Paying Sales and Use Tax

EBMS includes a step by step payment wizard to pay sales tax that has

been collected from customers and use tax for consumed items. The tools

included with EBMS are convenient ways to calculate the tax payable, the

taxable totals, and the gross total required by most state tax agencies.

These tools can be used in connection with the optional TaxJar SmartCalc

sales tax calculation tool. This section can be ignored

if the TaxJar > AutoFile tool is used

to pay sales taxes.

Create Tax Agency Vendor

Complete the following steps to create a vendor to pay sales tax:

Create a tax agency vendor. See

[Financials]

Vendors > Adding a New Vendor of the main documentation for

more details on creating a new vendor.

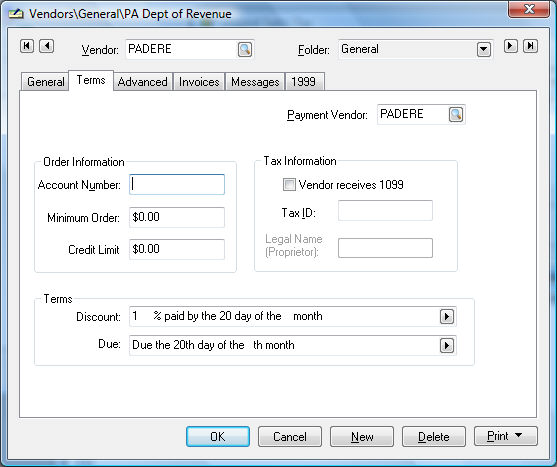

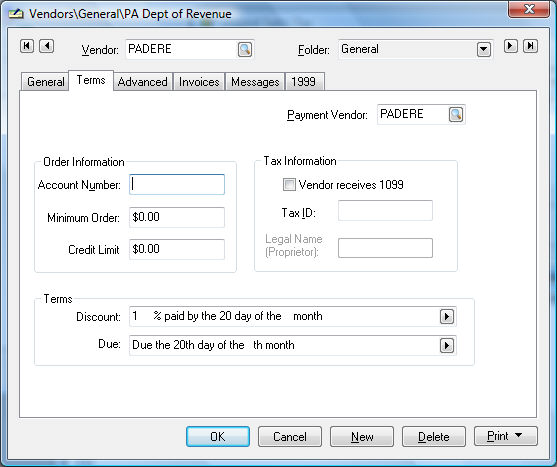

Click on the terms tab of the vendor

and set the proper terms.

.

Set the discount terms to the proper

percentage if the tax agency gives the tax collector a percentage

for the collection costs. The Discount

and Due settings shown above

are the appropriate settings if the state gives a 1% discount and

the payment due date is the 20th of the month.

Set the proper terms so the sales

tax is paid by the due date.

Click on the Advanced tab to set

the Vendor Discounts financial account.

This account should be a miscellaneous revenue account. Review

[Financials]

Chart of Accounts > Adding General Ledger Accounts for instruction

to create a new revenue account.

Save this vendor by clicking OK.

Create Invoice for Tax Payment

Complete the following steps to configure the tax agency, generate an

expense invoice, and pay the tax liability.

Verify that all tax rate tables contain the proper

tax agency vendor ID. Repeat for all sales tax rate tables that

are paid to the specific tax agency. This step must be completed before

launching the Pay Sales Tax

wizard.

Launch the Pay Sales

Tax wizard by selecting from the main EBMS menu. Note

that this wizard will include applicable sales and use taxes.

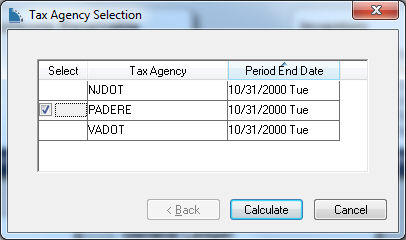

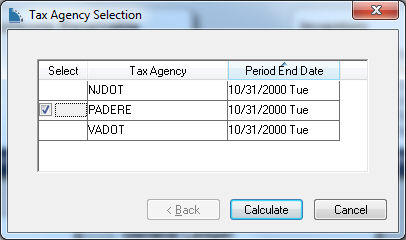

Select each Tax Agency

that is to be paid by clicking on the Select

column.

