Entering Existing Depreciable Assets

All existing depreciable assets should be entered

into the EBMS deprecation module before continuing with any processes.

This includes all assets

that are new, partially or fully depreciated. This section describes the

steps required to enter existing assets. Refer to the section, Purchasing

Assets, to enter any assets acquired in the current fiscal year.

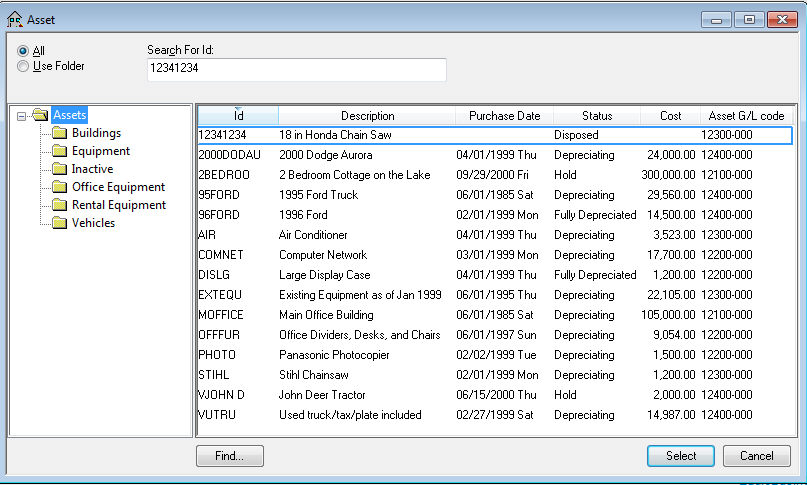

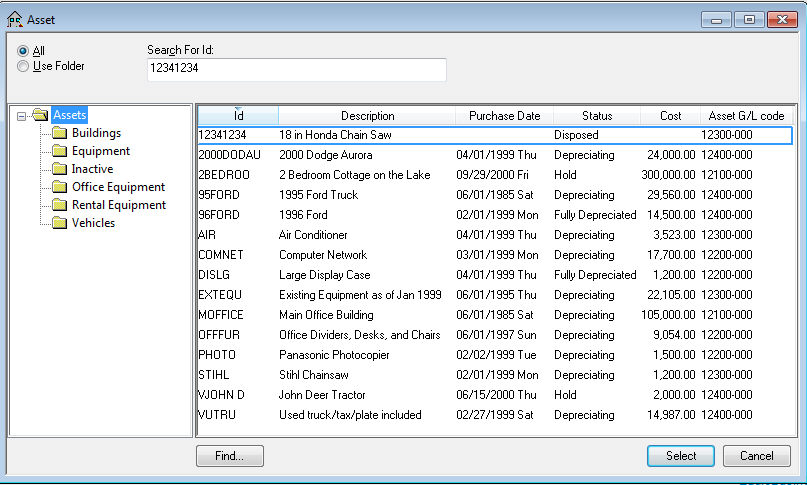

Open the depreciation list by selecting

Financials > Depreciation > Depreciable Assets

from the main menu.

.

Select Edit

> New (Alt + E + N) from the main menu

to start the new asset wizard as shown below:

Highlight the folder in which to

place the new asset and click Next. See the Getting

Started > Adding and Deleting Asset Folders section for more

details on creating new folders.

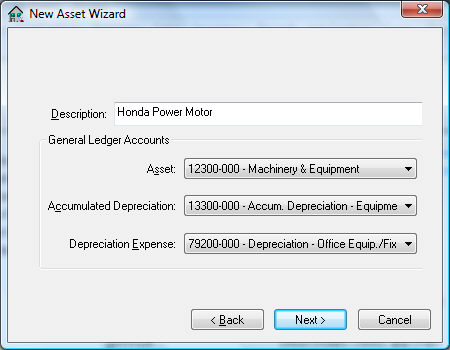

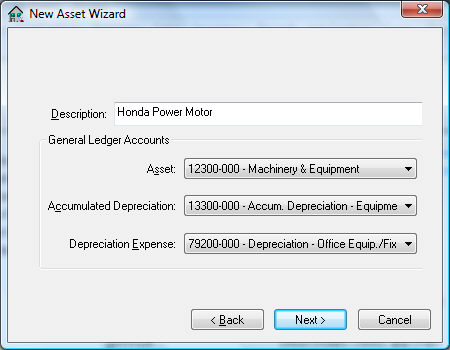

Enter a Description

to identify the specific depreciable asset.

