Account Reconciliation Overview

Any General Ledger account can be configured to be listed on the Account Reconciliation list within EBMS. Regular reconciliation of balance sheet accounts (assets & liabilities) are very important to insure

the integrity of your financial statements.

Account Reconciliation Webinar

Reconciling GL Accounts ERP Support Training

Complete the following steps to reconcile accounts:

-

Run the system utilities to verify that all EBMS totals are validated by selecting option from the main EBMS menu. Review [Main] Utilities > Maintenance Utility for details on running this utility and correcting any errors.

-

Go to from the main EBMS menu to open the following Account Reconciliation dialog as shown below

:

-

Show all the accounts that you wish to reconcile: Only the general ledger accounts that have the Reconcile option enabled will show on the Account Reconciliation list

as shown above. Review the Chart of Accounts > Changing Account Information section for more details on changing the Reconcile option.

-

Click on the Post All Transactions button to post all financial transactions. Review the Transactions > Transactions Overview section for more details on posting

transactions.

-

Identify the account Classification as shown in the reconciliation list shown above and following the instructions within the appropriate classification.

NOTE: Verify that the account Classification is correct if the balance does not reconcile in any of the steps below. Review Account Classification including Cash Flow, Reconcile, and 1099 format settings section for more classification details.

Note that only the balance sheet accounts (assets, liability, and capital) are listed below.

Account Classifications

The classification list below includes some of the following tags to assist with reconciliation.

(Combine) vs (Separate): Some classifications are easier to reconcile if you combine all the financial accounts with the same classification. For example, EBMS allows the user to create multiple accounts receivable accounts (AR) within

the general ledger. The easiest way to reconcile AR is to evaluate the totals of all AR accounts as a unit and then evaluate individual accounts as a second step. Classification reconciliations with the (Separate) tab may not benefit from a group

evaluation.

Accounts Payable: (Combine)

Review the Reconcile A/P Balance section within AP Transactions > Accounts Payable Transactions for reconciliation details, balance information, reports, and other details.

Accounts Receivable: (Combine)

Review the Reconcile A/R Balance section within [Sales] General Ledger Transactions > Accounts Receivable Transactions for reconciliation details, balance information, reports, and other details.

Allowance for Uncontrollable A/R:

These accounts are not managed by the software and should be adjusted by an accountant or financial staff. Launch the report by selecting

from the main EBMS menu to summarize transactions by date.

Bank Account and Credit Card Account: (Separate)

A bank account record should be reconciled regularly with the bank’s statement. Review the Reconciling a Bank Account section for specific details on reconciling a bank account.

Capital Investments and Capital Withdrawals: (Separate)

These accounts are not managed by the software and should be adjusted by an accountant or financial consultant. Launch the report by selecting

from the main EBMS menu to summarize transactions by date.

Cash: (Separate)

Review the Customer Payments > Cash Accounts, Deposits, and Reconciling Cash section within the

Sales documentation for specific details on reconciling a cash account.

Costs in Excess of Billings asset account, Billings in Excess of Costs liability account, and the Work in Process Variance accounts (Combine)

All work in process (WIP) accounts should balance between all WIP accounts. All WIP financial accounts should only contain transactions created by the work in process utility. These accounts should not contain any transactions created by any other source.

EBMS will create transactions for either the Job Complete transactions or the Percent Complete WIP method. Review Work in Process > Processing Work in Process for details on these transactions.

-

Launch the report from the menu to list all work in process transactions.

-

Match the Year and Month report prompts to the reconcilable period.

Compare the Billings in Excess and the Costs in Excess totals to the general ledger balances. Note that the Work in Process utility must be

run after a job is completed to update any work in process transactions.

Customer Down Payments (Combine)

Transactions are created to this account when a down payment is applied to a sales order. Note that a payment may be recorded in EBMS as a down payment if a payment was made to a sales invoice and then unprocessed to a sales order. See the Customer Payments > Down Payments section of the sales documentation for details on this process.

-

Launch the report from the menu to list the customer down payment amounts.

-

Set the Down Payments as of date on the report prompts to equal the end of the period that is being reconciled. Enable the Show G/L Reconciliation prompt and click

Print Preview to view the report as shown below:

-

Compare the Down Payments total to the Balance of the G/L Account as shown above.

Customer Gift Cards (Separate)

This liability account is used to record the value of gift cards sold to customer until they are redeemed. Review the Payment Card Processing > Gift Cards > Gift Card Overview section of the sales documentation for gift card details.

- Compare the gift card liabilities from your gift card merchant account with the balance on this liability account.

