Adding Assets using an Expense Invoice

Complete the following steps to add new assets to

the depreciation system is though an expense invoice at the time the item

is purchased.

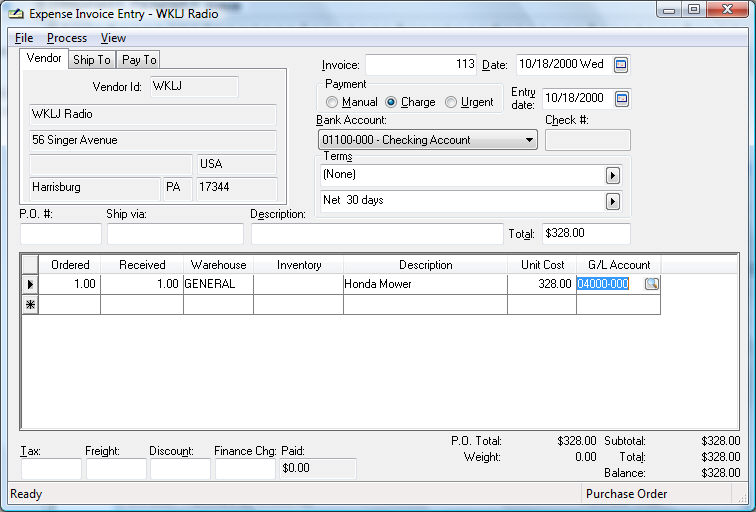

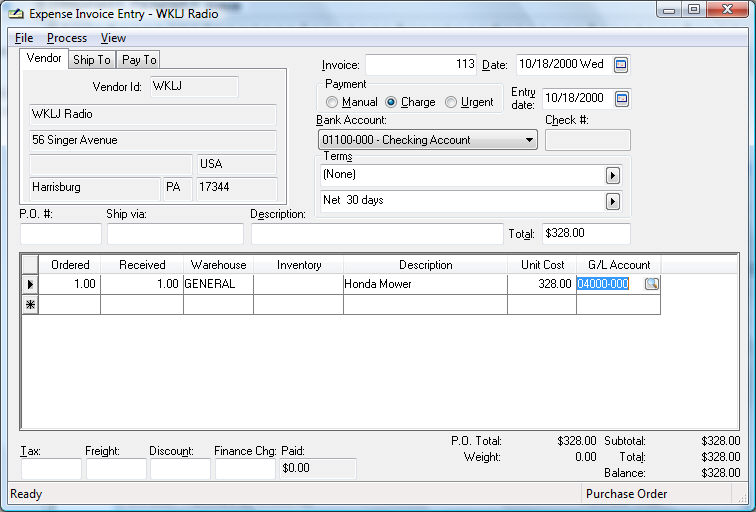

- Go to to open an expense invoice.

- Enter a purchase order or expense invoice in

the standard way with the exception of the General Ledger account.

