Select the Product code option will create credit offset transactions within various job cost and manufacturing processes. Click on the following links for more information:

EBMS allows the user to create product items within EBMS with a classification of No Count for the following purposes:

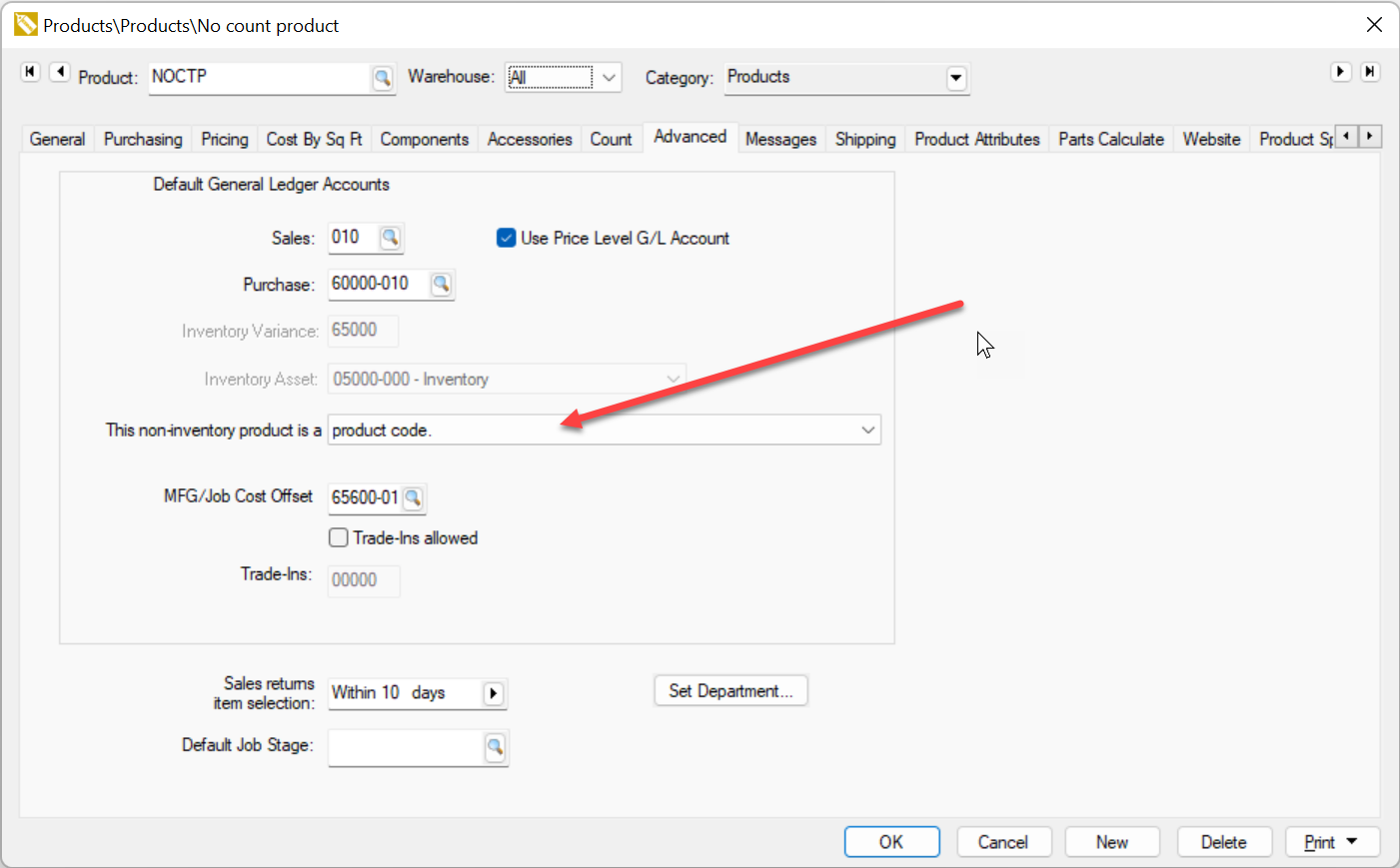

An item like Track Count product but the inventory manager does not want to track inventory counts: This approach expenses the cost of these No Count items at the time of purchase and the entire sale price is calculated as revenue. Track count items general cost of goods sold (COGS) transactions when product is sold. The Shortcut option should be disabled for these types of products.

A No Count inventory code shortcut that is not a product item such as:

A shortcut to assign description and pricing to a quote or invoice. This type of shortcut is valuable as a time saving billing tool.

A shortcut can be used to set the G/L account or other accounting settings.

A popular shortcut items classified as Service to bill or quote payroll labor.

A benefit of using product shortcut is tracking history on a specific activity.

A shortcut allows the user to scan barcodes for non-product codes. Review Barcodes > Overview for details.

A shortcut on a No Count item allows the user to implement EBMS inventory features for non-inventory product.

Scenario: A mechanical contractor sells contract HVAC solutions for commercial buildings. The budget, costs, and progress billings are managed using the EBMS Job Cost software solution. The mechanical fixtures are special ordered for the job and are delivered and installed onsite by the vendor. Most product is classified as Track Count is used to manage budgets, purchasing, and track costs. Some non-inventory material costs are also posted to the job using No-Count codes. The clerical staff also uses product codes as short cuts to populate descriptions, costs, financial accounts, and job stage settings for rental equipment expenses. These codes do not create materials costs for the job.

