The value of an asset will be recorded within the general ledger until the asset is disposed (not being used or junked) or sold. This section will explain the steps that should be used when an asset is sold. See the next section, Disposing Assets > Removing Disposed Assets, for an alternative method to dispose assets.

Often depreciable items that are being rented using the EBMS rental module are recorded within inventory. Rental items are normally depreciated instead of recorded within the standard inventory system. Many depreciable assets such as vehicles, building equipment, and other depreciable assets are not recorded as inventory.

The asset should be removed from the depreciable assets list at the time a sales invoice is entered. Complete the following steps to process the sale of the general fixed asset:

Go to Sales

> Invoices and S.O.s to open the sales

invoice.

.

Enter a sales order in the same manner as any other sale with the following exceptions:

Do not enter an inventory item when selling a depreciable asset but enter a brief Description in the invoice detail line.

Enter the sale price of the asset that is being sold.

Enter a G/L Account that is classified as "Sale of Asset". This will activate the depreciation wizard at the time the sales invoice is processed.

A separate sales invoice line should be entered for each depreciable asset. Complete the following steps to dispose of the asset.

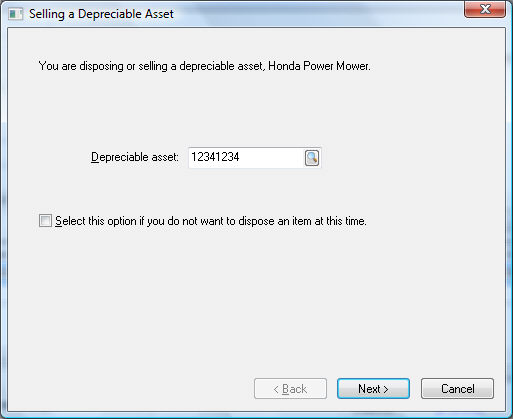

The Select this option if you do not want to dispose an item at this time option should be turned OFF. No assets will be disposed if this option is turned ON.

Click the Next

button to continue. The following dialog

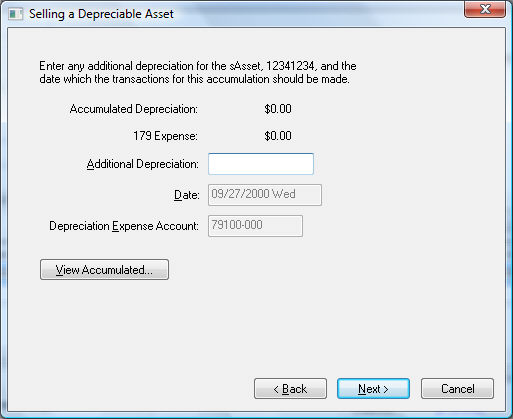

will only appear in the depreciable item is not fully depreciated.

Enter any Additional Depreciation that is to be expensed before the asset is disposed. This value would be in addition to any depreciation that has been processed in the current year or prior year. Click on the View Accumulated button to list the total amount of depreciation that has already been accumulated as well as the scheduled annual amounts.

The Date and the Depreciation Expense Account are necessary only if Additional Depreciation is entered which creates general ledger transactions. Otherwise ignore the values of these two fields.

Click Next

to continue with the next page of the wizard as

shown below:

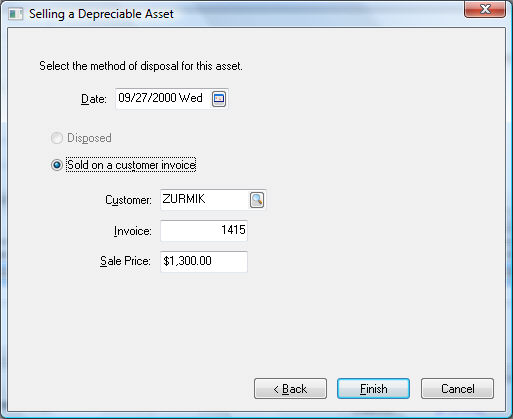

Select the method of disposal and the date it is to be disposed. The contents of the invoice will be copied into the fields on this page. These copied values should equal the correct disposal information. Click the Finish button to complete the disposal process.

Standard sales General Ledger transactions will be created based on the information entered into the sales invoice. Additional depreciation transactions will be created to dispose of the asset as listed below:

Debit |

Credit |

Accumulated Depreciation (Asset G/L) |

Asset Value (Asset G/L) |

Asset Disposal (Expense G/L) |

Depreciation Disposal (Expense G/L) |

Additional depreciation transactions will be created if Additional Depreciation was entered on page 2 of the wizard.

See the following section – Disposing Assets > Removing Disposed Assets to remove assets without using a sales invoice.