Verifying General Ledger Balances

Reconciling GL Accounts ERP Support Training

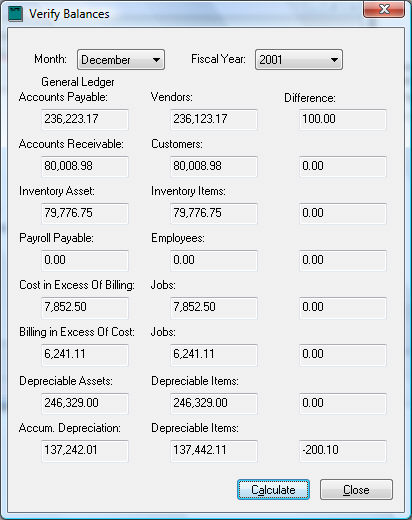

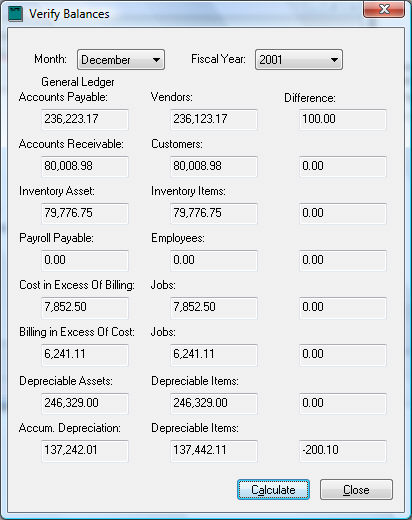

The Verify Balances utility is used to compare various financial account balances within the general ledger with the total of all the account history. The left column shows the balance within the general ledger financial accounts.

For example, the first set of values compares the total of all the financial accounts that are classified as Accounts Payable. The right column totals all the vendor history tabs. The Difference column calculates the difference between the two columns.

The Difference should equal zero, which indicates a proper balance. Review the Making Totals Balance section below for tips to correcting totals.

The same calculation is made between individual financial accounts and the totals within the history tabs of all customers, employees and inventory items. Review Transactions > Account History Tabs for more details

on the history tabs.

To run this utility, perform these steps:

-

Go to . The following window will appear:

-

In the Month block, choose the month that is to be verified. Since this utility is verifying month end balances, a quick way to check all months is to set the Month field to the last month of the fiscal year.

-

Check that the

Fiscal Year is correct. If not, choose the correct one.

-

Click on the

Calculate button. The system will check the balances and show the numbers for each area and the difference if any.

-

Adjustments are required if there is a difference in any of the accounts. Review the Making Totals Balance section below to correct values so the Difference amount is zero.

This important utility can also be launched from the Close Month or Close Year processes.

Making Totals Balance

A balance value that does not equal zero indicates issues with some of the financial balances within EBMS. These issues must be resolved to create accurate financial reports.

-

General Ledger (1st column) values are wrong:

-

Does the general ledger account total include non-EBMS account values?

-

Create separate G/L accounts with an ‘Other’ classification for all values that are not included in EBMS accounts. For example, The inventory value of inventory that is not being tracked in EBMS as Track Count inventory should be recorded

in a separate G/L account and classified as Other Inventory. Note classifications such as Other Inventory, Other Receivable, Other Payables,

etc.

-

Is a general ledger account is classified wrong?

-

Verify that all G/L accounts that contain values that are compared to account balances are properly classified. For example, only G/L accounts containing…

-

Accounts Payable balances should be classified as Accounts Payable.

-

Accounts Receivable balances should be classified as Accounts Receivable.

-

EBMS Inventory Asset values should be classified as Inventory.

-

Etc.

Review Chart of Accounts > Account Classification for instructions to view or change G/L account classifications.

-

Is the G/L account balance wrong?

-

Under accountant supervision, use a journal entry to adjust the general ledger account balance. Review Creating Journal Entries to adjust general ledger account balances. The ID column blank within

the journal should be blank as well as reference 2, Track 1, and track 2 columns, so the EBMS vendor, customer, and product accounts are not adjusted.

-

Account history year totals (2nd column) are wrong:

-

Is there a discrepancy between the account’s details and the year pages?

-

Run the maintenance utilities. Review [Main] Technical > Maintenance Utility to have EBMS verify that all

details match the year tab summary totals.

-

Is the Inventory Item's value wrong?

-

Review the steps described in [Inventory] Tracking Counts > Reconciling Inventory Value to correct inventory values.

-

Was a journal entry made to adjust a balance, but the ID was not put into the journal to also adjust the vendor, customer, product, or other account?

-

Review the ID and other technical journal column descriptions in Creating Journal Entries.

-

Don't know:

-

Review all the steps in the A. General Ledger Values are wrong step.

-

Review all the steps in the B. Account history year totals are wrong step.

-

Verify that beginning balances were properly entered when EBMS was originally setup. Review Chart of Accounts > Entering General Ledger Beginning Balances for setup instructions.

-

Create a general adjustment to make balances equal. Balances should be corrected. General adjustment journals can be changed if the offending issue is identified. Consult with your accountant or EBMS consultant if utility Difference values

continue to be non-zero. Review General Adjustments for steps to adjust a balance.