In this scenario the standard product items used within the job are classified as Track Count and the shortcut option does not apply. The No Count material costs applied to the job have the shortcut disabled. Shortcut codes for rental equipment costs for jobs have the shortcut enabled and are only used within the expense invoice.

Scenario: An equipment manufacturer assembles turf and fertilizer equipment for golf courses. Most raw material and parts are managed using the Track Count and serialized product items within the EBMS inventory system. Some costs such as fabricating equipment costs, labor, and some non-product costs are added to the batch to calculate a more accurate value of the finished equipment. Inventory codes for labor tasks and equipment expense codes attaches work orders to the batch as well as create “income” for the internal manufacturing equipment. The multiple step manufacturing process of creating parts, sub-assemblies, and finished goods give this company the management tools need to manage costs, schedule labor, and evaluate manufacturing batches of equipment.

In this scenario the raw material and parts costs applied to a the job are classified as Track Count and the shortcut option does not apply. The No Count manufacturing equipment and other non-inventory costs have the shortcut disabled. Shortcut codes for manufacturing payroll labor have the shortcut enabled.

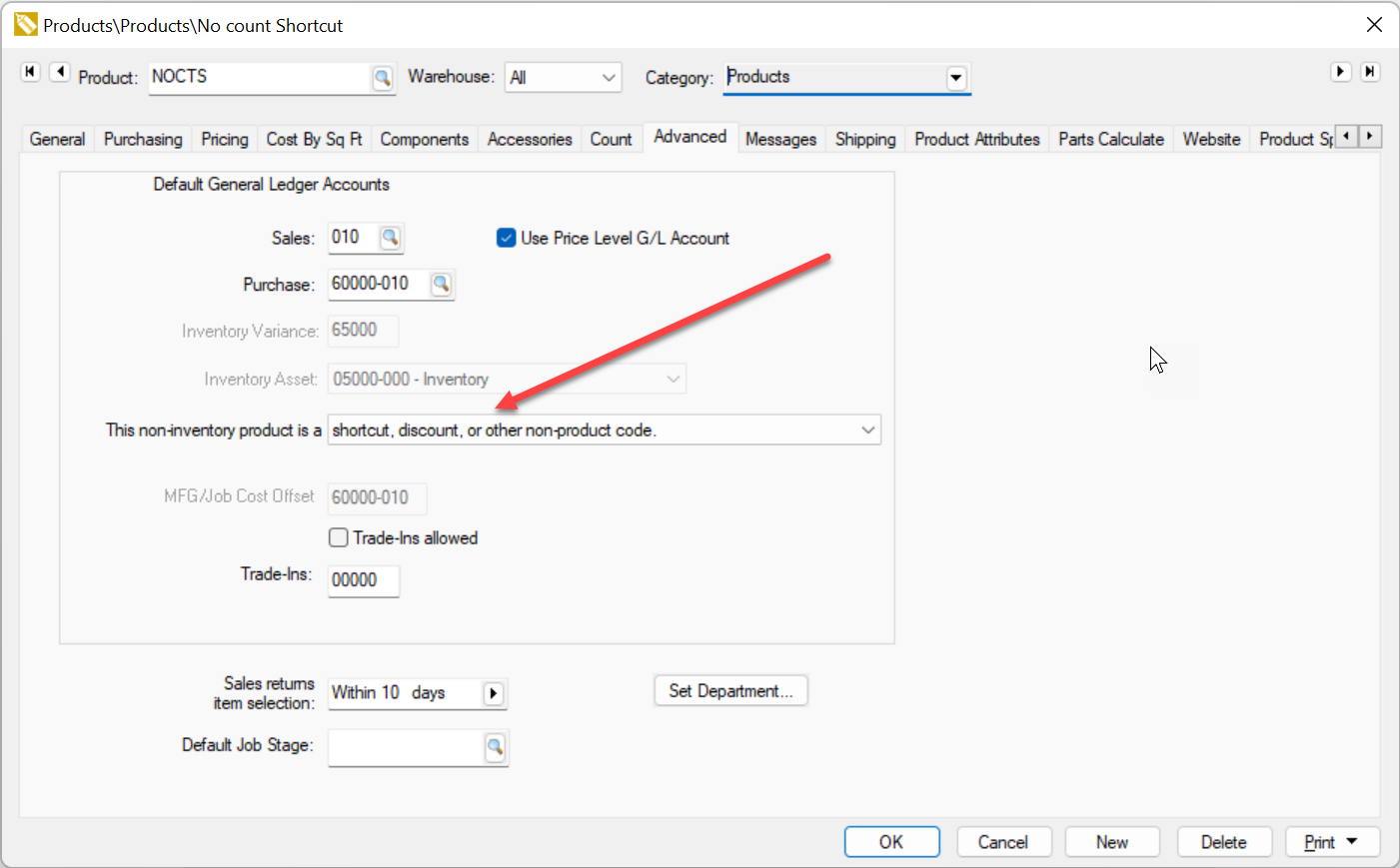

The Shortcut setting is found within any item that is classified EBMS will create non-revenue credit transactions when processing inventory items classified as No Count, Service, Non-Inventory Serialized item, and Rental Code. Open a product item that does not track inventory and click on the Advanced tab as shown below:

Select the Product code option will create credit offset transactions within various job cost and manufacturing processes. Click on the following links for more information:

The Product Code option should be used for the header of a component list.

Select the Shortcut option if this product code is used as a shortcut and does not identify actual product.