Entering Rental Equipment

The rental equipment codes are used to record the equipment that is

purchased or manufactured for rental use. For example, a rental equipment

code is created to record the purchase of a lawn mower that is purchased

as a rental. This inventory code is not to be confused with the rental

service code that is discussed in the Creating

Rental Service Codes section.

The following pair of management methods are available for rental items

with a set of corresponding Classifications for each method. The

first pair are depreciated and the 2nd set is managed as inventory items.

The recommended method to manage rental items is the asset

method:

Asset

method that includes depreciation:

Non-inventory

Serialized Items: this classification should be used

for most equipment such as vehicles, power equipment, and other

serialized items. Any rental equipment that has a serial number,

VIN number, or other number attached

to the item should be classified as Non-inventory

Serialized Items. This classification is the most common

classification used for rental equipment.

No Count: This

classification should only be used for depreciable assets without

a distinct number of items available. For example, a company that

has a large number of chains, scaffolding, or other supplies that

are not limited to a specific number of rentals would use this

classification.

Inventory

method that allows the sales person to sell or rent an item.

This method is not common for new product since a rental item

is normally discounted from the new item.

Serialized Item: This classification may be used

for used equipment sales with some rentals until the unit is sold.

This classification requires a serial or VIN number.

Track Count:

This classification only be used for inventory items

that are not identified individually, including used attachments,

scaffolding or other inventory items that are not identified individually.

Creating the Rental Equipment Item

Complete the following steps to create a rental equipment item:

Open the inventory item list by selecting from the main Inventory

menu.

Select from the main

menu to start the new inventory wizard (clicking New

within the inventory Item window will also activate the new wizard).

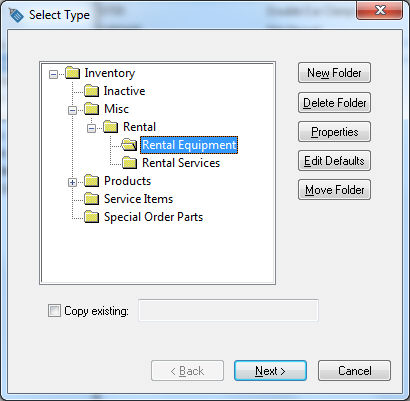

Highlight the folder in which you want to place the

new inventory item and click Next.

Review the Inventory

Folders for Rental Items section for more details on creating

new folders.

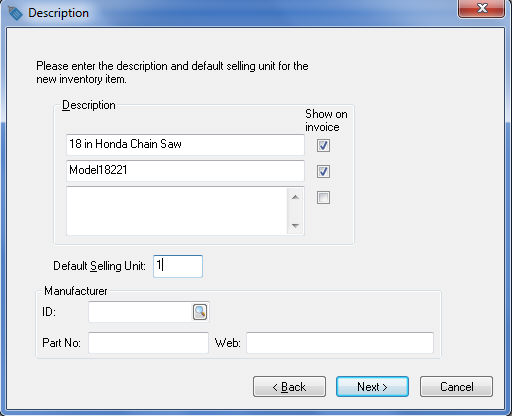

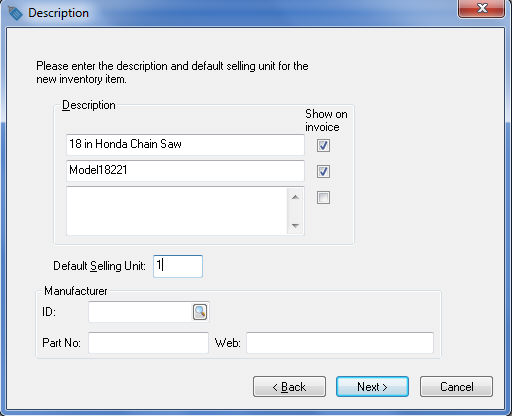

Enter a Description

of the equipment that is being purchased to rent. Click the Next button to continue to the Information page.