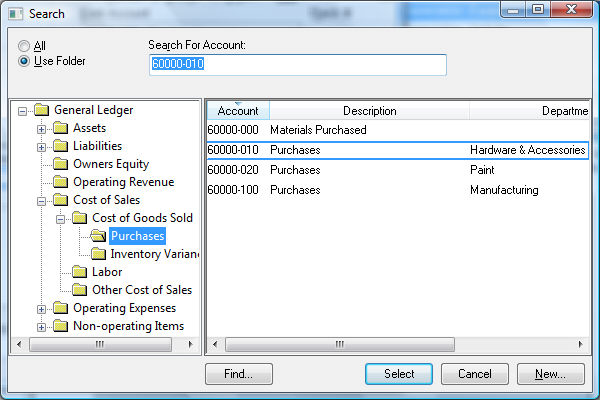

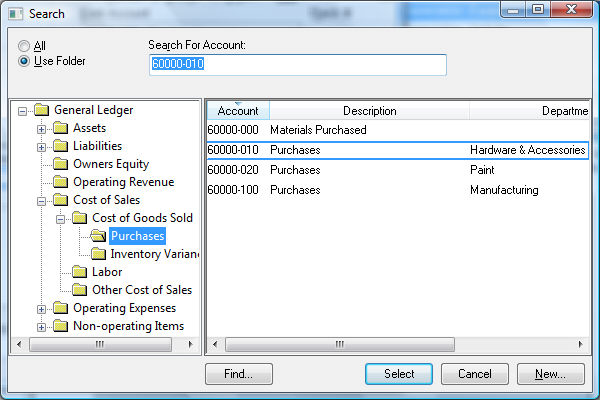

Click on the G/L

Account lookup button. The General Ledger

account must be set to an asset account that records depreciable assets.

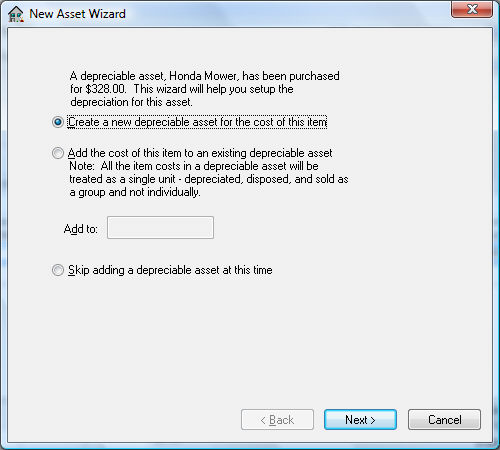

- The wizard to add depreciable assets will be

activated each time an expense invoice contains a General Ledger account

that is classified as Depreciable

Asset. Review the Getting

Started > Adding and Deleting Asset Folders section for more

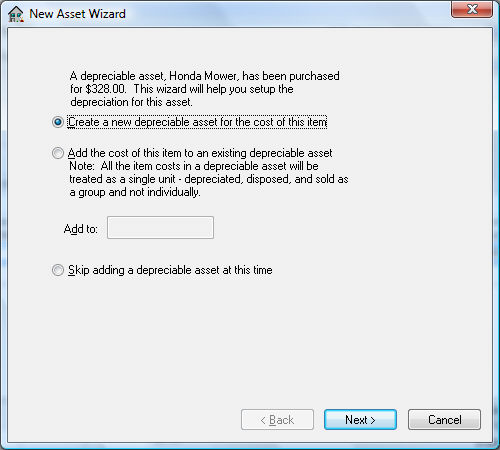

details on account classifications. The following wizard will be activated

at the time the invoice is processed:

- Select the first option – Create a new depreciable item for the cost

of this item to create a new asset. Select

the second option to add costs to an existing depreciable item. Click

the Next

button.

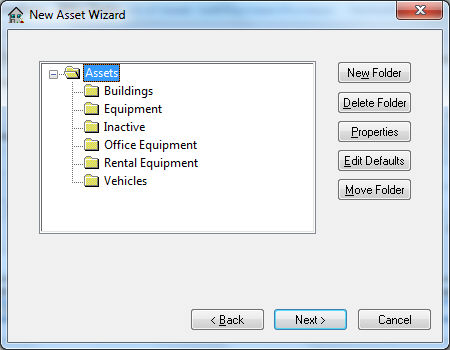

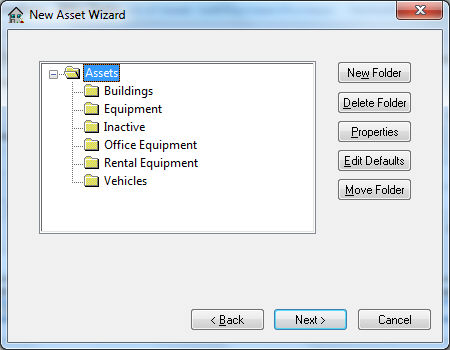

- Select the appropriate folder. Adding items

can be greatly simplified if the General Ledger accounts and other

defaults are properly set for each folder (group of assets). See the

Financials > Chart

of Accounts > Adding General Ledger Accounts section of the

main manual for more details on adding folders. Click the Next

button.

