Paying Sales Tax

EBMS includes a step by step payment wizard to pay the sales tax that

has been collected from customers. The payments can be based on an accrual

or cash method. The payment method must be set within the tax rate record

before proceeding with the Pay Sales

Tax wizard.

These tools can be used in connection with the TaxJar SmartCalc sales

tax calculation tool. This section can be ignored if

the TaxJar > AutoFile tool is used to

pay sales taxes.

- The first step is to properly set up the tax agency as

a vendor. This step can be ignored if the vendor has already been

created.

- Open the tax agency vendor. See [Financials]

Vendors > Adding a New Vendor of the main documentation

for more details on creating a new vendor.

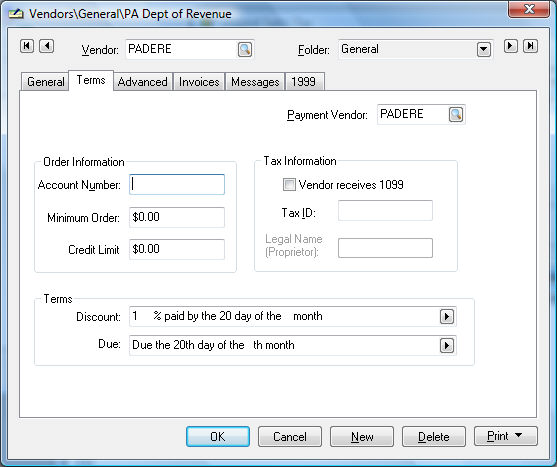

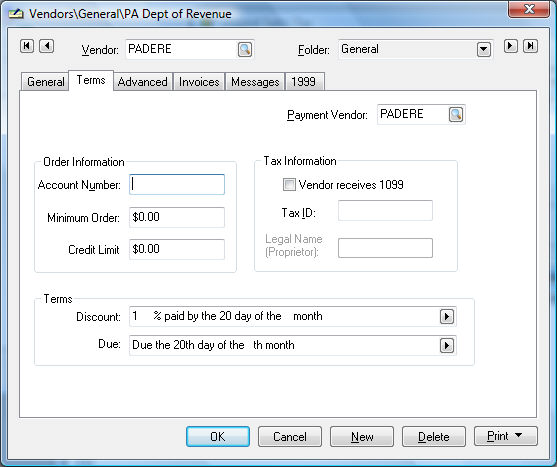

- Click on the terms tab of the vendor and set the

proper terms.

.

- Set the discount terms to the proper percentage if

the tax agency gives the tax collector a percentage for the collection

costs. The Discount and

Due settings shown above

are the appropriate settings if the state gives a 1% discount

and the payment due date is the 20th of the month.

- Set the proper terms so the sales tax is paid by

the due date.

- Save this vendor by clicking OK.

Enter the vendor ID into all sales tax rate tables that

are paid to the specific tax agency. This step must be completed

before launching the next step - Pay

Sales Tax wizard.

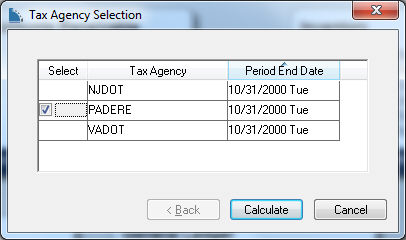

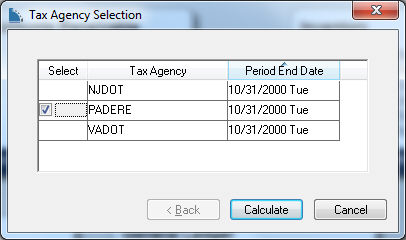

- Launch the Pay Sales

Tax wizard by selecting from the main EBMS menu.

- Select each Tax Agency

that is to be paid by clicking on the Select

column.

- Click the Calculate

button to open the following Unpaid

Sales Tax list:

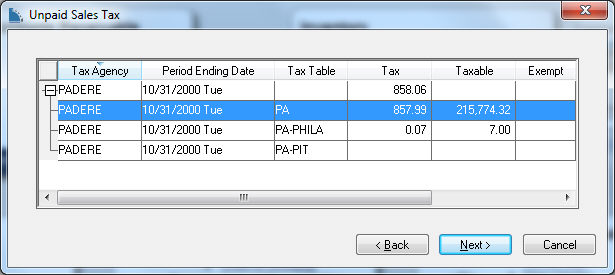

.

