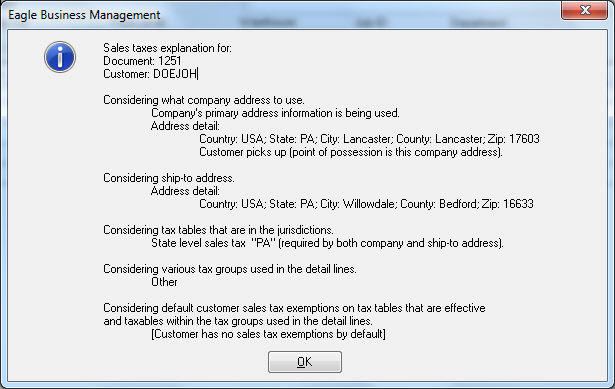

The EBMS software will explain the process used to calculate sales tax because of the varied factors involved in sales tax calculation. This explanation can be accessed by clicking on the View > Sales Tax Explanation from the sales invoice menu as shown below. The first dialog is if the EBMS sales tax process is used and the 2nd is the data sent to TaxJar.

Note: It is very important to set up the sales tax rate tables properly or configuring the TaxJar service before proceeding with the sales invoice processing within EBMS.