Retained Earnings and Other Equity Accounts

A financial charge of accounts includes the following types of accounts:

-

Balance sheet accounts

-

Assets: what the company owns.

-

Liabilities: what the company owes.

-

Equity: the focus of this documentation section. See details below.

-

Profit and loss accounts (income statement accounts)

-

Revenue: sales, service, and other income.

-

Expenses: cost of goods sold, operating expenses, and miscellaneous expenses.

Review Chart of Account Folders for additional financial account type information.

Equity Accounts

The Equity financial accounts are in a folder listed after the liability category and before the revenue category. The format of these accounts differs based on the type of company and preference of the accountant.

The listed equity financial accounts are common for the following types of companies:

-

For-profit corporations

-

The stock level equity accounts (both voting and non-voting) should be classified as Capital Investments.

-

The Retained Earnings account is incremented by the previous year's net income.

-

Sole proprietorship, LLC, and other sole owner for-profit companies

-

Capital Investments records the monies invested into the company by the owner.

-

Capital Withdrawals records monies withdrawn from the company that is not payroll labor.

-

Retained Earnings is the total earnings from prior years. See retained earnings section below.

-

Partnership, LLP, and other multiple owner for-profit companies

-

Each partner should contain a Capital Investment account amount that equals the ratio to match the partner's ownership percentage.

-

The Retained Earnings balance amount should be divided to each partner's Capital Investment account based on the partner's ownership percentage.

-

Non-profit organizations

-

A non-profit's equity folder should only contain fund accounts. Each fund account should be classified as Retained Earnings. Review Fund Accounts > Creating Fund Accounts for more details and setup instructions.

Retained Earnings Financials Account

The net revenue (Revenue - Expenses) for a specific year is posted to the retained earnings account that is set in each Revenue or Expense account. The year end balances for all assets, liabilities and capital accounts are carried forward to the next

year but all year end totals for revenue and expenses accounts are posted to the set retained earnings account. For example, if the total income for last year was $1,000,000 and the expenses totaled to $800,000, a net revenue of $200,000 would be

added to the beginning balance of the retained earnings account.

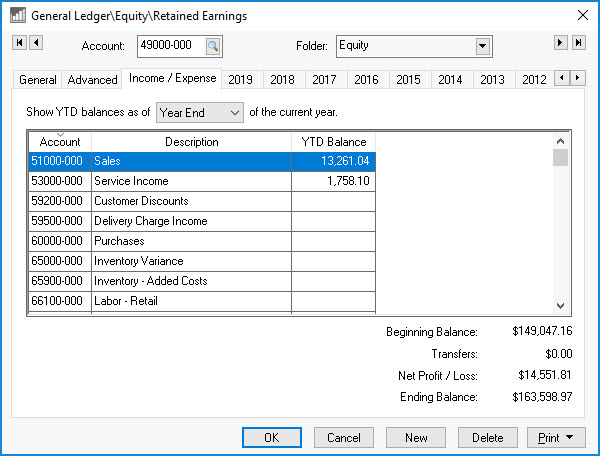

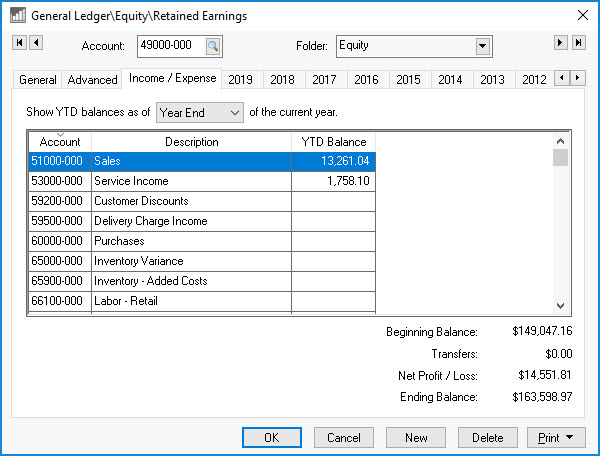

Complete the following steps to open the unique Income / Expense tab on the retained earnings account:

-

Open a financial account classified as Retained Earnings within the launched from the EBMS menu.

-

Click on the Income / Expense tab.

-

Each income and expense account that has the current retained earnings account set in the Advanced tab will be shown on this list. Note that the chart of accounts within most companies have a single account classified as Retained Earnings

so all P&L accounts would be listed on this account. Review the following Configure Retained Earnings section for details on viewing or changing the Retained Earnings Account settings within an income or expense

account.

-

Note that the Net Profit / Loss amount at year end will be added to the beginning balance of the following year. Use the P&L statement reports ( from

the main EBMS menu) to view the net profit and loss for past years.

Configure Retained Earnings

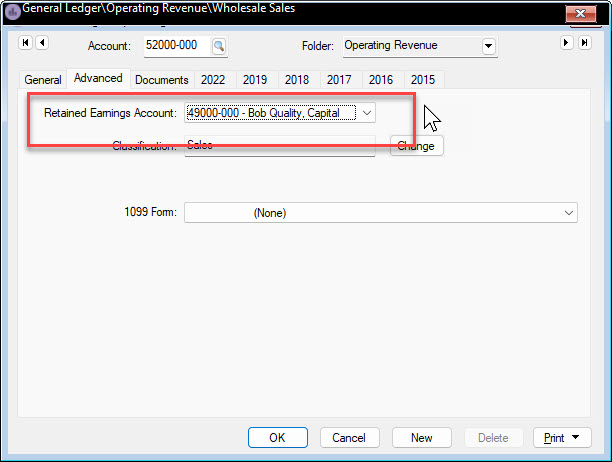

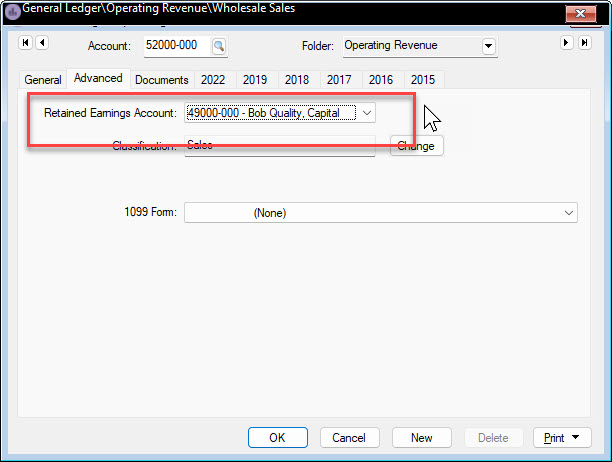

Complete the following steps to view or change the Retained Earnings setting within any revenue or expense financial account:

-

Open any revenue or expense financial account.

-

Click on the Advanced tab of the account.

-

Click on the drop down to change the Retained Earnings Account. Review Changing Account Information for more information on the Advanced tab.