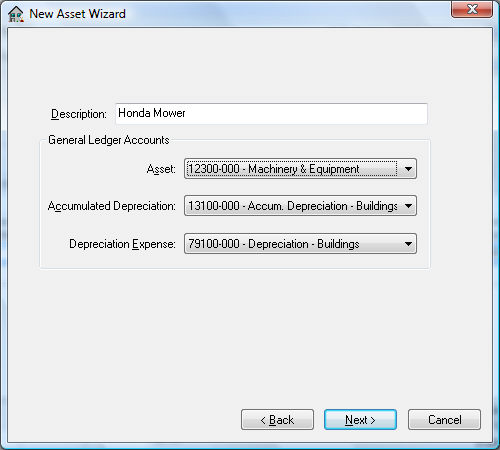

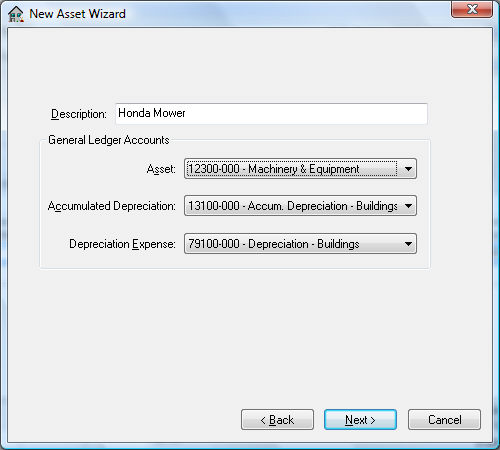

- Enter an appropriate Description

to identify the new asset.

- Set the correct General

Ledger Accounts. The Asset account

will be set to the G/L

Account entered within the invoice. The

Accumulated Depreciation

account is an asset account used to record the

accumulated depreciation. The Depreciation

Expense account is an expense account that

records the annual depreciation. Click the Next button.

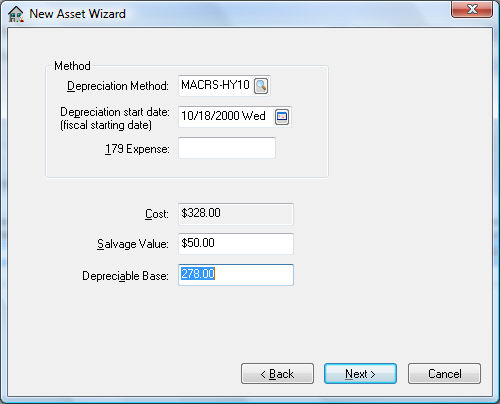

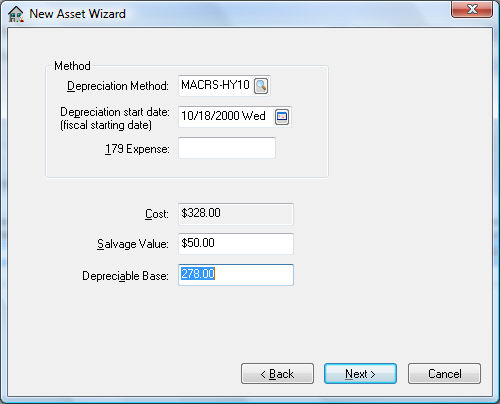

- Enter a Depreciation

Method by clicking on the lookup button

and selecting a method. This method can be changed at a later time

if a method has not been determined at this time. See the Getting

Started > Depreciation Methods section for more details on

adding or changing methods. See the following Managing

and Processing Assets > Changing Methods within an Asset section

for details on changing the depreciation method.

- The Depreciation

Start Date will default to the date found

on the expense invoice. The depreciation schedule will use this date

to determine in which fiscal years the depreciation is scheduled.

