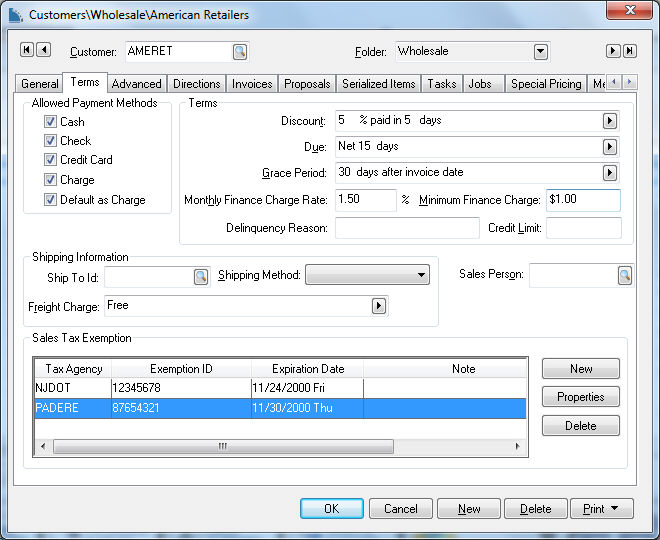

Open a customer and click on the Terms

tab.

The sales tax is determined from the customer shipping address if the product is shipped. Otherwise, the sales tax rate is derived from the company address set in File > Company Information dialog. See the Tax Overview section for details on how sales tax rates are determined. Sales tax will be charged for all customers that are located within the jurisdiction of any active sales tax rates. For example, if the system contains active sales tax rate tables for the states of NY and PA, all customers within those states will be charged sales tax unless the customer is identified as exempt for the specific Tax Agency. Customers within other states will not be charged sales tax and will not require to be labeled as exempt.

Complete the following steps to exempt a customer from sales tax(es):

Open a customer and click on the Terms

tab.

The Default Shipping Method should be set to the proper method since this setting will be copied to the Ship Via entry on the sales invoice. See the Changing the Tax Rate Within a Sales Invoice section for more details. The tax rate table and the Ship Via settings within the sales invoice should be properly set since tax exempt sales must be recorded on the proper tax report.

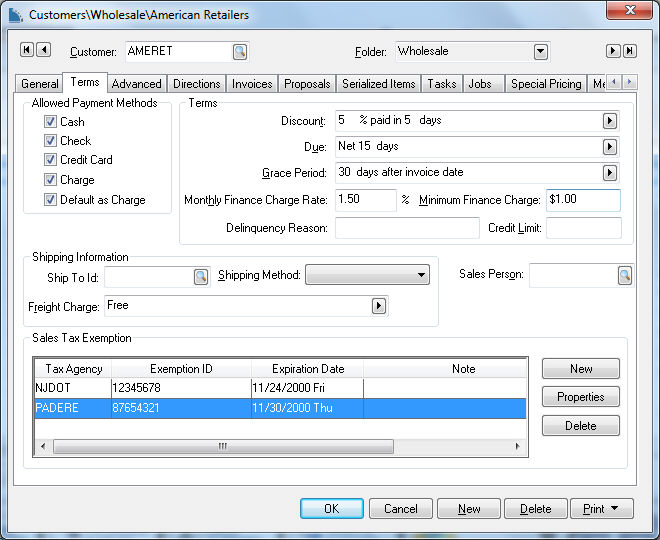

Click on the New

button to create a new Sales Tax

Exemption record as shown below:

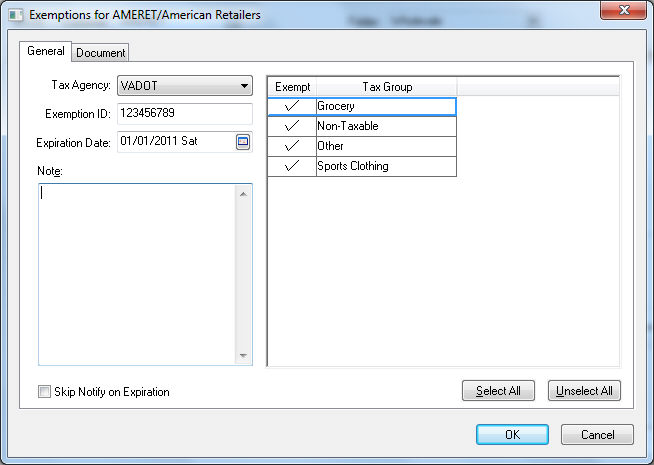

Click on the General tab and select a Tax Agency. The Tax Agency is identified within the Sales Tax Rates dialog.

Enter the sales tax account number into the Exemption ID entry.

Enter the exemption's Expiration Date.

Identify which product groups are exempt, by enabling each Exempt Tax Group. Multiple tax groups may need to be created if the sales tax exemption applies to a limited group of items. Review the Inventory Tax Groups section for details on creating tax groups.

Add any applicable Notes and click the OK button.

Repeat for each exempt Tax Agency.

Click OK to save.

EBMS includes a pair of sales tax tool options to manage sales taxes

Cloud based TaxJar service:

Sales tax reports and history can be reviewed on the www.TaxJar website. Review Upload Data for Reporting and Filing for more details on the information available online.

Sales tax tools within EBMS:

The user can view the tax exempt totals on the history tabs of the tax rate. See the Reviewing Tax History section to review totals within the EBMS system.

Go to Establishing Tax Rates for more EBMS setup details.