Customer Retainage (Combine)

Transactions are created for this account in the customer retainage within the EBMS job costing tool. See Retainage > Entering Customer Retainage of the job costing documentation for details on this process.

-

Launch the report from the menu.

-

Set the Calendar Month and Fiscal Period on the report prompts to equal the end of the period that is being reconciled.

-

Compare the Total Retainage to the financial account Balance as shown above.

Depreciable assets, Accumulated Depreciation, Non-depreciable Asset, Intangible Asset, and Accumulated Amortization (Separate)

The following steps are only needed if the EBMS deprecation (fixed asset) module is present. Contact the accountant or financial staff that is responsible for fixed assets and depreciation to reconcile these accounts.

-

Launch the from the main EBMS menu. Review the Account Reconciliation > Verifying General Ledger Balances Utility section for more details.

-

Verify that the Month and Fiscal Year setting on the utility matches the end of the last open fiscal period

.

-

The Accumulated Depreciation and the Depreciable Assets balances on the left column of the utility reflects the total of all the depreciation financial accounts. If

the either balance needs to be adjusted be one of the following:

-

Verify that all deprecation asset accounts in the general ledger are classified as Depreciable Asset or Accumulated Depreciation.

-

Use a journal entry to adjust these depreciation balances. Review the Journals > Creating Journal Entries documentation.

-

If either Depreciable Items balance on the right column is incorrect then run the following report within :

-

Launch the Accumulated Depreciation Reconciliation reports to list the detailed Accumulated Depreciation detail as shown below:

-

Compare the report Subtotal for each GL Account Balance with the total of all the assets within each account group. The Accumulated Balance must equal the GL account balance, the annual accumulated amount should equal the depreciation credits for the same year, and the Previous Years amount should equal the balance for the beginning of the

year.

-

Launch the Depreciation Reconciliation reports to list the detailed Accumulated Depreciation detail as shown below:

-

Compare the report Subtotal for each GL Account Balance with the total of all the assets within each account group. The Current Balance must equal the GL account balance, the annual asset amount should equal the amount of any assets purchased the same year, and the Previous Years amount should equal the asset value balance for the beginning

of the year. The Difference should always be zero. If not as shown in the 2nd asset GL group above, an adjustment must be made.

Inventory and Other Inventory (Combine)

Review the for instructions to properly manage

both perpetual track count inventory and other inventory.

Investments (Separate)

Total value of the investment

-

Compare the total value of the investment with the balance of each asset account. Use a separate software to manage investment accounts since EBMS does not contain an investment module. Launch the by selecting from the main EBMS menu to summarize transactions by date.

Loan Receivable (Separate)

Total value of the loans offered to others

-

Compare the total principle amount of the loans given to individuals or companies with the balance of each loan asset account. EBMS does not contain a loan management module to amortize or process loans. Launch the report by selecting from the main EBMS menu to summarize transactions by date.

Loans Payable (Separate)

Total value of loans borrowed from a financial institution

-

Compare the total principle amount of all loans from financial institutions, individuals, or companies with the balance of each loan liability account. All loan payments should debit both the loan payment account for the principle amount and an

interest expense for the interest payment. Launch the report by selecting from the main EBMS

menu to summarize loan transactions by date.

Other Deferred Income: (Separate)

This account classification should be used only for unmanaged prepaid sales. Any down payments managed by EBMS should use the Customer Down Payment classification. Launch the report by selecting from the main EBMS menu to summarize transactions by date.

Other Depreciation: (Separate)

This account classification should be used only for depreciation accounts that are not included in the EBMS Depreciation module. This account will show as depreciation within the cash flow statement. The Other Depreciation classification requires manual reconciliation since EBMS does not reconcile these accounts with the EBMS depreciation records. Review Fixed Assets and Depreciation > Overview for details about standard fixed

asset and depreciation accounts. Launch the report by selecting from the main EBMS menu to summarize transactions

by date.

Other Payables:(Separate)

This account classification should be used only for payables besides accounts payable, tax payables, loans payables, and any other payables managed by EBMS. The Other Payable classification requires manual reconciliation

since EBMS does not reconcile these accounts. Review the Accounts Payable and Tax Payable classification for reconciliation details for standard payable accounts. Launch

the report by selecting from the main EBMS menu to summarize transactions by date.

Other Prepaid Expenses:

This account classification should be used only for unmanaged prepaid expenses. Any vendor down payments or prepaid expenses managed by EBMS should use the Vendor Down Payment classification. Launch the

report by selecting from the main EBMS menu to summarize transactions by date.