Enter the Asset general

ledger account that should contain the purchase value of the depreciable

asset item.

Enter the Accumulated Depreciation general

ledger account. This account must be an asset account that is classified

as Accumulated Depreciation.

The Depreciation

Expense account must be an expense account

that is classified as Depreciation Expense within general ledger.

See the Financials > Chart

of Accounts > Account Classification section

for more details on classifications. Click the Next button

to continue.

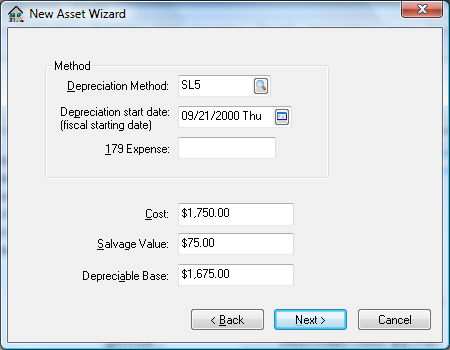

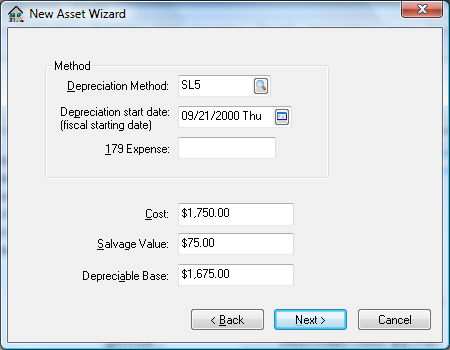

Enter a Depreciation

Method by clicking on the lookup button

and selecting a method. This method can be changed at a later time

if a method has not yet been determined. See the Getting

Started > Depreciation Methods section for more details on

adding or changing methods. See the Managing

and Processing Assets > Changing Methods within an Asset section

for details on changing the depreciation method.

Enter the Depreciation Start Date of

the asset. This date must fall within the fiscal year in which the

first depreciable asset is processed and may not be the same year

as the purchase date. The process date may not be the same year as

the purchase date if the asset is not to be depreciated immediately.

The depreciation schedule will use this date to determine in which

fiscal years the depreciation is scheduled.

Enter the purchase Cost of

the asset. This should include the total value of the asset at the

time of purchase.

Enter the 179 Expense.

This is the additional Section 179 depreciation that will be expensed

the first year. This field can be kept blank to depreciate the asset

completely using the selected method. Contact your accountant to determine

the amount of this entry.

Enter the estimated Salvage Value of asset at time of disposal. This amount will be deducted

from the Cost

to calculate the Depreciable

Amount. Depreciable

Amount = Cost – Salvage Value.

The depreciation schedule will be determined using

the Depreciable Amount.

Click the Next

button to continue.

