Most jobs require materials to be purchased for a job or to be tranferred from stock inventory. Inventory is reduced and cost-of-goods-sold (COGS) transactions created when product is pulled for a job rather than waiting till the materials are billed within a customer invoice.

Inventory product can be applied to a job using either of the following two ways:

Two step process: Use the expense invoice to purchase inventory and then transfer the product into a job.

One step process: Enter the product item and the job Id into the same expense invoice. This process creates an additional set of job cost transactions to the typical purchase transactions.

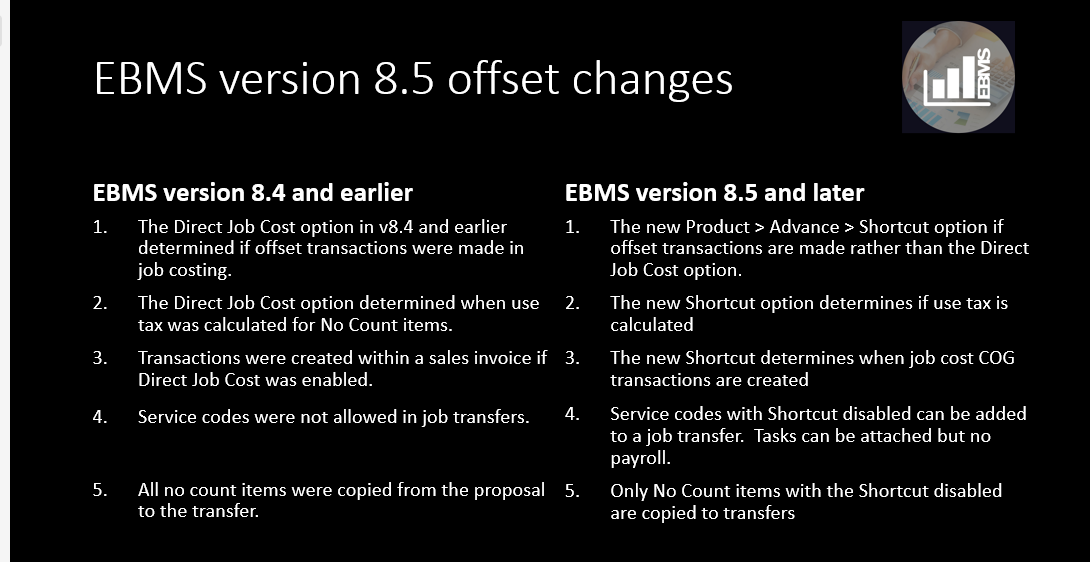

The expense transactions created when applying costs to a job has changed in vversion 8.5. Review the ERP support training video for 8.5 version changes as well as an explaination of job costing transactions.

Note: Prior to EBMS version 8.5, the following transactions were affected by the option. The Direct Job Cost setting no longer affects the type of job cost transactions. Review Job Costs > Inventory items and Direct Job Costs for the transaction details created in version 8.4.

The additional G/L transactions are created for the individual processes listed below. Note that the standard purchase, COGS, accounts payable, and accounts receivable transactions are not listed.

If the product item within the transfer list is classified as track count then the following transaction is created:

If the item is classified as Service and the shortcut option in the Advanced tab is disabled:

Otherwise the inventory item is classified as No Count and the shortcut option in the Advanced tab is disabled:

Note that an item with the shortcut option enabled cannot be inserted into the job transfer. Review Transactions and Journals > Credit Offset Transactions for more information on the shortcut option or the credit Offset account.

The transactions created from an expense invoice detail with job costs are identical to the standard expense invoice transactions (with no job) and the Inventory Transfer transactions listed above.

If the inventory item within the transfer list is classified as track count then the following job cost transaction is created:

If the inventory item is classified as No Count and the shortcut option in the Advanced tab is disabled:

No transactions are created if the inventory item is classified as No Count or Service and the shortcut option in the Advanced tab is enabled.

If the item is classified as Service and the shortcut option in the Advanced tab is disabled.

Review Transactions and Journals > Credit Offset Transactions for more information on the shortcut option or the credit Offset financial account.

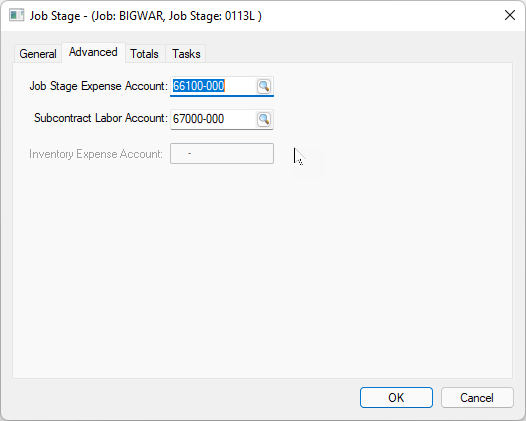

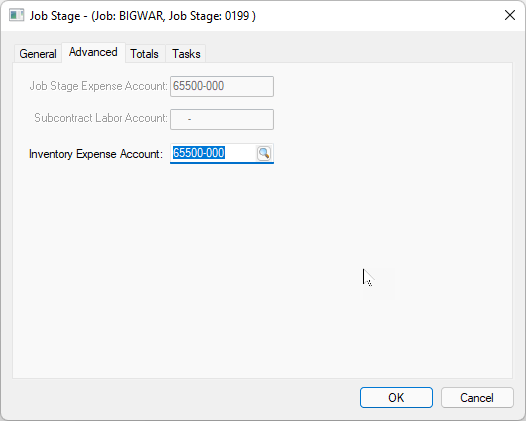

Note that the job cost expense financial accounts must be set to generate these transactions.

Note the Inventory Expense Account is disabled in the previous image and enabled in the following image based on the stage classification. Review Jobs > Classifications for more details.

.

Review Work in Proces > Selecting a Work in Process Option for information on this powerful option to apply job costs to the balance sheet