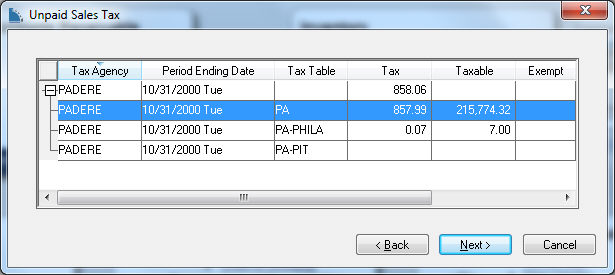

- Review the tax values for each Tax

Table associated with the selected Tax

Agency. Click Next

to open the following dialog:

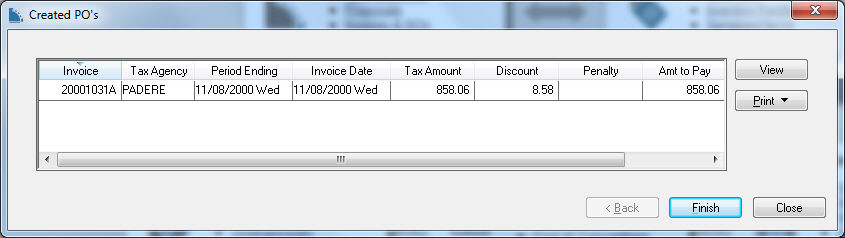

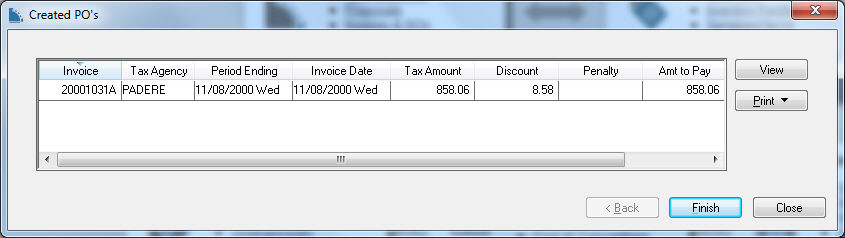

- Enter any necessary Penalty

fees.

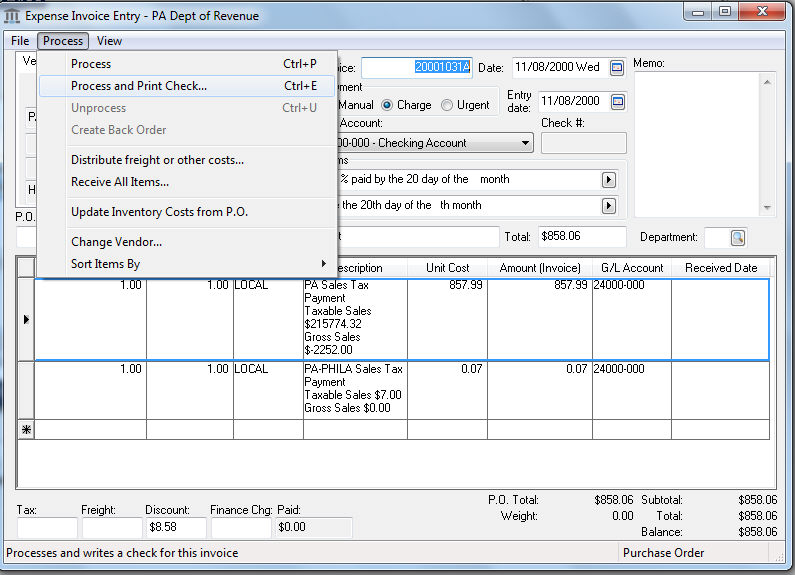

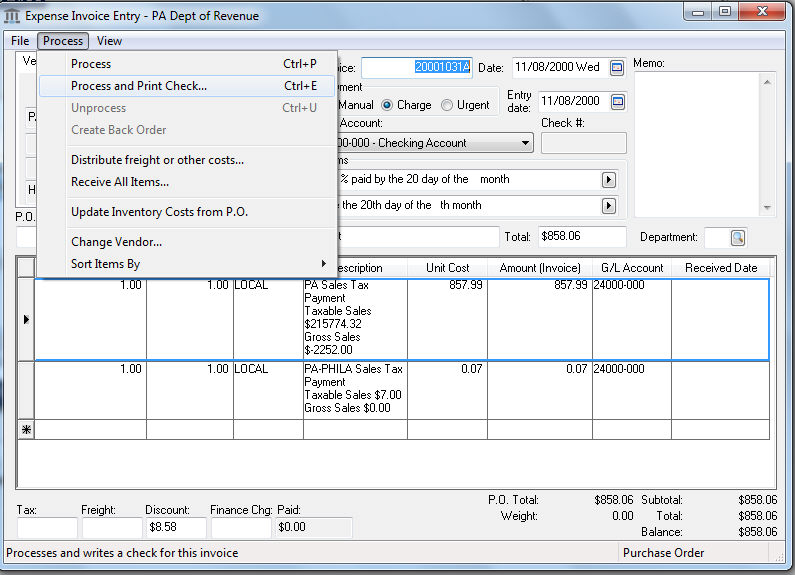

- View and process the payment expense invoice by selecting

the invoice and clicking on the View

button.

- Reports can be printed to list the transaction detail

by selecting the appropriate report from the Print

button. Review [Main]

Reports > Print Button for instructions to add specific sales

tax reports to the Print button.

- Repeat for each sales tax invoice. Click Finish

to complete process.