Support >

Year End

>

Open Fiscal Year 2023

As we approach the end of 2022 and prepare for 2023, you need to open fiscal year 2023 in EBMS so you can process transactions in the new year.

Opening the new year will close fiscal year 2021, however, you will still be able to make transactions in 2022. We recommend running this process early or middle of December to avoid being rushed at the end of the month.

2021 should only be closed after:

- All transactions have been posted for the year. (Financials > Post All Transactions)

- The accountant has processed tax returns and has made all necessary adjusting and closing entries.

Important Note:

This process may take a long time - from a few minutes to a day or more depending on your data size. You may want to start in the evening and let it run overnight.

Step-by-Step Instructions

to Close the Old Year and Open the New Year

1. It is reccomended to do this from the EBMS data server, but not required. If you have a larger data file you will have a better experience doing it from the server.

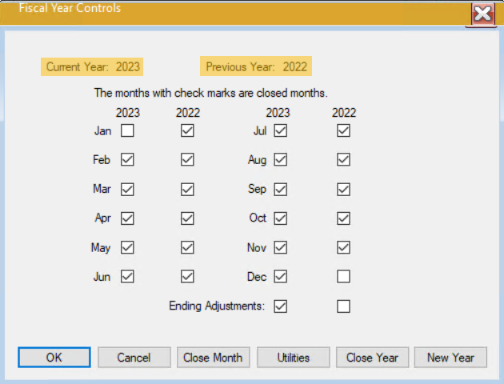

2. Go to General Ledger > Fiscal Year Controls

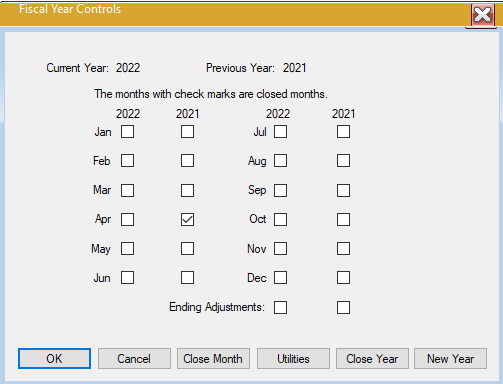

3. Ensure that this process has not already been done for your company.

- If your current year is 2023, this process has already been done. Do not proceed.

- If your current year is 2022, please continue.

4. Close the 2021 year by checking off each month,and be sure to check the 2021 Ending Adjustments box as well. (Clicking the close year button checks these all at once for you.)

5. Click on New Year

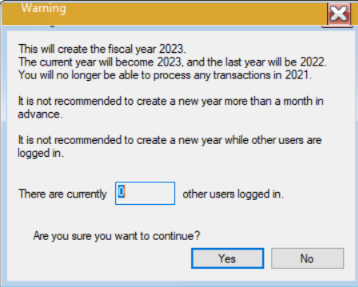

6. A warning message will appear telling you how many people are logged in.

It is recommended to have all other users out of EBMS, but it is not required to move forward.

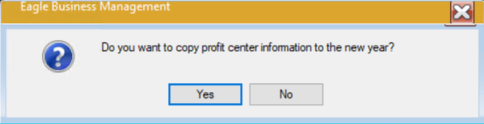

7. After you've clicked yes, a message will appear asking if you want to copy profit center information to the new year. Click yes if you do. If you are unsure if you have profit centers, you can click yes as well; it will only copy them if you have them.

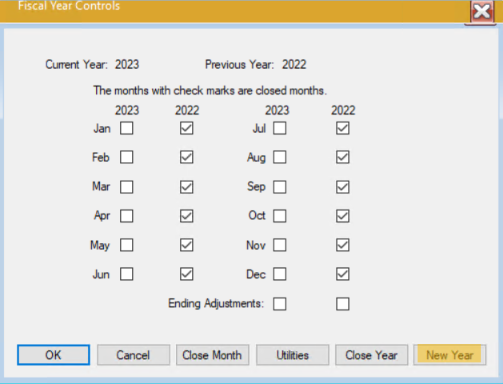

8. The process will run. When it is done your fiscal year controls window should look like this:

9. We suggest closing all months you are not currently working in. In this case, all months except December 2022 and January 2023 should be checked.

10. Congratulations! You're ready to make sales in 2023!

For more instructions review these sections:

Please feel free to contact the client support team if you have any questions.

< Return to Year End web page