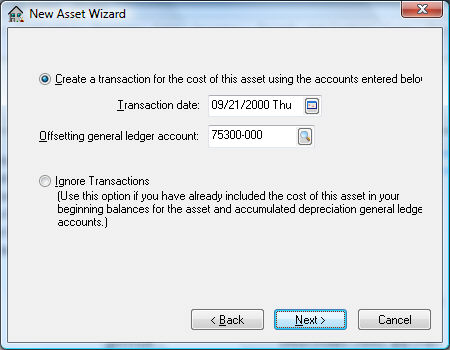

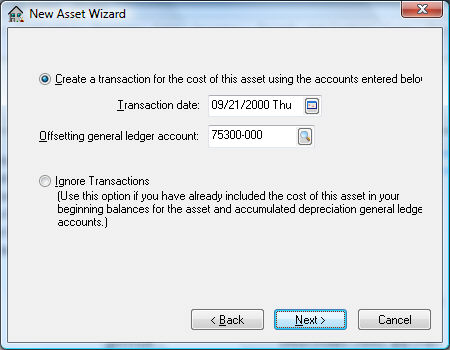

Select the Ignore Transactions only

if all the depreciation values have already been entered into the

balance sheet of the general ledger; otherwise select the Create a transaction for the

cost of this asset using the accounts entered below option

to create a general ledger transaction for this asset.

The first option is recommended if the depreciation

module of EBMS has recently been installed and the depreciable asset values

are already reflected within the general ledger. Complete the following

steps if the Create

a transaction for the cost of this asset using the accounts entered below

option is selected:

Enter a Transaction

Date within the last fiscal year to post

past asset values to the prior year. The adjustments posted to last

year will create the correct beginning balance for the asset general

ledger account for the current fiscal year.

Select the offsetting general ledger account

that will be credited. Enter an expense account that

was used when the depreciable asset was expensed if the item was purchased

within existing open general ledger fiscal periods. Otherwise use

an equity

type or other

general ledger account.

Click the Next

button to open the following page:

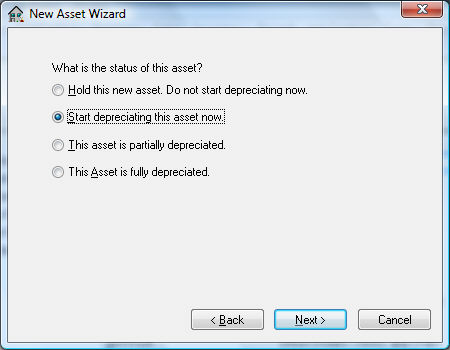

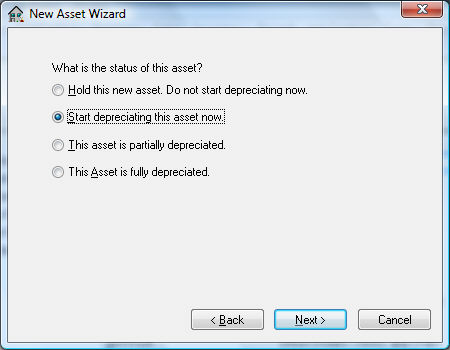

Select one of the following status

options for the asset:

Hold this new asset. Do

not start depreciating now. This option is the

only available option if no depreciating method has been entered for this

asset. The Hold

option will record the asset but will not process any

accumulating depreciation and is useful if the user wishes to obtain advice

on the appropriate depreciation method. The asset status can be changed

to a depreciating status at anytime. See the Managing

and Processing Assets > Changing Methods within an Asset section.

Start depreciating this

asset now option will cause the asset to start

depreciating at the time of the next Monthly

Process. See the Managing

and Processing Assets > Depreciating Assets Using the Monthly Process

section for more details on processing depreciation.

This asset is partially

depreciated - This option should be used for

any asset that has already been partially depreciated. This option should

only be selected when the EBMS Depreciation module is initially installed

and setup.

This Asset is fully depreciated

option should only be used for asset items that are

currently listed on the financial statements and are fully depreciated.

This option is also used when entering the initial asset list. All assets

that are reflected on the company’s balance statement should be entered

into the EBMS depreciation system. See the Disposing

Assets > Removing Disposed Assets section

for instructions on how to remove disposed assets from the list.

Click the Next

button to continue.

NOTE: The

following two wizard pages will not appear if the depreciation method

has not been entered in the wizard, page 3.

