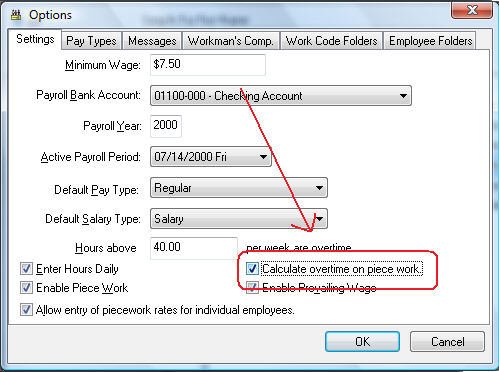

Go

to Labor >

Options as shown below:

Enable the Calculate overtime on piecework option and click OK.

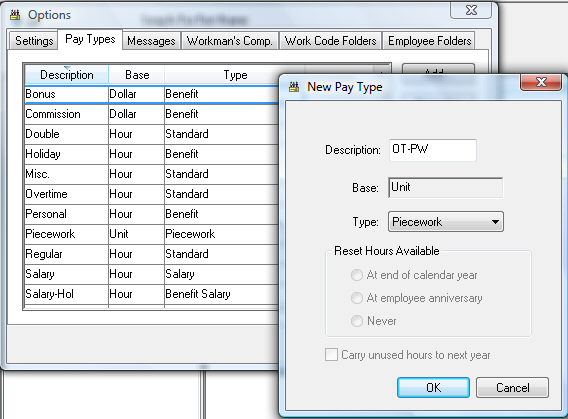

The

next step is to create an overtime piecework pay type if it does not

already exist. Select Labor > Options from the EBMS menu

and click on the Pay Types

tab as shown below:

Click on the New button if no piecework overtime pay type exists. Enter the overtime piecework pay type Description. Change the Type option to Piecework and the Base entry will be changed to Unit as shown above. Click the OK button to save the pay type.

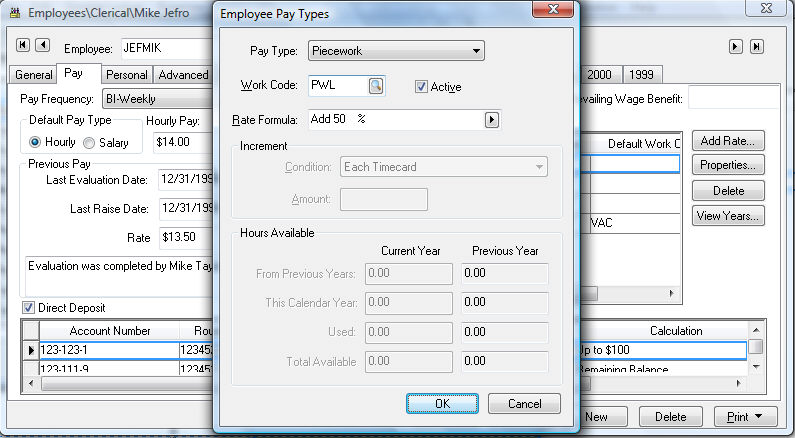

The

pay type must be added to each Worker that is being paid piecework

overtime as shown below:

Make sure the Rate Formula is set to Add 50 % as show above. Review the Pay tab section of Workers > Changing Workers Information section for details on adding pay types into the Worker’s Pay tab. Review the Pay Tab section of the Workers > Setting Employee Defaults section to add the pay type to a group of an employees or all employees. Save the employee record by clicking the OK button.

Enter

hourly and piecework time into the timecard using the standard pay

types as described in the Processing

Payroll > Entering Timecards section of the documentation.

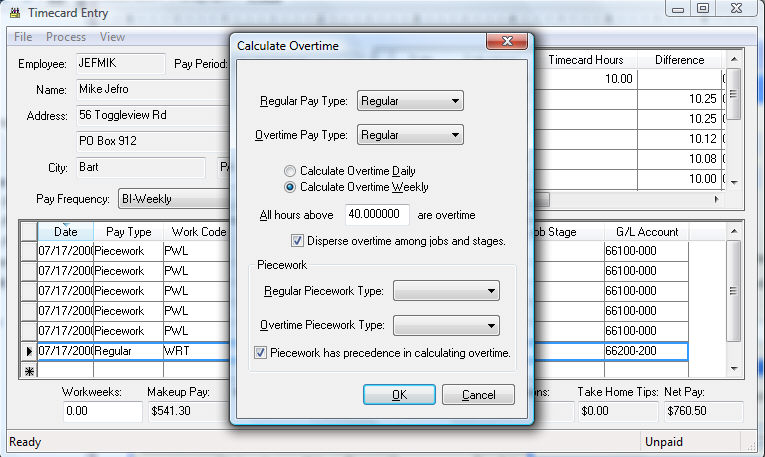

Click on the Process > Calculate Overtime option from the timecard menu. The Regular Pay Type and Overtime Pay Type settings must be set properly. Review the Processing Payroll > Calculating Overtime section for more details on the standard overtime fields.

Set the Regular Piecework Type and Overtime Piecework Type. These are pay types created within the Labor > Options > Pay Type tab described earlier in this section. Review the Getting Started > Pay Types section for more details on pay types.

The Piecework has precedence in calculating overtime option will determine if the hourly or piecework time has precedence. The following tables describe the calculations that are completed using the overhead wizard and the affect that this option on the pay calculations. The following table includes only regular hourly and piecework pay.

Pay Type |

Work Code |

Units/Hours |

Rate |

Total Pay |

Reg Piecework |

A |

15 |

10.00 |

150.00 |

Reg Piecework |

B |

10 |

5.00 |

50.00 |

Reg Piecework |

B |

20 |

5.00 |

100.00 |

Reg Hourly |

C |

10 |

15.00 |

150.00 |

OT Piecework |

A |

5 |

15.00 |

75.00 |

OT Piecework |

B |

10 |

7.50 |

75.00 |

Totals: |

|

60units / 10hrs |

|

600.00 |

If

Piecework has precedence in calculating

overtime option is enabled the wizard will determine the ratio

of piecework overtime. If the employee worked 50 hours this week,

then 10 hours of the 40 piecework hours (50 – hourly time) are overtime.

This results in 25% of the piecework being overtime. The wizard will

create overtime piecework lines in the timecard for each work code.

The following chart illustrates how these new lines are created in

the timecard:

If Piecework has precedence in calculating

overtime option is disabled the wizard results will be as follows:

Click the OK button to create the overtime records.

Repeat this step for each timecard that contains hourly and piecework pay.