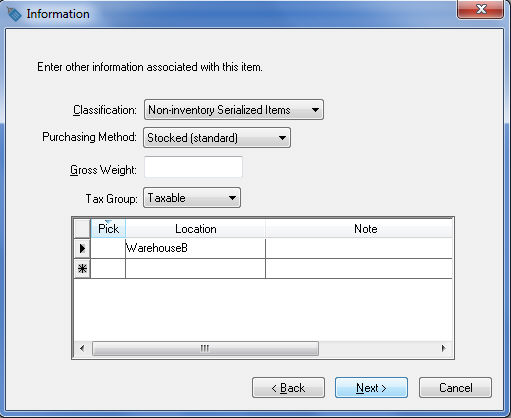

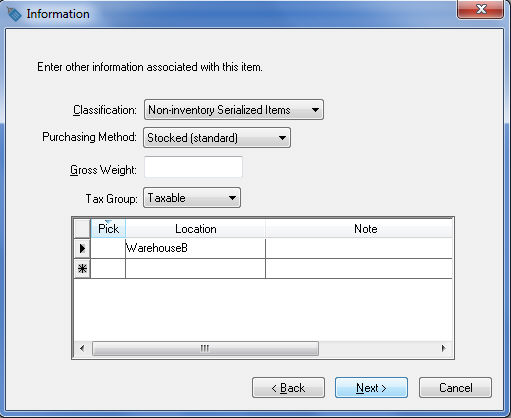

Set the product Classifications based on the selected method listed

at the beginning of this section.

Asset method that includes depreciation:

Non-inventory

Serialized Items: this classification should

be used for most equipment such as vehicles, power equipment,

and other serialized items. Any rental equipment that has

a serial number, VIN number, or

other number attached to the item should be classified as

Non-inventory Serialized

Items. This classification is the most common classification

used for rental equipment.

No Count:

This classification should only be used for depreciable

assets without a distinct number of items available. For example,

a company that has a large number of chains, scaffolding,

or other supplies that are not limited to a specific number

of rentals would use this classification.

Inventory method that allows the sales person

to rent and sell an item. This method is not common for

new product since a rental item is normally discounted from the

new item.

Serialized Item: This classification may be

used for used equipment sales with some rentals until the

unit is sold. This classification requires a serial

or VIN number.

Track Count:

This classification only be used for inventory

items that are not identified individually, including used

attachments, scaffolding or other inventory items that are

not identified individually.

Enter the Location

of the rental items if applicable and set the proper Taxable

setting. Ignore the Gross Weight

entry for rental service codes. Review the Inventory

Items > Entering New Inventory Items section of the Inventory

manual for more details on these entries. Press Next

to continue.

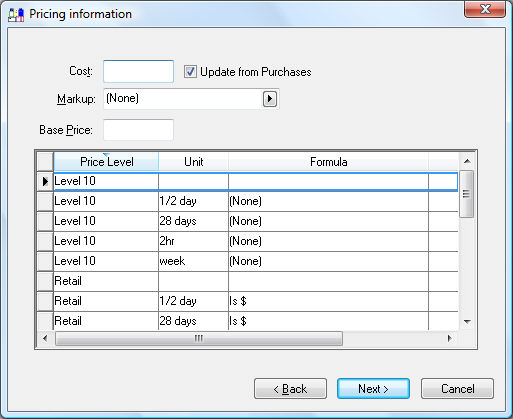

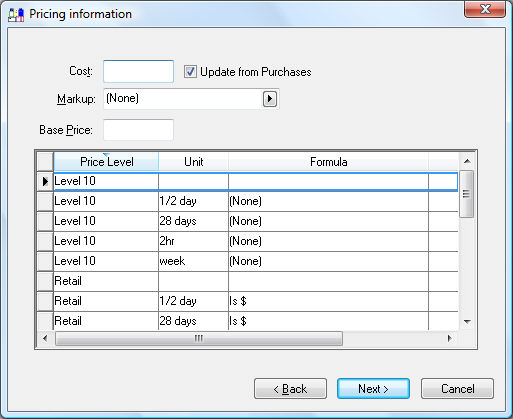

The Pricing

settings of the rental equipment items can be ignored unless the user

wishes to maintain the current selling price of the rental equipment.

Review the Inventory

> Pricing section of the Inventory manual for more details

on pricing options. Click Next

to continue.

