EBMS gives the manager the tools to set vendor setting defaults so that important standard settings are consistently set for each new account. Configuring accounting defaults in the Advanced tab, setting terms, standard messages, and other important configurations can save the manager a lot of time and make data entry consistent.

It is wise to set customer folder defaults before entering new customers.

If you are not familiar with editing defaults, review Changing

Defaults, Filtering Down Data and Globally Editing Data for more details

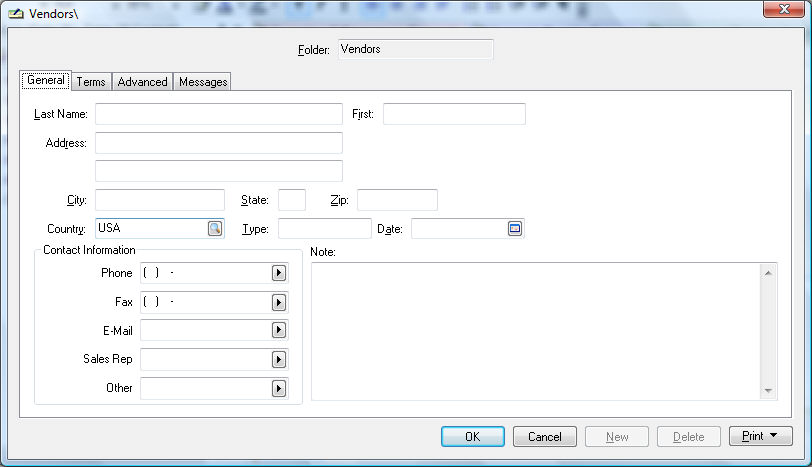

on these important default settings. To continue, select Expenses

> Options > Vendor Folders and click on the root folder named

Vendors and click the Edit

Defaults button. The following window will appear:

The Vendor window appears very similar to the vendor entry window but is used only to enter default values. Any data entered into any of the entry fields will default the next time a new vendor is entered in the main vendor entry window.

EXAMPLE: If you set the country entry field default to "USA," you will not need to enter this data when entering a new vendor.

Suggested Vendor Default Settings

Set the Contact Information field labels to reflect the most common contact information obtained from vendors. Click on the right arrow button to the right of each of the five entry fields, and select a variety of labels.

Set the Lead Time __ days to a value greater than zero to create a default setting. Review [Inventory] Purchasing > Estimate Time of Arrival (ETA) Date for more on this inventory purchasing feature.

Set the Pay-From Account setting if a specific bank account is used for the current group of vendors.

Do not set default values of Terms, Pay-From Account , or other settings if they are not consistent for the current category of vendors.

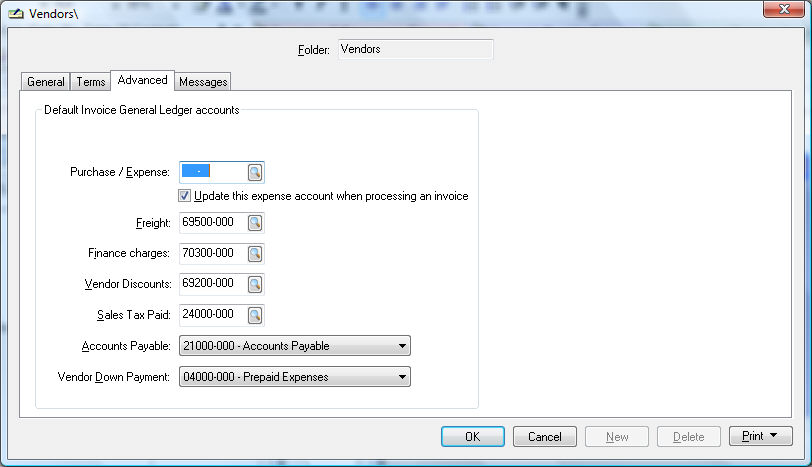

Many of the settings within the Advanced tab should be set before entering or importing vendors since these important settings are normally set by the accounting managers and should be consistent for an entire catagory of vendors.

Enable the Update this expense account when processing an invoice option to record the last general ledger expense account for each vendor each time an expense invoice is processed. Review the Vendor History section for more details on this setting.

Set the Freight general ledger code to an expense account used to record shipping expenses.

The Finance charges general ledger account should be set to an expense account used to record any finance charges paid to a vendor.

The Vendor Discounts general ledger account can be an income account or an offsetting cost of sales account that accumulates any discount earned on an expense invoice. Review the Discounts and Finance Charges section for more details.

Enter an expense general ledger account into the Sales Tax Paid entry field. Do not get this entry confused with the sales tax liability code. The Sales Tax Paid account is used to record sales tax paid to vendors and does not include sales tax paid to the state that has been collected from customers.

Set the Accounts Payable liability account that will be affected when vendor invoices are processed. Most companies use only one accounts payable trade account. Only the general ledger accounts classified as Accounts Payable will be available.

The Vendor Down Payment account records any down payments or deposits paid to a vendor. This should be an asset general ledger account. Only the general ledger accounts classified as Vendor Down Payments will be available.

Enable the Exclude... setting if the entire group of vendors should be excluded form the Auto Send process. Review [Sales] CRM > Auto Send > Overview for details on the Auto Send feature.

If you wish to enter messages that appear on all vendors, enter them into the Messages tab. Review [Main] Features > Custom Messages for instructions to create messages.

To copy the default values from the root folder into the subfolders, filter down each default value for each entry field within each tab. Review [Main] Standard Features > Editing Defaults, Filtering Down Data and Globally Editing Data for detailed instructions on this copy process.

Click the OK button to return to the options window.

Repeat the steps above if you wish to set different default settings for subfolders than the ones set for the root vendor folder.

For more details on individual fields go to Vendors.