How do I return an item/credit to the customer?

How do I print a check – I can't find the report?

How do I print a check – my margins are off?

Where is a report that shows my Sales, Expense or Inventory based on this or that parameter?

Why does my General Ledger not balance?

Why are my inventory Costs or Prices off on a Sales order or Manufacturing Batch?

Why can't I reconcile my checking Account; I can't get it to a Zero difference?

Why don't my gross sales on my Sales Tax report match my total income on my P&L?

How can I reprint my bank reconciliation report?

How can I easily see my bank balance?

Is there a report showing my checks that I just wrote?

Is there a way to re-print a payroll check?

Why can't I find the payment in the deposit screen when my customer invoice shows it was paid?

Why is my customer payment showing in the direct deposit screen when the invoice is still outstanding?

Why do I have an invalid G/L account when I try to post/deposit?

Why is my check or payment for the same vendor splitting into different checks?

How can I write off bad debt?

How do I return an item/credit to the customer?

Create a Sales Order for the customer returning the product. Enter the return as you would enter a typical sale to the customer, however, enter the quantities as "negative" values. This will turn your sale into a refund and add the items returned to your On Hand Inventory count, (i.e. if the items have a classification of Track Count and purchase method of Stocked).

Next choose whether you wish to print a refund check (click Check payment method), pay cash for the refund (click Cash payment method), or apply the credit to the customer's account (click Charge payment method). If you select Check, verify the correct Bank Account to pay from is selected, leave the Print Credit Check switch turned on, then click Pay & Process. Click OK to proceed with the refund check, verify the check number and bank account in the Print Check dialog, then click Print to continue writing the check.

Back to top

How do I print a check – I can't find the report?

Check reports are configured in the bank account window.

- Go to Expenses>Bank accounts, and double click the bank account from which you desire to write checks.

- Click the reports tab.

- For vendor payments, click the Select Report button next to the accounts payable field, and browse to Expenses > Forms, and choose the desired check report.

- For payroll payments, click the Select Report button next to the payroll field, and browse to Payroll>Forms and choose the desired check report.

- Click the drop down to choose your desired configuration: checks printed in the middle or checks printed on the top.

- If you are using pre-printed checks, select the pre-printed box.

You will then be ready to print both accounts payable and payroll checks.

Back to top

How do I print a check – my margins are off?

- Sometimes when printing checks you will need to make minor adjustments so that EBMS prints in the correct areas of the check.

- The most common adjustment is to adjust the top margin down so there is more space at the top of the check as well as pushing the printing on the check downward.

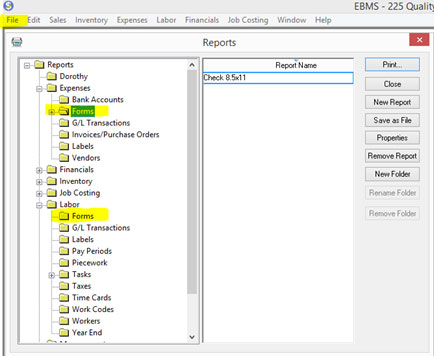

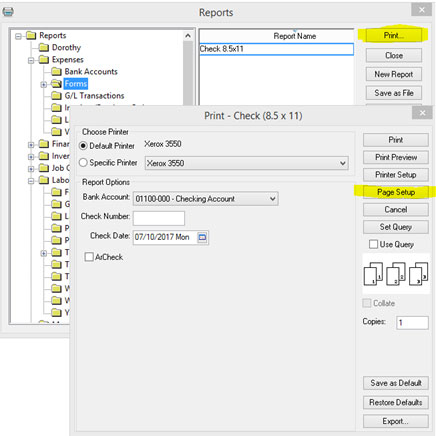

- To make an adjustment of the top margin, go to the File Menu and then the Reports Menu. On the Reports Menu go to the Expenses Folder and the Forms Folder. For Payroll Checks, go to the Payroll Folder and then the Forms Folder.

- Select the 8.5x11 Report.

- Now Click the Prints and then Page Setup.

- Adjust the top Margin to .5 and make sure you click Save as Default in the Print Dialog.

- Make additional adjustments as needed.

Back to top

Where is a report that shows my Sales, Expense or Inventory based on this or that parameter?