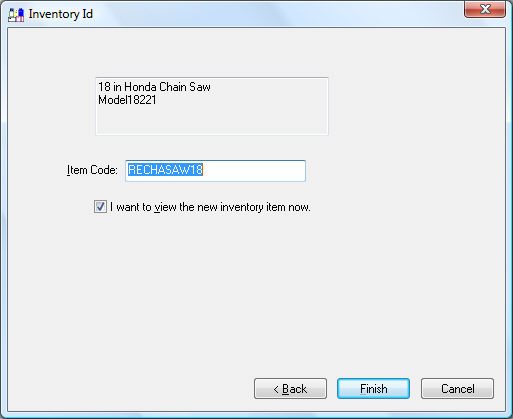

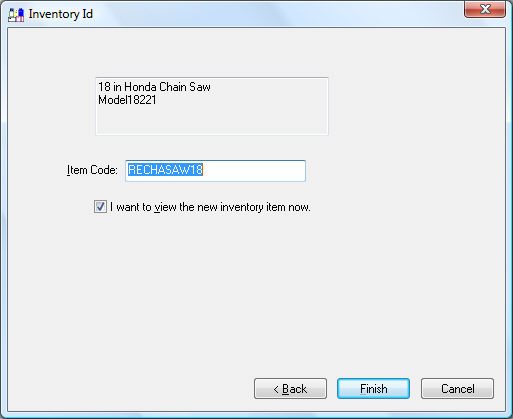

Enter an Item Code

for the rental equipment. Enable the I

want to view the new inventory item now option to enter the

serialized item details. Click the Finish

button to open the inventory item.

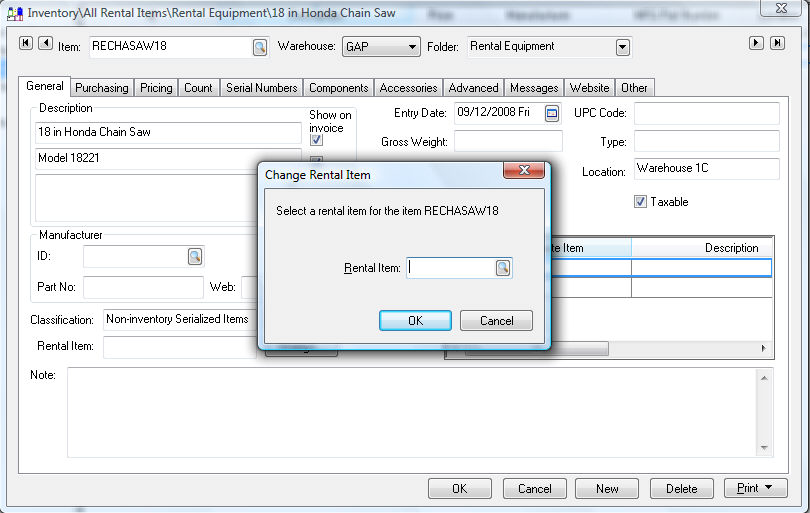

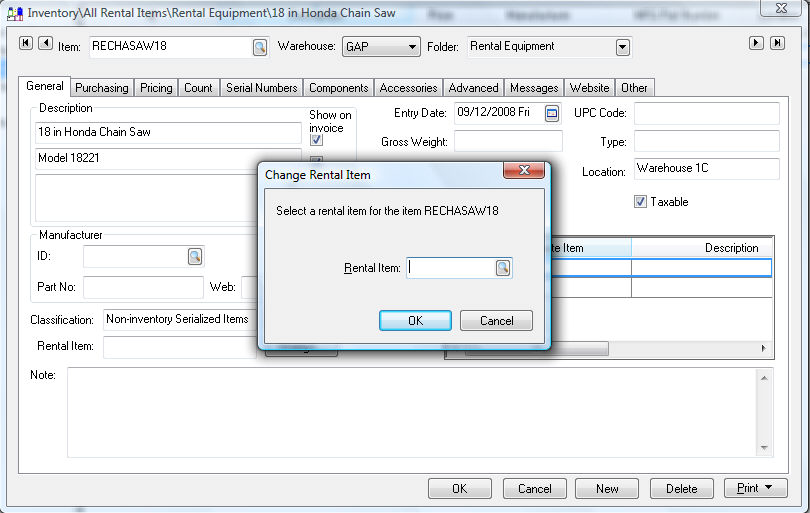

Click on the Change

button to the right of the Rental

Item field to open the Change

Rental Item dialog as shown below:

Select the Rental

service Item that will be

used to rent this equipment and click OK.

Review the Creating Rental Service

Codes section for more details on the rental service code.

