Configuring Worker Taxes

All taxes or deductions that are deducted from a worker's pay must be

entered within the Worker Taxes tab. This

can include federal, state, or local taxes or other costs that are deducted

from the worker's pay. All taxes and deductions that are calculated

by the payroll process but are not deducted from the worker's pay should

be configured within the Company

Taxes tab.

Globally setup a tax or deduction for a group of workers, right click

on the worker category and select Edit Defaults

from the context menu. Review Workers

> Setting Worker Defaults for details on globally changing worker

information.

Complete the following steps to configure worker taxes:

Open the worker default

dialog or worker record.

Click on the Worker Taxes

tab:

- Click the New Taxes button to open the

following dialog:

- Select the Tax identification

code. Review Taxes

and Deductions > Adding New Taxes and Deductions for instructions

to add a new tax or deduction.

Select the Paid

By option as Employee.

The marital Status

will be copied from the employee’s Personal tab and should be kept

the same unless this particular tax is to be calculated using a different

marital status.

The number of Exemptions

will be copied from the employee’s Personal tab and should be kept

the same unless this particular tax is to be calculated using a different

exemption number.

The Extra Deduction

Formula is used to add an additional tax to the standard rate.

This formula should be set to Equal

to except for the following situations:

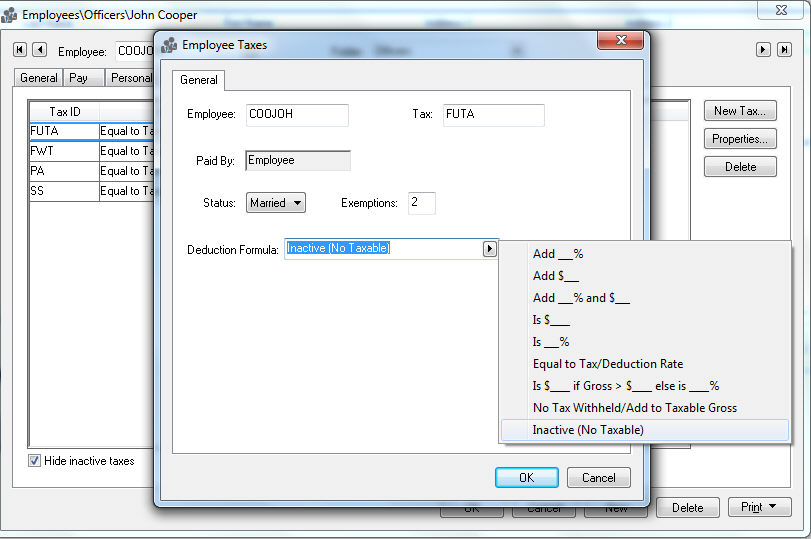

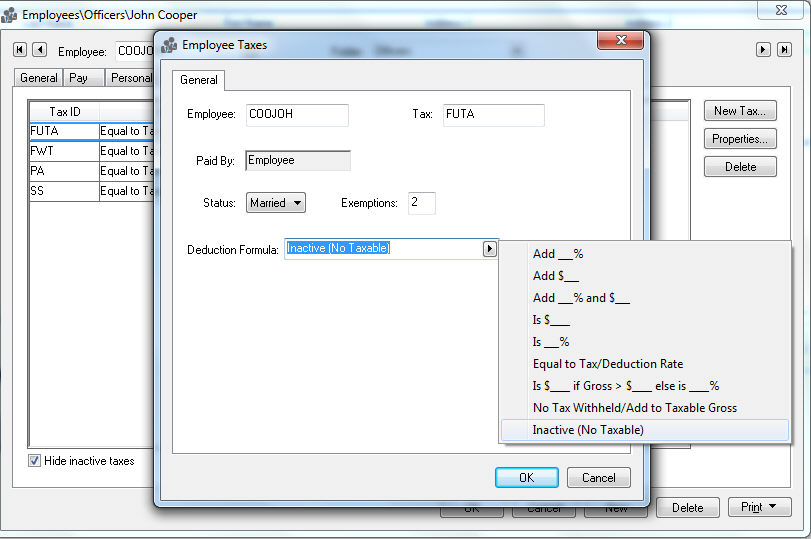

Set the Deduction

Formula to Inactive (no

taxable) to make the tax or deduction inactive. Note that

a tax cannot be deleted if history is present. Review the Taxes

and Deductions > Removing an Unused Tax Entry section for

more details.

To add

additional tax to the standard rate use the Add

__ % template to add additional percentage for this employee

or Add $__ template to

add additional dollar amount. This feature is useful if an employee

wishes to withhold an additional amount of Federal Withholding

Tax, or if an additional amount is deducted from one employee

compared to the other employees. It is best to set the appropriate

rate within the Tax/Deduction

window when possible, but the Deduction

Formula can be used to do deductions that are more complex

or variations.

To ignore Tax/Deduction

rate and manually set the deduction amount use the Is

$___ template to set the exact dollar amount of the deduction

or use Is ___% template

to set a percentage that is unique to this employee. These templates

will ignore any rates set within the Tax/Deduction window.

Click OK

to save. Repeat the steps listed above for each tax that you

wish to add or edit.

Deleting or Disabling a Tax

Highlight the desired Tax ID

and click on the Delete button

to remove a tax entry that has not been used. A tax or deduction cannot

be deleted but should be made inactive if any tax has been withheld. This

limitation is required so the employee history is not lost. Complete the

following steps to configure a tax or deduction as inactive:

Select

an existing tax and click on the Properties

button

Select

the Inactive (No Taxable)

option, as shown below:

Click

on the OK button to return to the tax list.

Click

the Hide inactive taxes option

ON if you wish to remove the inactive taxes from the list.

View History

Complete the following steps to view both

tax summary and details information:

Open the desired worker or company

tax or deduction record.

Click on the desired year tab as shown

below:tax and click on the Properties

button. Go to the appropriate year tab to view the tax or deduction

history for the entire year.

The history consists of 3 columns.

The Tax

amount is the total that has been withheld from the employee.

The Taxable

Gross amount is the employee’s total pay that was subject

to the tax or deduction.

The Total

Gross amount reflects the employee’s total gross including

both the taxable and non-taxable totals.

To view the source detail for both

the Tax and the Total

Gross columns right click on the total you wish to view and

select Drill down from the

context menu. From the details list select the pay date that you wish

to view and click Source to

view the timecard from which the tax or deductions was withheld.