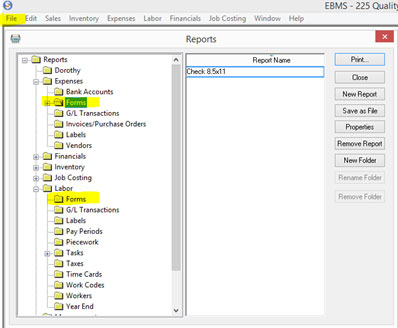

Reports can be accessed from many places throughout EBMS. If you wish to access all reports that exist in EBMS go to the EBMS Navigator (home screen) and click File>Reports and visit the folder containing the category you wish to peruse – Sales, Expenses, Inventory (or Products), General Ledger (or Financials), Payroll (or Labor), etc.

The reports folder named System Folders contains a duplicate copy of reports that are set as default reports within EBMS. You may select any folder and click Print to bring up the print dialog where you can choose criteria to pull your report. You may choose Print to print the report, or choose Print Preview to view the report on your computer screen.

Back to top

Why does my General Ledger not balance?

Many times, an unbalanced journal entry is the cause of an unbalanced general ledger. Another possible cause is network or data connection errors that resulted in unbalanced postings.

Back to top

Why are my inventory Costs or Prices off on a Sales order or Manufacturing Batch?

Sales Order selling price:

- Do you have the correct Price Level selected?

- Is the Price Level formula correct for this item?

- Right click on the Inventory ID and click Lookup.

- View the Pricing tab and check the Price Level formula.

- Also check the Markup formula that sets the value for Base Price. Is that formula correct? (Most Price Level formulas work off of the Base Price.)

- If the switch beside Cost named 'Update from Purchases' is turned on it means the cost will be updated when a Purchase Order is processed into an Expense Invoice.

- Was a PO processed recently that changed the cost and therefore changed the Base Price and Price Level selling price?

- Is a Special Pricing record set for this customer and item?

- Check by right clicking on the item in question and click View Special Pricing. If so, a description of the Special Price will be listed.

Sales Order & Manufacturing cost:

- Is cost not matching the cost on the Pricing tab of the item?

- To track the Inventory costs of Track Count, Stocked items, EBMS uses FIFO (First In First Out) which means if you buy new stock but have existing stock to get rid of, EBMS will continue linking the cost of the existing stock until all of it has been sold before it starts linking the cost of the new stock. E.g. if you buy 10 items at $10.00 cost and buy 10 more at $8.00 when you still have 5 in stock, EBMS will link the 5 remaining items with a cost of $10.00 before it starts linking the new stock that has the reduced cost.

Back to top

Why can't I reconcile my checking Account; I can't get it to a Zero difference?

Be sure that your selected totals, (both in the deposits window and the payments window) match the deposits and payments totals listed on your statements. You may have bank fees or interest that need to be added as an adjustment. Make sure you've entered your ending balance correctly. If the ending balance and the deposits and payments totals are all correct, but you still have a difference, this may be an indicator that something has been voided which was previously reconciled.

Please contact our support team for further troubleshooting assistance.

Back to top

Why don't my gross sales on my Sales Tax report match my total income on my P&L?

Your P&L/income statement totals reflect any document (sales invoices, journal entries, expense invoices) that use a sales/revenue GL account. The gross sales on your sales tax report only reflect transactions on AR sales invoices using a taxable GL account.

Back to top

How can I reprint my bank reconciliation report?

- Go to File > Reports > Bank Accounts > Account Reconciliation

- Choose the desired amount

- Enter your statement ending date (alternatively, you can enter the date of the newest transaction in the reconciliation window, if you want to see ALL outstanding transactions, but you will not have a zero-dollar difference on your report if you do so.)

- Enter the statement ending balance (the number to which you last reconciled)

- Print

You can also print the account reconciliation report directly from the reconciliation window. Click the Print button at the bottom of the reconciliation window and choose the Account Reconciliation report. If it is not listed on that menu, click Add Report and choose it from the report menu.

Back to top

How can I easily see my bank balance?

- On the EBMS Navigator (home screen) you may click Bank Accounts, or go to Expenses>Bank Accounts.

- Click yes if prompts pop up asking you to post transactions, and the bank account(s) will indicate the balance in the Bank Accounts window.

- To see account transactions, checks, deposits, etc., click to select and highlight the bank account you wish to view and click Reconcile.

- Or, go to Account Reconciliation and your Bank Account balance will be reflected there.

- Click yes if prompts pop up asking you to post transactions.

- You can also access this by visiting General Ledger (or Financials)>Account Reconciliation. To see account transactions, checks, deposits, etc., click to select and highlight the bank account you wish to view and click Reconcile.