Click on the Advanced

tab to set the purchase and sale general ledger code of all

rental items that are being depreciated as shown below:

Set the following general ledger codes for the recommended fixed Asset method:

Enter the sale of asset general ledger account

into the Sales entry so

the disposal of the depreciable asset is processed when the item

is sold. Review [Financials]

Fixed Assets and Depreciation > Disposing Assets > Selling

Assets within a Sales Invoice for more details on how the

sale of asset general ledger code launches the depreciable asset

deposal process.

Enter the depreciable rental asset general ledger

code under the Purchase GL

code: Review [Financials]

Fixed Assets and Depreciation > Fixed Assets > Adding Assets

> Adding Assets using an Expense Invoice for more details

on how the depreciable asset general ledger code launches the

add depreciation wizard.

Note that the Inventory

Asset general ledger code is disabled since the product

is being depreciated rather than recorded as inventory.

Set the standard inventory general ledger

codes for all items using the Inventory

method. Review the Advanced Tab section of [Inventory]

Products > Changing Defaults for general ledger settings for inventory

rental items.

Entering Non-Inventory Serialized Items

The following steps are only necessary for Rental Equipment that is

classified as Non-Inventory Serialized

Items which is the common classification

used for rental items. You can ignore these steps

for all items classified as Track Count,

No Count, or Serialized Item..

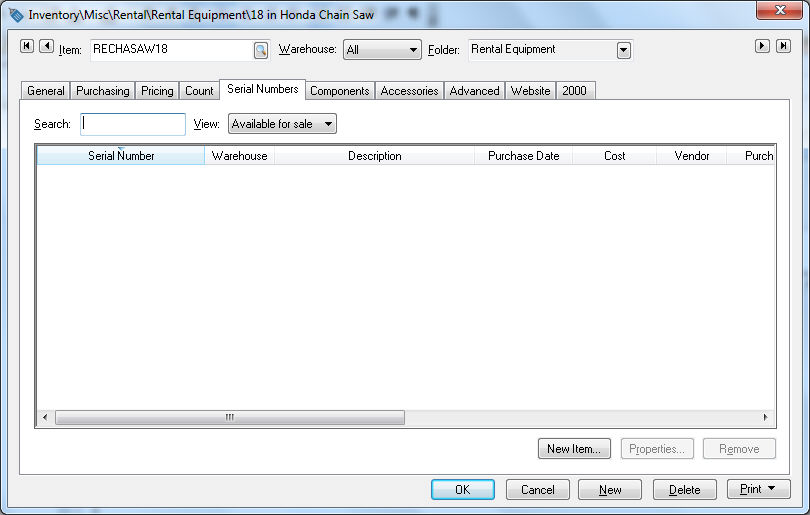

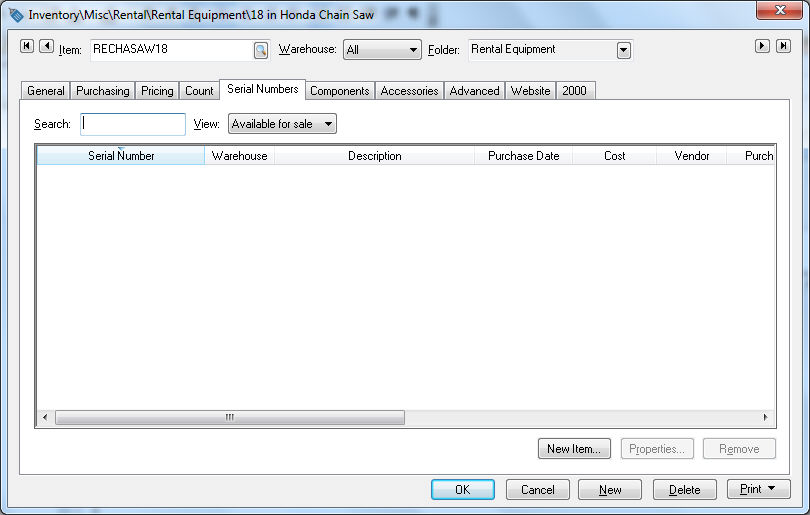

Click on the Serial Numbers

tab to enter the details for each serialized item.

Non-inventory serialized items require an extra step to enter the information

for the individual pieces of equipment. For example, if the company

rents multiple 18 in. Honda chain saws

to rent, the product details for each chain saw should be entered

as well as the serial number, VIN number,

or other unique identifier.

