The steps to edit or add a company tax are very similar

to adding an employee withholding tax.

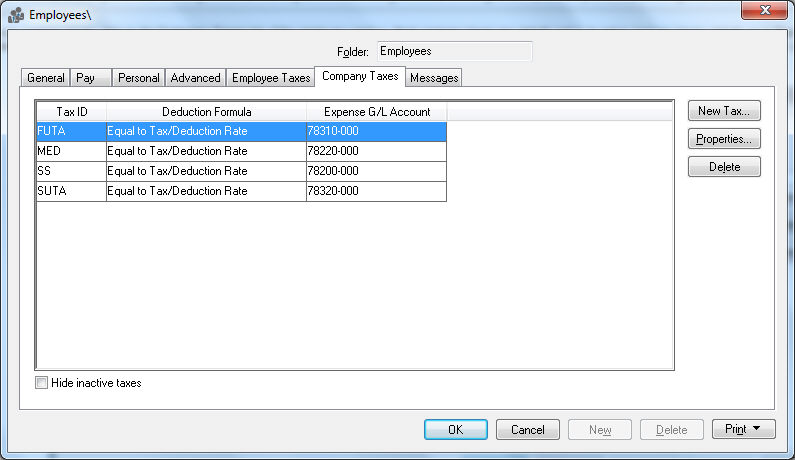

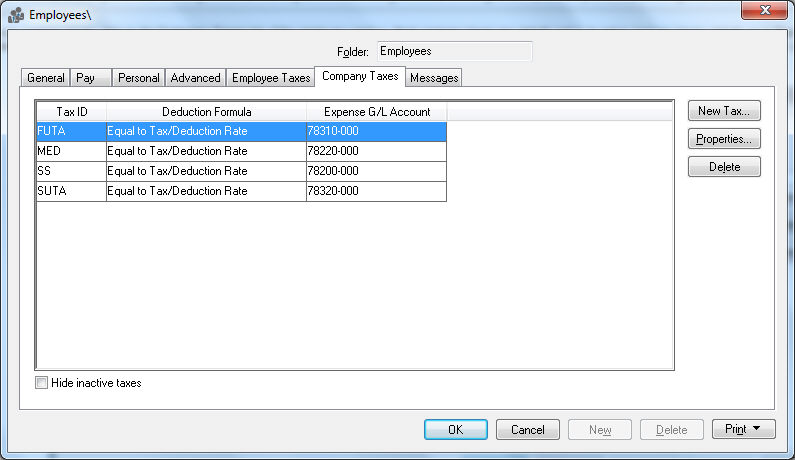

If you need to change company taxes, click on the Company Taxes tab of the employee window. Most company taxes are globally setup; to setup company taxes globally go to Labor > Options > Employee Folders and click the Edit Defaults button and click on the Company Taxes tab. Review the Workers > Setting Employee Defaults section for more details on employee defaults.

Follow the steps listed below to setup a company tax or deduction:

The steps to edit or add a company tax are very similar

to adding an employee withholding tax.

Click on the Properties button

to edit any existing tax information, or click on the New

Tax button to add taxes to the list. The following window will

appear if either button is clicked.

To add a company tax or deduction, a valid tax must be selected from the tax list. To select a tax, click on the lookup button to the right of the tax field and select a valid tax. To create a new tax, click on the New button on the tax list, or go to Labor > Taxes/Deductions. Review the Taxes and Deductions > Adding New Taxes and Deductions section for more details on entering or editing taxes or deductions. EBMS contains many of the common taxes, but verify that the correct rates are entered for each tax before you process any payroll.

When editing tax Properties you cannot change the Tax identification code. To change the tax Id, the original tax must be made inactive and the new tax line added.

A tax cannot be deleted but should be made inactive by selecting the Inactive (no taxable) deduction formula option. Review the Taxes and Deductions > Removing an Unused Tax Entry section for more details.

The Extra Deduction Formula is used to add additional tax to the standard rate. This formula should be set to (none) or Equal to for all company taxes except in very rare occasions.

Set the Expense G/L Code to a general ledger overhead account to record the expense of this tax. Since employee taxes are withheld from the employee’s check they are not recorded as an expense to the company, but company taxes are paid by the employer and must be recorded within an expense general ledger account. Click on the lookup button to view the available general ledger accounts. The tax expense codes should be located within the expense folder of the ledger.

Click OK to save changes.

Repeat the steps listed above for each tax that you wish to add or edit.

Pretax NOTE: The worker's taxable wage is the wage base for any pretax company paid tax or benefit. Therefore, A company tax is only processed as pretaxed if there is a worker withholding deduction with the same tax id or tax type.

Select the correct year tab to view annual tax or deduction history.