Other Receivable: (Separate)

This account classification should be used only for receivables besides accounts receivables, loans receivables, and any other receivables managed by EBMS. The Other Receivables classification requires manual

reconciliation since EBMS does not reconcile these accounts. Review the Accounts Receivable and Loans Receivable classifications for reconciliation details for standard

payable accounts. Launch the report by selecting from the main EBMS menu to summarize transactions

by date.

Payroll Payable: (Combine)

-

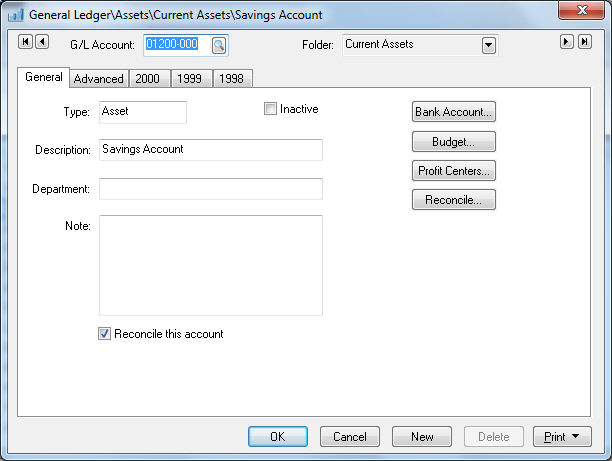

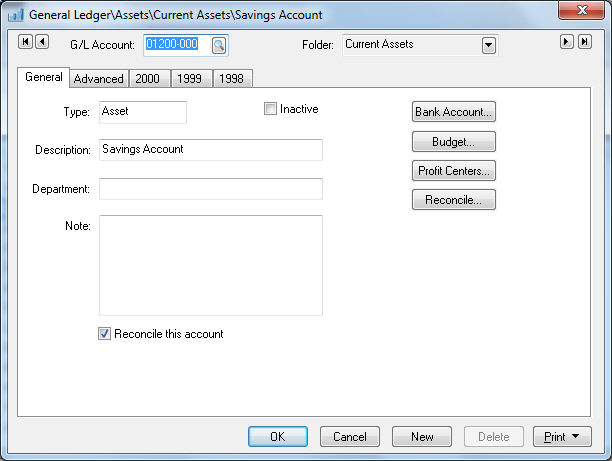

The payroll payable account is somewhat simple to reconcile. The EBMS financial system should only have a single account classified as Payroll Payable. Open the general ledger account as shown below:

-

The YTD Balance should equal zero for the current payroll month as well as any future months. Since the payroll payable account holds the labor that has been performed and not paid, the Payroll Payable balance should be zero when the payroll is completed processed. Verify that no detail lines have been processed for any open pay periods if this value is not zero. Review the Processing Payroll > Process Detail Lines Before Payroll is Processed section of the labor documentation for more details on processing detail lines or the payroll payable account.

Review payroll payable transaction report options by selecting from the main report menu.

Payroll Tax/Deduction (Separate)

The important step of reconciling individual payroll tax and deduction liability accounts depends on the payment pay frequency. Reconcile tax and deduction accounts frequently because of the volume of transactions that are posted to these accounts.

Review [Labor] Taxes and Deductions > Adding New Taxes and Deductions for setup instructions. See reconciliation

instructions below:

-

Launch the report by selecting from the main EBMS menu. Note the Debit, and Credit summary values as well as a running Balance amount for each Date as shown below:

- An alterative way to review monthly values as well as a convenient way to drill down on each total is to open a liability tax or deduction account from the list as shown below:

- The Credit column records the amount of tax deducted. Since the tax shown above is paid at the end of each quarter, the January debit amount equals the beginning balance, and the April payment equals the YTD

balance at the end of March. Use the reports to list the detailed transactions for a specific month.

Retained Earnings (Separate)

This important setting is used to record the accumulated net income that is retained by the company. This cooperate term should be used to classify the account that reflects the net income/loss for the current fiscal year. Review Chart of Accounts > Retained Earnings and Other Equity Accounts for more information on the required retained earnings account.

Sales Tax: (Separate)

EBMS contains many powerful tools to automate the sales tax calculation as well as organize the liability accounts to record the amount of sales tax collected and payments. Review the Sales Tax > Establishing Sales Tax Rates section of the sales documentation for instructions to setup and view liability accounts.

The liability accounts classified as Sales Tax should be reconciled each time a sales tax payment is made. Review the Sales Tax > Paying Sales Tax section of the sales documentation for details.

Salesperson Commission (Separate)

Unpaid salesperson commission is recorded in a liability account by the commission module until the salesperson is paid. Review the Sales Person Commission > Sales Person Commission Overview section of the sales documentation for details.