- The purchase Cost

of the asset will be copied from the invoice.

- Enter the estimated Salvage

Value of asset at time of disposal. This

amount will be deducted from the Cost

to calculate the Depreciable

Amount. Depreciable

Amount = Cost – Salvage Value. Click

the Next

button to continue.

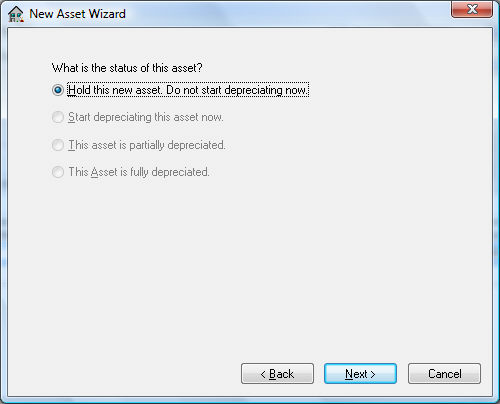

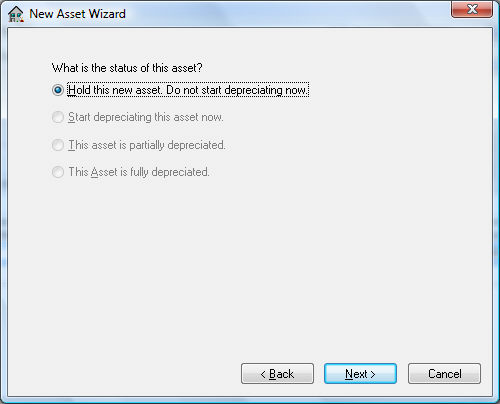

- Select one of the following status options for

the asset:

- Hold

this new asset. Do not start depreciating now. This option

is the only available option if no depreciating method has been

entered for this asset. The Hold

option will record the asset but will not process

any accumulating depreciation and is useful if the user wishes

to obtain advice on the appropriate depreciation method. The asset

status can be changed to a depreciating status at anytime. See

the Managing and

Processing Assets > Changing Methods within an Asset section

below.

- Start

depreciating this asset now option will

cause the asset to start depreciating at the time of the next

Monthly Process. See the Managing

and Processing Assets > Depreciating Assets Using a Monthly

Process section for more details

on processing depreciation.

- This

asset is partially depreciated and

This

Asset is fully depreciated. These options

should not be used when adding new assets from an expense invoice.

- Click the Next button.

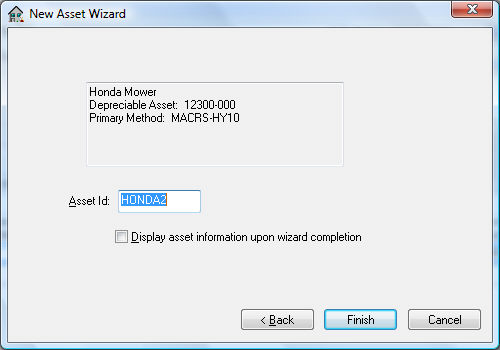

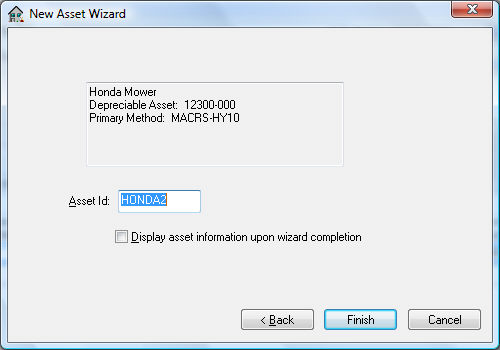

- Enter the Asset ID.

Display asset information upon

wizard completion will open the Depreciable

Asset window. Click Finish to

complete the wizard.

See the Managing

and Processing Assets > Viewing or Changing Asset information section

of this manual for more details on viewing or changing new asset information.