EBMS Support Center > IRS New Federal Withholding Tables

The IRS has issued new federal withholding tables that are effective immediately. These new tables have been developed due to changes to the tax law made in the American

Recovery and Reinvestment Act of 2009. The IRS asks that employers begin using these

tables in lieu of the applicable previously published tables as soon as possible,

but no later than April 1, 2009.

This change involves only a few numbers in the tax table for married and singles. Below are instructions for changing those numbers in EBMS.

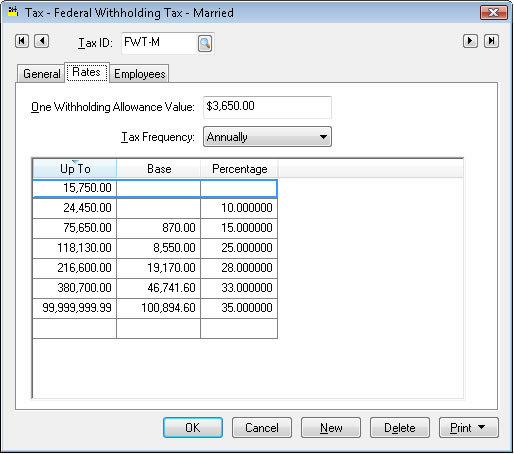

Go to Payroll -> Taxes/Deductions and find the FWT-M tax (or whatever you call

your federal table for Married). Go to the Rates tab, and change the numbers according

to the screen below:

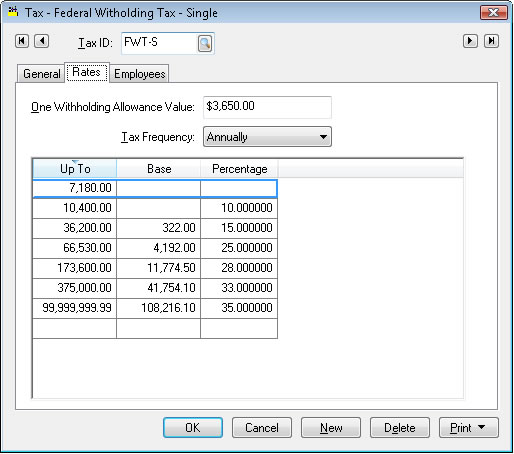

The rates for FWT-S (Single) are as follows:

For anyone running the tax update, these rates are now reflected there as well.