Creating Journal Entries

There are times when general journal entries may need to be made. A journal entry window is available in most modules. For example, if you wish to enter a sales journal, use the

Journal Entry window within the

Sales menu. Some possible reasons for creating a journal are listed below.

-

An expense or income transaction may have been posted to the wrong account and rather than going back and changing the invoice it is easier to make a general journal entry.

-

To enter any Ending Adjustment "Month 13" transactions.

-

When adjustments are necessary to make loan balances equal the correct ending balance.

-

To adjust any payroll tax amounts or employee balances.

-

When inventory history totals do not match the detailed inventory amounts.

-

To adjust accounts receivable or accounts payable balances including adjustments to the customer or vendor’s history totals.

-

To enter beginning balances when starting to use the system.

-

To distribute Retained Earnings totals to different equity accounts.

-

To enter year-end adjustments needed to correct any balance sheet account.

This list is not complete since the journal can be used to create any transaction. Each module contains it’s own journal window which will post to different transaction files.

-

The General Ledger Journal’s transactions are posted directly into general ledger and history files. No additional posting step is needed

-

The Expenses, Sales, Inventory, and Payroll (as well as any other module) journals will be posted into the corresponding module’s unposted transaction file. For example, the Expense Journal will be posted in the Expense Unposted Transaction file.

Creating a General Journal Entry

To make a general journal entry, take the following steps:

-

Go to

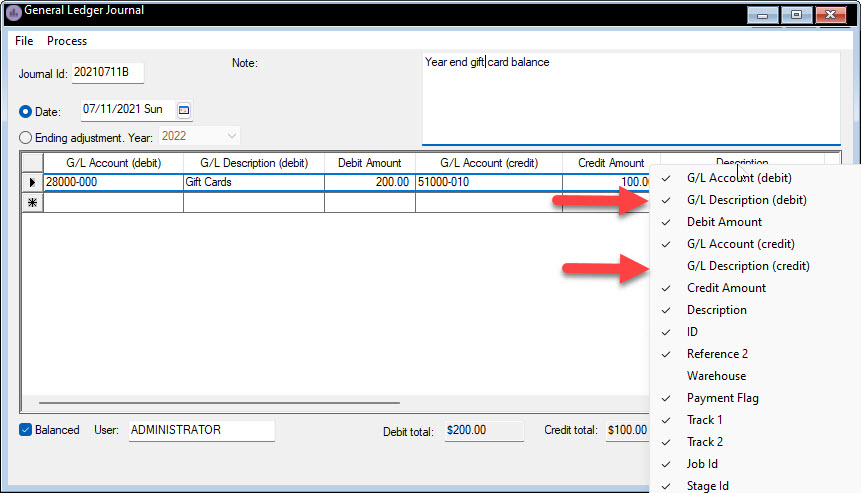

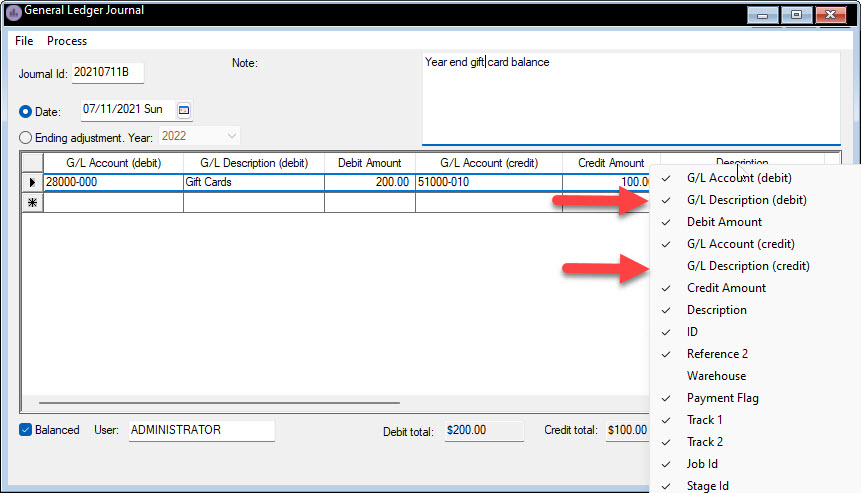

and the following window will appear:

-

Enter a

Journal ID. A Journal ID can be a date, word, initials, or anything that helps identify the journal. A recommended journal ID format is to use YYYYMMDD (using the journal date). The date journal ID can be suffixed or prefixed with a sort

code such as YE for Year End, ADJ for adjustment journal, or BB for a Beginning Balance journal. For example, a month end adjustment for the month of October could be coded as 19981031ADJ.

-

Enter the transaction

Date, which will determine the month and year in which the transaction will be posted. To post Ending Adjustment "Month 13" transactions select

Ending Adjustment Year and set the appropriate year.

-

Enter the

G/l account to be debited. Use the drill down button to view all accounts if unsure of the account number. A journal line may contain only a Credit Account with the Debit Account blank or vice versa. A Debit

G/L account must be entered if the Debit amount contains a value.

-

Show the G/L Description (debit) and the G/L Description (credit) to include the G/L Account descriptions. This column is for reference purposes only. Review [Main] Features > Column Appearance for steps to show or hide columns.

