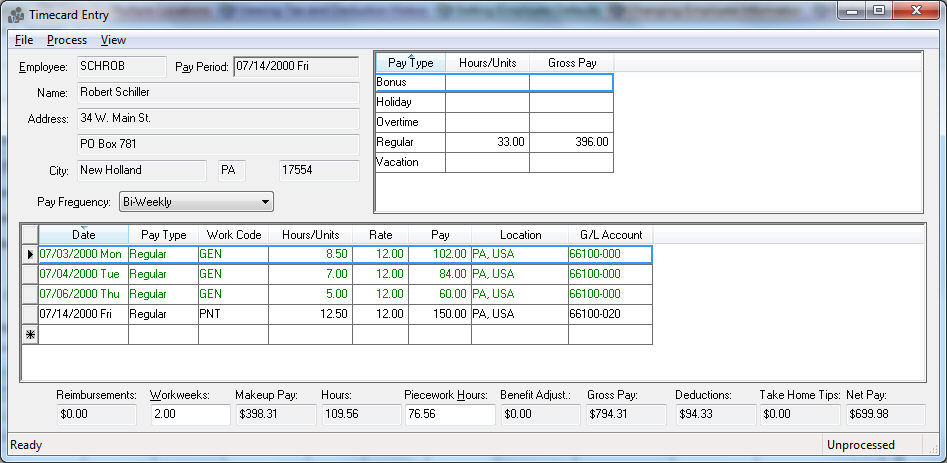

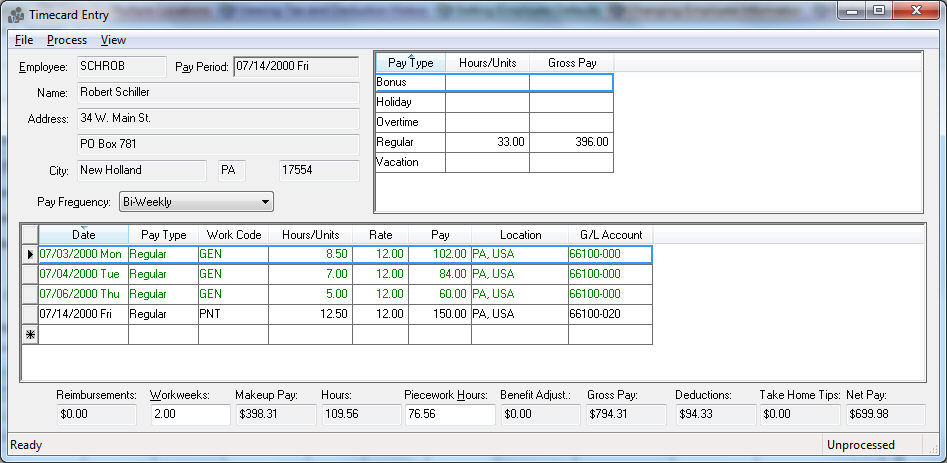

Entering Timecards

The timecard window is the main window used to enter employee’s time.

Hourly time, daily hours, piecework, commissions, tips and other types

of pay are all entered into this window. An employee can only have one

timecard per pay period. This screen can also be used to view processed

timecards and the taxes withheld from the wages. A pay period must be

established before any timecards can be entered.

To enter employee hours into timecards take the following steps:

Go

to Labor > Time Card Entry

and the following window will appear:

Enter

a Worker Id or click on the

lookup button to the right of the field and select from the employee

list.

Select the Pay

Period from the list of open pay periods by clicking on the

down arrow. Note that multiple open pay periods can be established

at one time.

The Pay

Frequency field identifies this timecard as weekly, BI-weekly, or otherwise. The Pay Frequency field

is copied from the Pay Frequency field within the employee window.

Unless the employee’s pay frequency changes on a regular basis, set

the frequency field within the employee window under the Labor

> Workers > Pay tab.

An unlimited number of

detail lines can be entered within a timecard. If an employee is involved

in different workstations within the same day, the multiple work codes

must be entered on multiple lines. Each day’s work should be entered

on separate detail lines. The window will scroll to accommodate as

many lines as necessary.

Enter the Date the employee worked. A

separate line should be used for each day in which an employee

worked. The expense of the payroll detail line will be posted

to the general ledger month in which the detail occurred. For

example, if most of the payroll occurred within the last month,

but the paycheck was printed this month, the expense would be

posted to the month in which the expense occurred, rather than

on the date the employee was paid.

Enter the Pay Type, i.e. regular, overtime,

etc. These pay types are determined within the Labor

> Options window. Go to Labor

> Options > Pay Types. The pay type on the first

line will default to the pay type that is specified within payroll

options (Labor > Options >

Settings – Default Pay Type field). The pay type on all

other lines will copy from the previous line. The pay type determines

the pay rate unless a piecework or prevailing wage code is used.

It also identifies the entry format on the wage that is being

entered. For example, if the Pay Type is Overtime (hour based)

the system will prompt for the number of hours but if the Pay

Type is Commission (dollar based) the system would ignore the

hour column. Go to Labor >

Workers > Pay tab to set the employee’s pay type rates.

The Work

Code identifies the type of work the employee was involved

in. The general ledger account is set based on the work code.

Review the Work Codes > Work Codes

section for more details on work codes. This field will default

to the pay type work code set in the employee pay tab key (Labor > Workers > Pay

tab key – Pay Rates table

– Default Work Code).

If piecework or prevailing wage work codes are used the rate is

derived from the work code.

