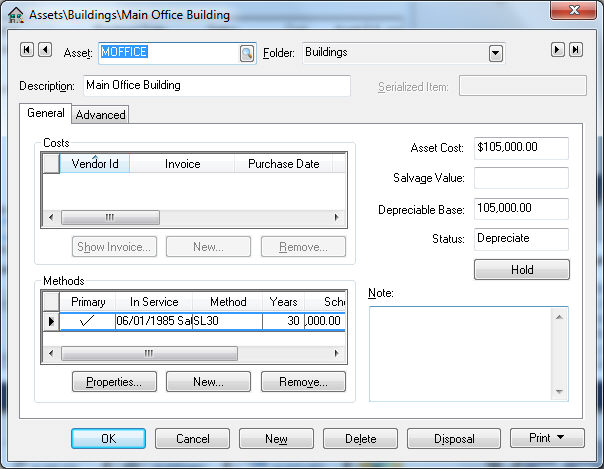

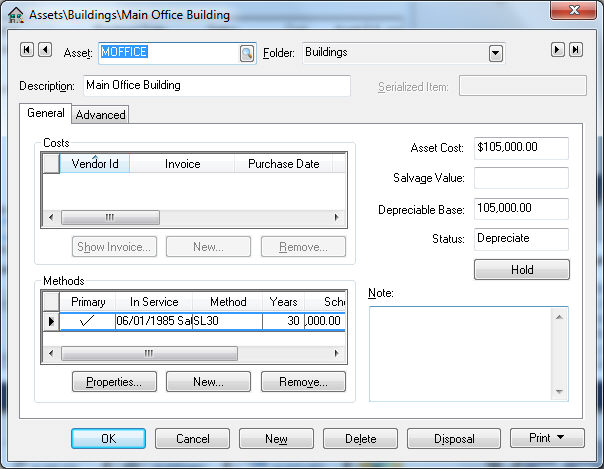

Viewing or Changing Asset Information

Depreciable asset information such as methods, status,

scheduled amounts, or miscellaneous notes can be viewed or changed during

the process of the depreciation. Some values will be protected based on

the status or progress of depreciation. Complete the following steps to

view or change asset information:

- Go to Financials

> Depreciation

> Depreciable Assets and select an existing

asset.

- The asset Description,

Folder, and Notes

can be changed at anytime.

- Highlight an invoice within the Costs box and

click on the View

Invoice button to view the expense invoice

for the depreciable asset. If the Vendor

Id contains "($)DEPR" the cost

was manually entered using the new asset wizard rather than generated

from an expense invoice and cannot be viewed. See the Purchasing

Assets > Adding Assets Using an Expense Invoice section for more details creating new asset records from

an invoice. Additional costs can be added to an asset if the status

is set to Hold. See the Purchasing

Assets > An Alternative Method of Adding Costs and Assets

for details on how to add costs to assets.

- An asset can be assigned multiple methods. The

primary method (identified by the check mark) is the method used during

the monthly process. See the Depreciating

Assets using the Monthly Process section

of this manual. All other methods are used to create adjustments within

the general ledger for report purposes. See the Alternative Depreciation Methods for Reporting

Purposes section for details on how to add

or use alternate methods.

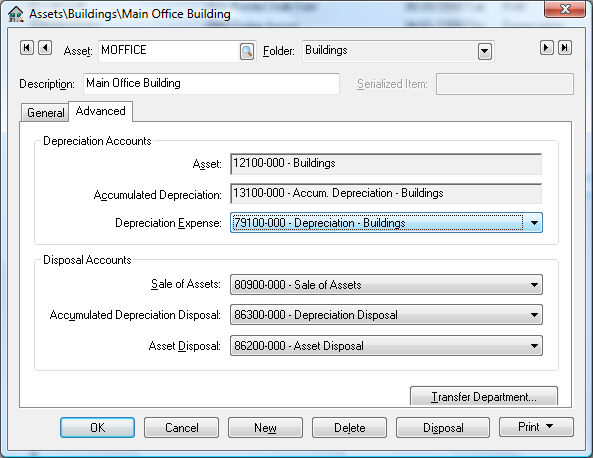

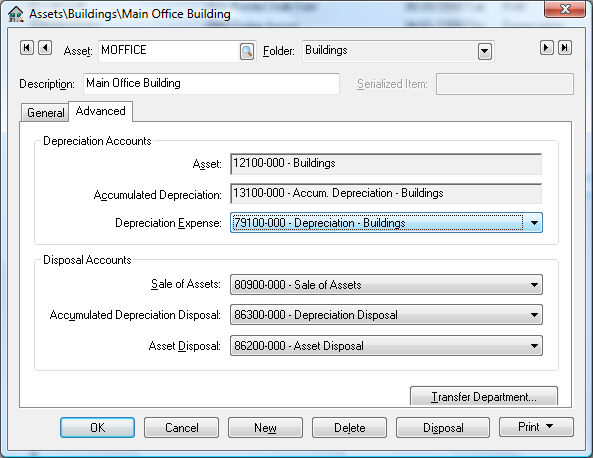

- The general ledger account settings for an asset

can be seen by clicking on the Advanced

tab as shown below:

- The Depreciation

Accounts are general ledger accounts that

must be classified with the following settings:

- Asset: An asset account classified

as Depreciable

Asset

- Accumulated

Depreciation: Enter an asset account

classified as Accumulated

Depreciation. The monthly depreciation

amounts will be credited to this account during process. See Managing

and Processing Assets > Depreciating Assets using the Monthly

Process section for details on the

depreciation process.

- Depreciation

Expense: Enter an expense account

classified as Depreciation

Expense. The monthly depreciation amounts

will be debited to this account during process. See Managing

and Processing Assets > Depreciating Assets using the Monthly

Process section for details on the

depreciation process.

- The Disposal

Accounts are general ledger accounts that

must be classified with the following settings: These accounts

will be used when an item is disposed or sold. See the Disposing Assets section of this manual for more details.

Sale

of Assets: Enter a revenue account

classified as Sales

of Assets

- Accumulated

Depreciation Disposal: Enter an expense

account classified as Depreciation

Disposal

- Asset

Disposal: Enter an expense account

classified as Depreciation

Asset Disposal.

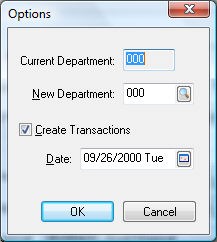

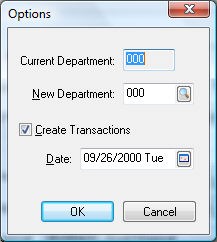

- Click on the Transfer

Department button to move an asset from one department into another.

- Enter the new Department

code. The system will change all general ledger

codes to match the new department if they exist. The general ledger

account will not be changed if any of the Depreciation

or Disposal

Accounts do not contain the new department. General ledger transactions

will be created if the Asset

or Accumulated

Depreciation accounts are changed. The new

transactions will be created using the Process

Date. Click OK

to create the transactions.

- Click on the OK

button to save any changes to the asset.