New equipment is normally entered as a rental item by using the purchasing

steps. Review the Managing

Rental Equipment > Purchasing Rental Items section for more

details. Continue with the following steps to enter the rental equipment

during the initial setup period.

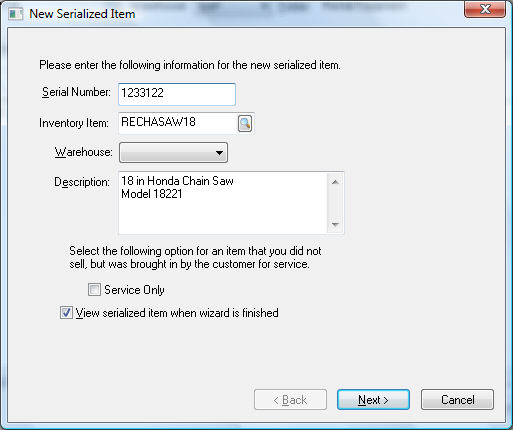

Click on the New Item button to add each piece of

equipment.

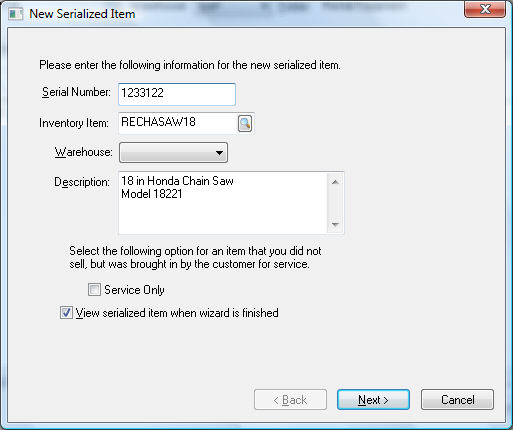

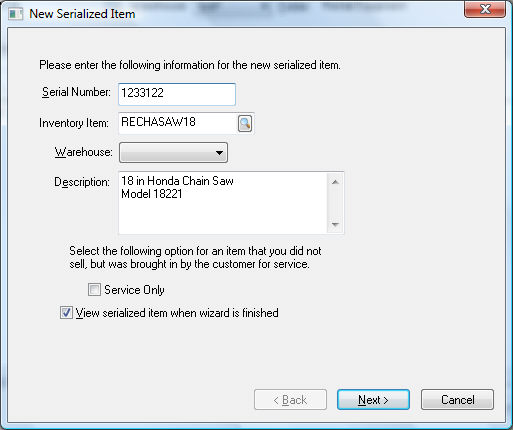

Enter the Serial Number

of the rental equipment. This unique code can be a VIN

number or other unique identifier of the equipment. Click the Next button to continue. This

wizard is used to create a fixed depreciation asset within EBMS. The

user is encouraged to install the EBMS Depreciation module when using

the rental system. Review the Depreciation

section of the main documentation for details about depreciable assets.

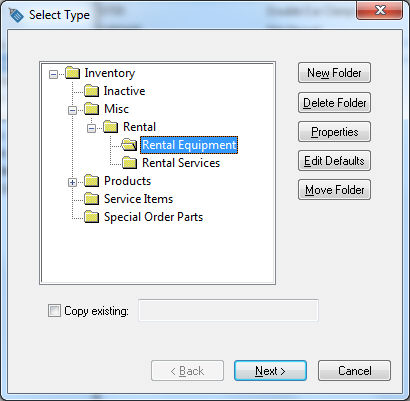

Select the appropriate asset folder and click Next

to continue. Review the Depreciation

> Getting Starting > Adding and Deleting Asset Folders section

of the main manual.

Review [Main]

Depreciation > Fixed Assets > Adding Assets > Entering Existing

Depreciable Assets for detailed instructions on the remainder

of the new depreciation asset wizard.

Repeat these steps for the each additional piece of equipment.

Only similar equipment should be entered using the same rental equipment

inventory ID.

Review Rental Contacts

> Scanning Serialized Rental Equipment for instructions to associate

barcodes to rental equipment.

Refer to the Managing Rental

Equipment > Purchasing Rental Items and the Managing

Rental Equipment > Selling Rental Items sections for more details

in adding and removing rental equipment.