-

Enter the

Debit Amount.

-

Enter the

G/L account to be credited. Use the drill down button to view all accounts if unsure of the account number. A Credit

G/L account must be entered if the Debit amount contains a value.

-

The G/L Description (credit) can be inserted to identify the account that is credited.

-

Enter the

Credit Amount.

-

Enter a

Description of the journal entry. Note that this description will be the primary explanation of this transaction to an accountant or auditor at a later date.

-

The

ID, Reference 2, Track 1, and

Track 2 are advanced fields that affect a variety of historical data within the system and should be used with caution. These columns should not be used with a "13th month" journal entry since the customer, vendor, inventory,

and other history tabs do not contain a 13th month.

Common Journal Adjustment Settings

Listed below are some of the more common uses for these fields. The G/L Class column is to identify the class of general ledger account required for this adjustment. It is very important that the general ledger account is set with the proper classification.

Go to

tab to view a general ledger account's classification. The account must also be listed in the proper debit or credit column as described in the

Debit/Credit column. Negative credits or debits must be used at times to decrease history. Multiple adjustments within the same date period may be listed on the same journal.

N/A indicates that the column is not applicable and can be left blank.

|

Debit/Credit

|

GL Classification

|

ID

|

Reference2

|

Track1

|

Track2

|

|

Adjusting Vendor Invoice History

|

|

|

Credit

|

Accounts Payable

|

Vendor ID

|

N/A

|

N/A

|

N/A

|

|

Adjusting Vendor's Down Payment History

|

|

Debit

|

Prepaid Expense

|

Vendor ID

|

Check No.

|

N/A

|

Bank G/L Account

|

|

Adjusting Vendor Payment History

|

|

Debit

|

Accounts Payable

|

Vendor ID

|

N/A

|

N/A

|

N/A

|

|

Sales Tax Adjustments

|

|

Credit

|

Sales Tax

|

Customer ID*

|

Sales Tax ID

|

Taxable Gross

|

Total Gross

|

|

* The ID entry is optional since the customer history contains no sales tax history. List the customer if the adjustment is a result of an invoice involving a specific customer; otherwise ignore the ID column.

|

|

Adjusting Customer Invoice History

|

|

Debit

|

Accounts Receivable

|

Customer ID

|

N/A

|

N/A

|

N/A

|

|

Adjusting Customer Down Payment History

|

|

Credit

|

Deferred Income

|

Customer ID

|

Check No.

|

N/A

|

Cash G/L Account

|

|

Adjusting Customer Payment History

|

|

Credit

|

Accounts Receivable

|

Customer ID

|

N/A

|

N/A

|

N/A

|

|

Adjusting Inventory Purchase Totals (Increase)

|

|

Debit

|

Inventory

|

Vendor ID*

|

Inventory ID

|

Count

|

N/A Adjustment

|

|

*Optional: List the vendor's ID if the adjustment is a result of an invoice involving a specific vendor; otherwise ignore the ID column.

|

|

Adjusting Inventory Sales Totals (Decrease)

|

|

|

|

|

Credit

|

Inventory

|

Customer ID*

|

Inventory ID

|

Count Adjustment

|

Extended Sale Price

|

|

*Optional: List the customer's ID if the adjustment is a result of an invoice involving a specific customer; otherwise ignore the ID column.

|

|

Debit/Credit

|

GL Class

|

Employee ID

|

Reference2

|

Payment Flag

|

Track1

|

Track2

|

|

Adjusting an Employee’s Gross Pay or Work Weeks

|

|

|

|

|

Debit

|

Payroll Payable

|

Employee ID

|

Check No.

|

N/A

|

Work Weeks

|

Bank GL Account

|

|

Note that adjusting the gross pay within a journal will not add gross pay-by-pay-type in

Employee Pay tab > View Years. The gross pay totals by pay type cannot be adjusted since these totals are determined based on the pay date rather than the timecard detail date.

|

|

Adjusting an Employee’s Tax Amount or Taxable Gross Pay

|

|

Credit

|

Payroll Tax

|

Employee ID

|

Tax ID

|

E (Employee)

|

Taxable Gross

|

Gross Pay

|

|

Adjusting Company Tax Amounts

|

|

Credit

|

Payroll Tax

|

Employee ID

|

Tax ID

|

C (Company)

|

Taxable Gross

|

Gross Pay

|

|

Adjusting Work Code History

|

|

Credit

|

Payroll Payable

|

Employee ID

|

Work Code

|

N/A

|

N/A

|

Hours Pay Level

|

Repeat the steps above for each line of the journal. Not all journals must have the same number of debits and credits.

The

Balanced switch makes sure the journal is balanced (Debit total = Credit total). EBMS is a double entry accounting system requiring all transactions to be balanced. If a lopsided journal entry is needed, turn the

Balanced switch off.

The

User name will default to the login name. This entry identifies the user responsible for the journal entry.

Select

from the journal menu to process the journal or press Ctrl + P on the keyboard.

Select from the journal menu to import journal information from a CSV file. Review [Main] Technical > Import Document Details for instructions to use this data entry saving tool.

To create a new journal, select

from the journal menu.

Review Chart of Accounts > Retained Earnings and Other Equity Accounts for information on configuring fund accounts.