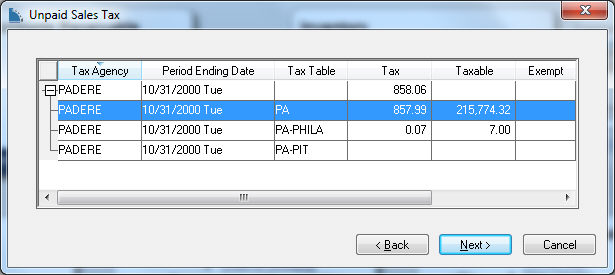

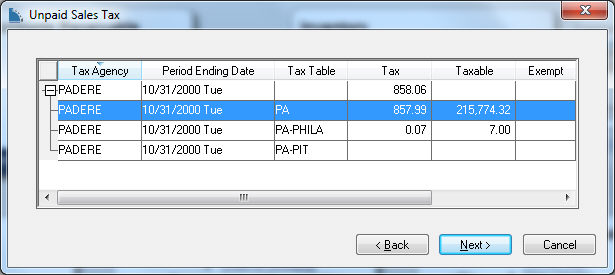

Click the Calculate

button to open the following Unpaid

Sales Tax list:

.

Review the tax values for each Tax

Table associated with the selected Tax

Agency. Click Next

to open the following dialog:

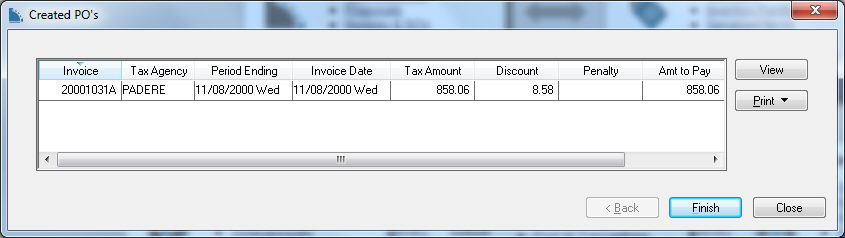

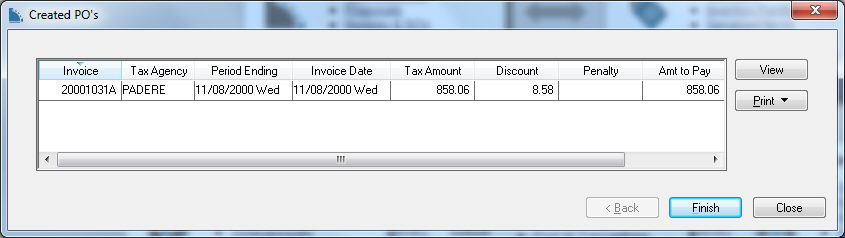

Enter any necessary Penalty

fees.

Click Print to print the

Sales Tax Detail report. Review the report documentation section

below for details.

Click View to add any discount to the invoice as shown

below:

NOTE: that the discount must be properly configured. If

the user entered a credit line to the invoice the G/L

Account MUST identify

the discount income account and cannot use the same tax liability

account as the tax lines.

Click one of the following to create the expense invoice:

Click Finish to process

the payment expense invoice. Review [Financials]

Vendor Payments > Selecting Invoices to be Paid for steps

to generate the payment.

Click Close to create

a purchase order but not process the document into an expense

invoice.

The sales tax payment invoice can be deleted and the

payment wizard relaunched. Note that the system marks

sales tax transactions paid when invoice is processed. Creating

an invoice manually without using the payment wizard does

not properly mark sales tax records paid.

Review [Financials]

Expense Invoices > Processing an Invoice for instructions to process

the invoice.

Tax Report

This report requires that the payment wizard to create the payment invoice

(see previous section) has been completed.

Select from to list tax liability totals.

Reports can be printed to list the transaction detail by selecting the

appropriate report from the Print

button located on the tax rate dialog. Review [Main]

Reports > Print Button for instructions to add specific sales tax

reports to the Print button.