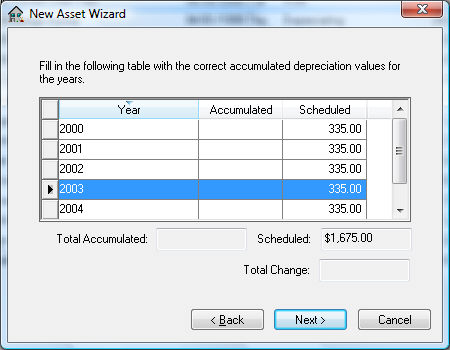

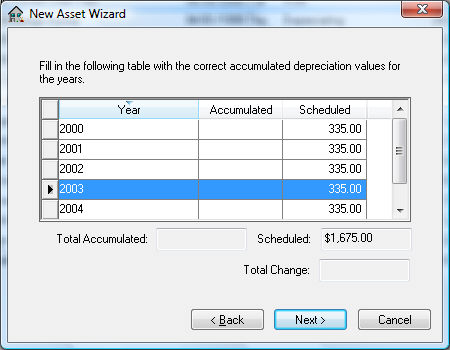

A table will be displayed listing

the Scheduled

depreciation on the right and the Accumulated depreciation

on the left as well as the Year.

The Year

column will be sequentially incremented based on the

Depreciation Start Date

of the asset and cannot be changed without changing

the Depreciation

Start Date. The wizard must be canceled and

restarted if the Depreciation

Start Date or the Method

is incorrect. The wizard cannot be paged backwards

at this point.

Enter the Accumulated

depreciation if the asset has been partially depreciated.

Change the accumulated depreciation for each year if the asset is fully

depreciated and the Scheduled

depreciation does not match the annual amount depreciated.

The Scheduled

depreciation is calculated using the depreciation

Method entered

earlier in the wizard. This amount can be changed to match a user’s schedule

without having any ill effects on the accuracy of the system. Any changes

to the Scheduled

amount must equal the total Depreciable

Amount for the asset.

The following page will appear only if the

Accumulated depreciation column of the previous page contains any

value.

Select the Ignore Transactions only

if all the accumulated depreciation values have already been entered

into the balance sheet of the general ledger. Otherwise select the

Create a transaction

of ??? for the accumulated depreciation option

to create general ledger transactions for accumulated depreciation.

Complete the following steps if the Create

a transaction… option is selected:

Enter a Transaction

Date within the last fiscal year to post

past accumulated depreciation values to the prior year. The adjustments

posted to last year will create the correct beginning balance for

the asset general ledger account for the current year.

Enter a depreciation expense general

ledger account as the Offsetting

general ledger account that will be credited.

Click the Next button.

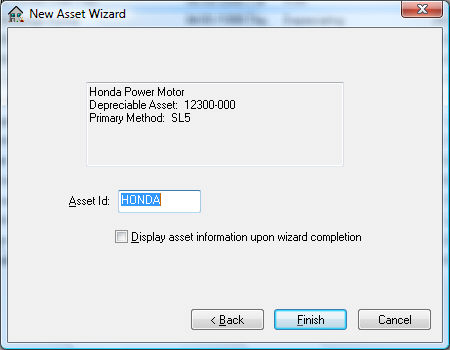

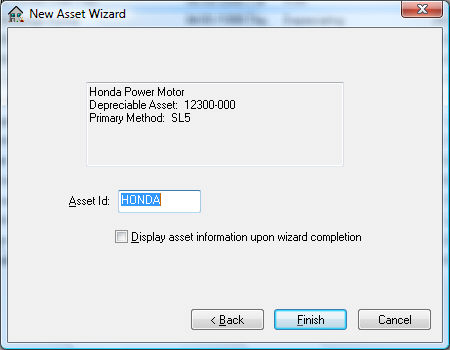

Enter the Asset ID code.

The Display asset information upon

wizard completion will open the Depreciable

Asset information window.

Click Finish to

add the new depreciable item.

Continue with the next section to view or change

depreciable asset information.