Enter the Hours worked. If the Pay Type

is dollar based this field will be ignored. If a piecework work

code is used this column identifies the number of piecework units

being processed.

The Rate

will be copied from the Labor

> Workers > Pay tab – Pay Rates table. This rate

can be changed on a per line basis without any problem. For example

if you wish to increase the hourly rate for a detail line, change

the Rate value to the

desired amount. Note that if the Pay Type is dollar based the

rate column will be irrelevant.

The Pay

will be calculated by multiplying the hours times the rate if

the pay type is hour based or of piecework type. This field will

be entered directly if the pay type is dollar based.

The Location will

default from the employee setting. Change it if the work

rendered on this line is in a different location. Review the Taxes and Deductions >

Taxes for Multiple Locations section for more details.

The G/L

Account identifies the account that the wage expense is

posted to within general ledger. This code is defaulted from the

work code.

Repeat the steps above for each detail

line. Enter a new detail line if either the date, pay type, or work

code are different from the line before.

The source of the timecard detail line can be determined by showing

the 3 columns shown below:

Show the following fields:

The Time

Entry Device will indicate the timeclock, user, or other

source of the data entry.

The Time

Entry User will show the login user that recorded the time.

Review the Getting

Started > Security > Creating Users and Assigning Rights

section of the main documentation for user setup and details.

The Time

Entry Date shows the actual date and time of the data entry.

Review Time

and Attendance > Timecard Color Codes for information on the green

and blue timecard line color codes.

Review Standard

Features > Column Appearance of the main documentation for instructions

on showing or hiding columns within the timecard.

Overtime can be calculated weekly or daily by selecting Calculate

Overtime from the timecard’s Process

menu. Overtime can be calculated from the Worker

Payments > Process > Calculate Overtime option.

Review the Calculating Overtime

section for details and instructions for this powerful feature.

NOTE: The user

can manually alter the regular and overtime pay types after this utility

has been completed.

View Options

By clicking on the View menu

on the timecard screen you can choose from a number of view options listed

below.

Click

Employee Account menu option

to quickly view the employee information screen.

View

Taxes option allows the user

to view the total taxes that will be withheld from the paycheck as

well as company taxes. You must calculate taxes prior to viewing or

the list will be blank. Go to Timecard

menu > Process > Calculate

Taxes option to calculate taxes. Note that taxes and deductions

can be calculated in a batch basis within the Employee Payment window.

Advanced Options window is used

to view or change advanced options copied from the employee screen

such as payroll payable. To permanently change these codes within

an employee go to Labor > Workers

> Advanced tab.

The

Daily Hours option allows

the user to view the pay type totals or the daily hour detail. If

the Daily Hours are not checked, the pay type summary totals will

show both total hours and total gross for each pay type. If the Daily Hours option is checked (this

can be done by selecting Daily Hours on the menu), the Daily Hours

are shown instead of the Pay Type Totals.

Review the Time

and Attendance > Daily Hours section for details in entering and

processing daily hours. The Daily Hours menu option is an option, which

is checked when it is ON or unchecked when the status is OFF.

Select

the Memo option to enter or

edit a memo or note to add to the current timecard. This can be used

to enter miscellaneous notes about this employee within the current

pay period.

Click

Details to hide the timecard

detail section and to view more timecard detail lines. This convenient

feature enables the user to see more timecard detail lines simultaneously.

The Details selection is a switch option similar to the Daily Hours

option.

These View options are optional during Timecard

Entry.

Timecard detail lines can also be created using the following methods:

A. Populated

by the task or work order: Review the Tasks

section for more details.

B. Added to the timecard

by the Time Track App: Review Microsoft Store

App > Store Configuration for details on the user setup for the

Time Track App.

Summary Totals

Located at the bottom of the timecard are varieties of summary totals:

The

Workweeks amount is calculated

at the time that taxes are calculated and reflect the total workweeks

for the current period. The Workweeks

field is the only total that can be changed by the user. Do not change

this field unless you are familiar with workweeks. Review the Processing

Payroll - Advanced > Processing Workweeks section for more

details.

Makeup Pay

is automatically calculated to ensure that employees meet minimum

wage requirements. Review the Processing

Payroll - Advanced > Minimum Wage and Makeup Pay section for

further description of makeup pay or details to disable the feature.

Total

Hours for the current timecard.

Total

Gross Pay for the current

Pay Period. Gross pay may include benefit adjustments and take home

tips, which are not paid to the employee via a paycheck.

Total

Deductions is the total withholding

taxes and deductions. To view a detailed list of this total, select

View > Taxes from the timecard

menu.

Take Home Tips total identifies

the cash paid tips that are added to the gross pay but subtracted

from paycheck since they were paid by cash. Review the Workers

> Processing Tips section.

Net Pay amount is the total amount

of the paycheck.

Net

Pay = Gross Pay – Deductions – Take Home Tips.

Saving a Timecard

Save the timecard by selecting the Save

option within the timecard’s File

menu or by pressing the Ctrl + S on the keyboard. All processes can be

accomplished in a batch manner within the Employee Payment window.

Giving Access to a Personal Timecard

EBMS gives the option to security block workers from accessing sensitive

payroll information within the labor module but give individual workers

to access only their personal timecard to add labor records. Review

Worker Added Timecard Entries

for setup access.

Copying Timecards

Copying timecards for salaried workers or other workers whose timecard

detail is very similar each pay period can save data entry. Review

Copying Timecards for instructions.

Creating Another New Timecard

To create another new timecard select

within the timecard menu or press Ctrl + N.

Exit the Timecard Window by selecting

from the timecard menu.