Vendor Down Payments (Combine)

Transactions are created to this account when a down payment is applied to a purchase order. Note that a payment may be recorded in EBMS as a down payment if a payment was made to an expense invoice and then unprocessed to a purchase order. See Vendor Payments > Invoice or Purchase Order Down Payments for details on this process.

-

Launch the report from the menu to list the down payment amounts.

-

Enable the Show G/L Reconciliation prompt and click Print Preview to view the report as shown below:

-

Compare the Paid total to the asset account Balance as shown above.

Vendor Retainage: (Separate)

Unlike customer retainage, vendor retainage is not managed by the EBMS job costing system. These accounts should be adjusted by an accountant or financial staff.

Review the Account Classification including Cash Flow, Reconcile, and 1099 format settings section for instructions to review the account Classification options.

The Account Reconciliation list is also a convenient way to review account balances. Click on the Post All Transactions button in the lower left hand corner to update balances

since transactions do not show on the reconciliation tabs until they have been posted to the general ledger.

Steps for Reconciling an Account

Select an account and click on the Properties button in the lower right hand corner to open the following dialog.

The Reconcile this account option must be enabled to include an account on the Account Reconciliation list.

Click on the Reconcile button to open the Account Reconciliation dialog from the Account Reconciliation list, as shown below:

NOTE: The last two tab labels will change depending on what type of account is being reconciled. The naming of the two tabs is based on the account classification.

See the following for a breakdown of how the tabs are named based on account classification.

-

Bank Accounts will call the tabs

Deposits and

Checks.

-

Cash Accounts will call the tabs

Cash In and

Cash Out.

-

Sales Tax Accounts will call the tabs

Payments and

Collected.

-

Payroll Taxes Payable Accounts will call the tabs

Payments and

Withheld.

-

Accounts with no classification will call the tabs

Debit and

Credit.

Statement settings

-

Set the account Ending Date to reflect the date that you wish to reconcile.

For example, if you are reconciling a bank account, enter the bank statement date in the Statement

Ending Date field. All transactions with a date more recent than the Account

Ending Date will be hidden and not be displayed in either tab. If you wish to display all transactions, set the date to the last date of the fiscal year. The

Account Balance total reflects the general ledger balance as of the reconciliation date.

-

The Beginning Balance should be copied from the previous reconciliation. Right click on the Beginning Balance entry and disable the Read Only option to enter a beginning

balance amount.

-

Enter the Account

Ending Balance as of the ending date entered above.

For example, if you are reconciling a cash account, enter the total monies that you have collected but not deposited including cash, personal checks and credit card payments. To reconcile

a payroll tax withheld general ledger account, enter zero into the statement entry field.

The Account Ending Balance in most situations will not match the Statement Ending Balance since some transactions may be outstanding. The main purpose

of this window is to reconcile the general ledger balance with the statement balance by identifying all outstanding transactions.

-

Go to the second tab (

Cash In, in the example above) and notice the list of debit transactions. To sort the list of transactions by date, first drag the scroll bar to the top and click on the

Date column heading. Click on the heading a second time if the dates are listed in descending order.

-

The first column on the list is labeled

Status. This is a check-mark column that identifies the transactions that are NOT outstanding with a check mark.

-

The total on the bottom right side of the tab is the sum of all the outstanding transactions. As the transactions are checked on, the Outstanding Total decreases.

-

Use the

Unselect All and the

Select All buttons to mark the entire list.

-

Go to the third tab (Cash Out in the example above) and notice the list of checks. Transactions need to be switched in the Status column the same way as the previous tab. As transactions are checked, the totals on the bottom of the window will be changed.

Explanation of Figures

This amount must be zero indicating that the account reconciles before processing can be completed. The

Process button will be disabled until the account is reconciled.

A transaction can be voided with the

Void button. Not all transactions can be voided from this window. Typically, only checks and deposits can be voided.

The

Process button will remove all the marked transactions. The process performs the following items:

-

Removes all transactions turned ON, leaving only the outstanding transactions.

-

The

User, Date, and

Time information in the

Last Reconcile area of the

Controls tab is updated.

Click the

Source button to view the source of a transaction. The system will display the source of the transaction by opening the invoice, journal, payment, or other appropriate window.

Click the

Adjustments button to insert adjustment transactions directly into the tab. Review General Adjustments for more details on general adjustments.

The

Print button works like other print buttons and can have reports linked to it to select or reports can be added by selecting Add Report.

The

Wizard button will list the available wizards for this window and account. See the Reconciling Checking Account section for more details.