Back to top

Is there a report showing my checks that I just wrote?

No but we do have a bank account register reports under expenses -> bank accounts, that can give you all the activity for a certain day.

Back to top

Is there a way to re-print a payroll check?

Yes, there is a way to re-print a payroll check.

- Open the payroll period in which the check was written. This is only possible in the current payroll year.

- Go to the reconciliation window of the bank account the check was written from, and void the payroll check you wish to re-print. This will make the timecard outstanding again.

- Go to the employee payments window and re-print the check.

Back to top

Why can't I find the payment in the deposit screen when my customer invoice shows it was paid?

The first thing to check, is to make sure the payment was received into the correct account.

- Go the invoice that was paid and click View>Processed Payments.

- Confirm that GL account listed under Cash Account is the deposit account you expect it to be.

- If it is not, you can void the payment, and re-enter it into the correct cash account.

Please contact our support team for further troubleshooting assistance. This can be a data issue that will need to be corrected by one of our data experts.

Back to top

Why is my customer payment showing in the deposit screen when the invoice is still outstanding?

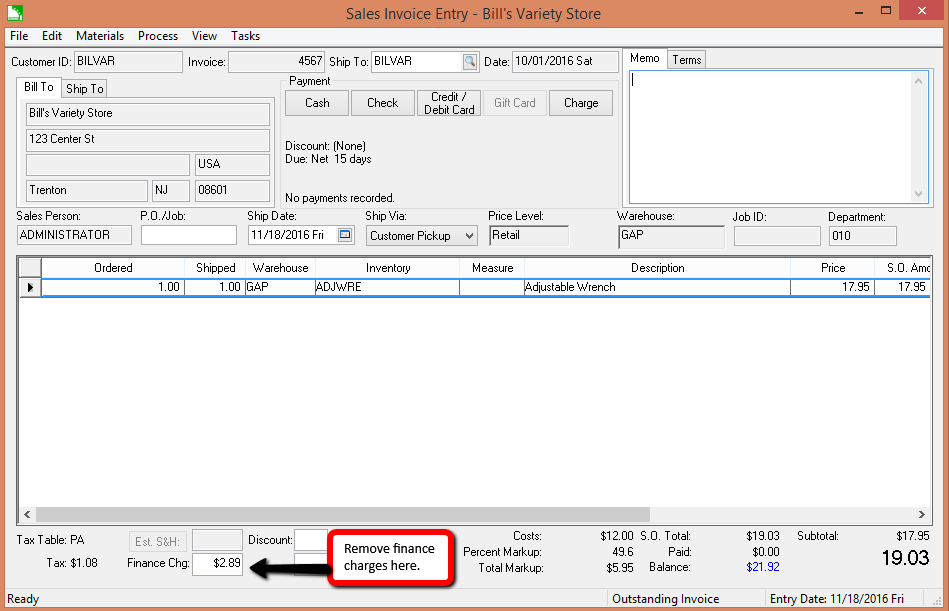

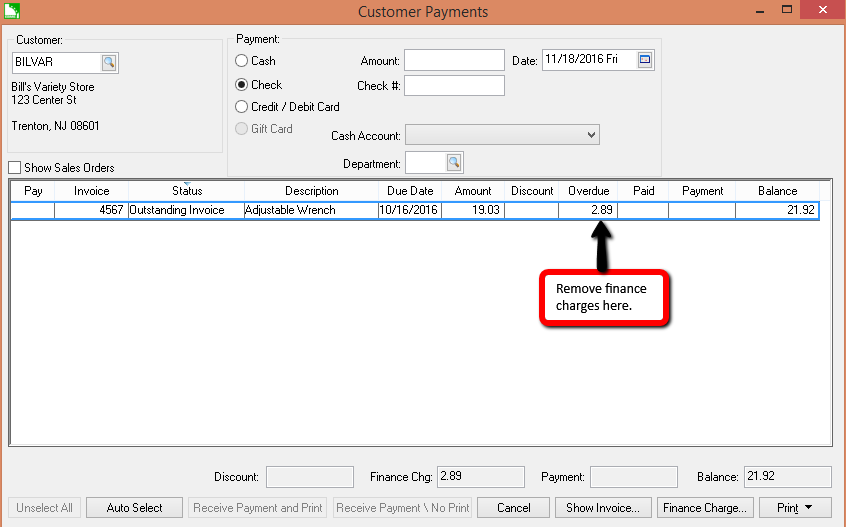

This could be due to finance charges or discounts that remain on the invoice. Those must be cleared or removed and then the invoice will be shown as paid. Network or data connection errors that prevent transactions from posting correctly could also be the cause.

