Depreciating

Assets using a Monthly Process

The monthly accumulated depreciation process

must be launched to create accumulated depreciation transactions within

the general ledger. This process is designed to be run monthly to distribute

depreciation expenses to each monthly period. The process can be run multiple

times per month or be launched on a quarterly, annual, or any other user

defined period.

The Accumulated Depreciation process will not duplicate

the expenses if the process is run multiple times in a single month. The

process will only make adjustments based on additional assets or any depreciation

schedule changes.

The process will post 1/12th of the scheduled value

each month but will calculate a larger ration if the process date is forwarded

to skip months. For example, the process will post 1/4 of the annual scheduled

value if the date is changed from the first to the 3rd month on the initial

process.

Complete the following steps to create accumulated

depreciation transactions:

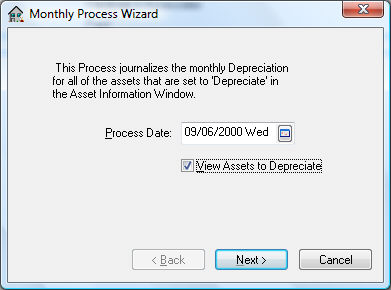

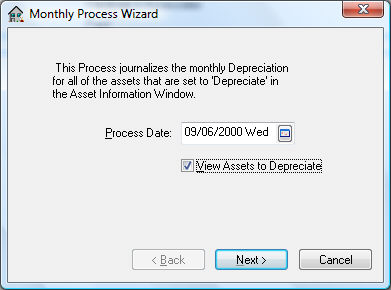

- Go to Financials

> Depreciation

> Monthly Process to open the following

dialog. Depreciation transactions will need to be posted first.

- The Process

Date reflects the next fiscal month to process.

This date should be set to the first fiscal month date if it is the

initial depreciation process. After the depreciation has been calculated

and processed for the specified month the Process

Date will be incremented to the next month.

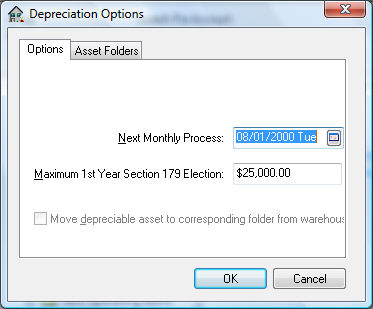

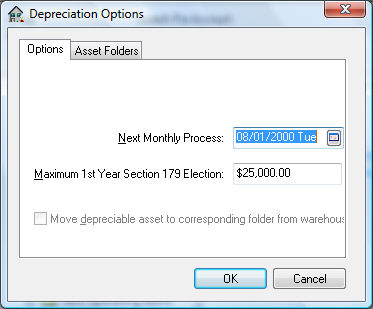

The Next Monthly

Process date can be viewed or changed in

Financials >

Depreciation > Options

> Options tab.

- The accumulated monthly depreciation amount

is calculated using the following equation:

- Monthly Depreciation

= SD / 12 * FM – PD

- SD = Scheduled annual Depreciation on the primary method.

- FM = Fiscal year Month number.

If the fiscal year is same as calendar year then January =1, February

= 2, etc.

- PD = Previous Depreciation for the year.

- If the user wishes to post depreciation for

the entire year, the Process

Date should be set to equal the last date of the fiscal year.

Enter the last month of the fiscal year quarter to post the entire

quarter’s depreciation. Note that the Process

Date will always default the next month.

- Turn the View

Assets to Depreciation option ON to list

each asset and its scheduled depreciation before processing.

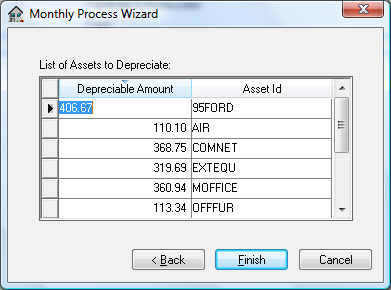

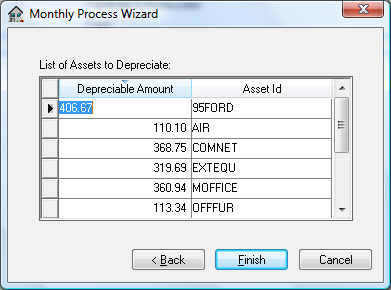

- Click on the Next button

and the following dialog will appear:

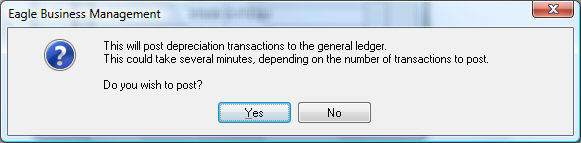

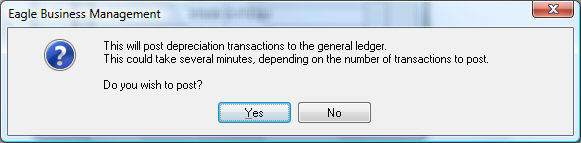

- Click Finish to

process and update the monthly depreciation totals. In order to finish,

click Yes

to post transactions to general ledger. Click

No if

you prefer to view or print transactions before they are posted to

general ledger. View transactions from the Financials

> Depreciation

> Display Unposted Transactions selection

of the menu if they have not been posted.

Asset accumulated depreciation totals will not be

updated until the transactions are posted.

The Monthly

Process is the only step needed monthly

to calculate and post accumulated transactions.