Finance charges can be removed or edited two different ways.

- They can be deleted (or edited) from the invoice itself:

- They can also be deleted (or edited) in the customer payments window:

Back to top

Why do I have an invalid G/L account when I try to post/deposit?

One of your documents contains an invalid (usually blank) G/L account and during the "Process" step, EBMS created a transaction set that contains that invalid G/L. If you go under each module menu you will see a submenu called "Display unposted transactions" and then a list of G/L codes. In one of these screens you will see the invalid G/L account (displayed in red). At the bottom of this screen you will see the option to change this G/L account to a valid account.

Back to top

Why is my check or payment for the same vendor splitting into different checks?

There must be a slight difference in spelling of an address or something (even spaces and caps make a difference) – change EACH expense invoice's "Pay to" vendor to a random vendor then back to the correct vendor and that should resolve the issue.

Look at the name (not ID) of the Pay-to vendor on the expense invoices. If the names are different, even though the ID's are the same, EBMS will create a separate check for each unique name.

Back to top

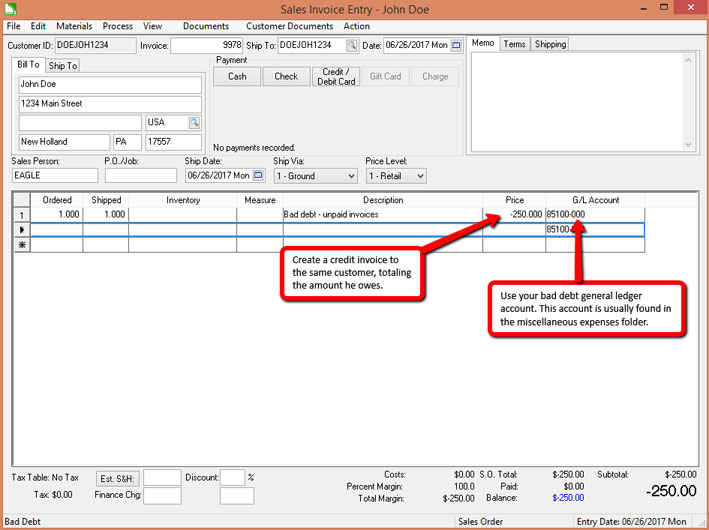

How can I write off bad debt?

At one time or another, most companies will run into a situation where they are unable to collect payment for products or services they’ve delivered. If you have reached the point where you believe you will not receive payment for an outstanding invoice, you can write it off to bad debt by following the steps below.

- Create a credit invoice to the customer who has failed to pay, totaling the unpaid amount.

(Be sure to remove the finance charges from the unpaid invoices, and do not include them in the credit amount.)

- In the detail line of the invoice, use your bad debt general ledger account.

(It is important to use the correct gl account; this credit invoice should be non-taxable.)

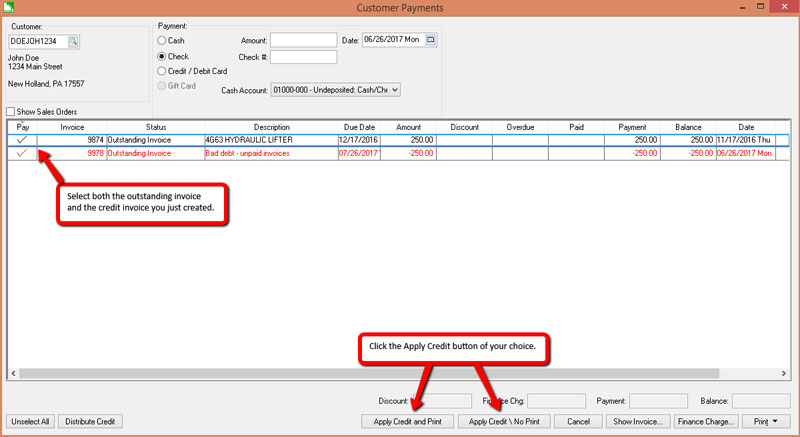

- Process the invoice.

- Go to the customer payments window and enter the customer.

- Select both the past due invoice and the credit invoice you created.

- Click Apply Credit

This process will decrease your accounts receivable and increase your expenses.

Back to top