Go to Sales > Deposits from the main EBMS menu.

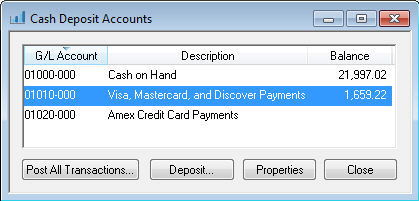

Select the cash account that contains the credit card transactions.

Note that multiple settlements based on payment card type should

be separated into multiple cash accounts. Review the Customer

Payments > Cash Accounts, Deposits, and Reconciling Cash section

for more details on cash accounts.

Open the Visa, Mastercard,

and Discover Payments account to deposit the Receipts

or view the transactions as shown below:

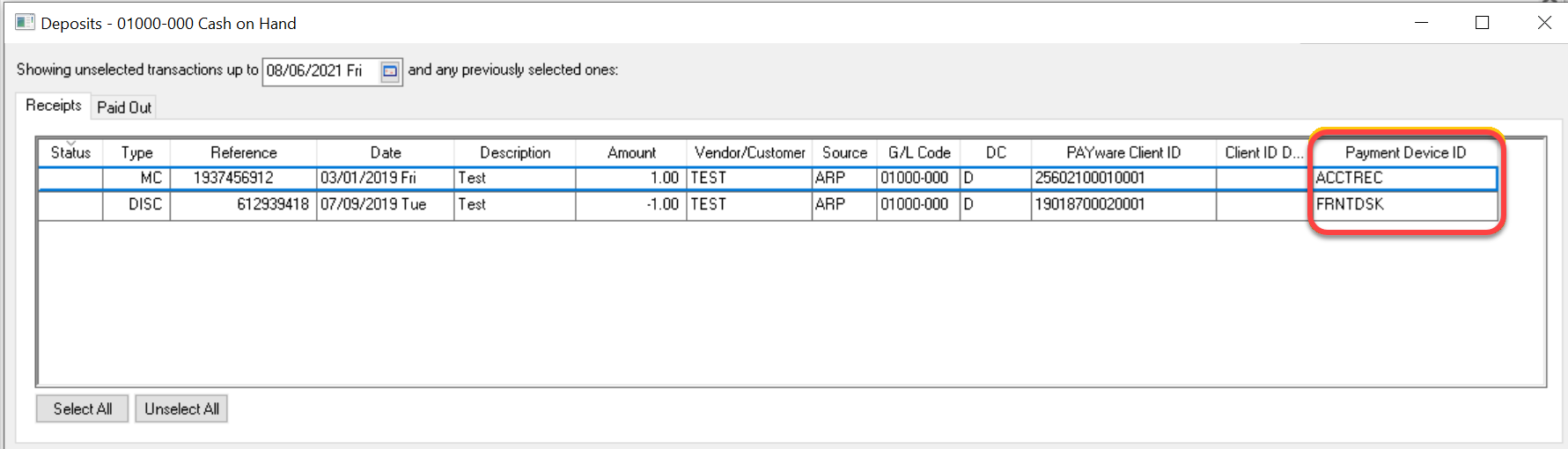

Select the transactions that are listed on the payment card settlement report generated by the merchant service provider. Note the Payment Device ID to separate transactions by payment processing device.

The amount on the Total Deposit should equal the total on the settlement report.

Click on the Deposit and Print to complete the deposit and print a deposit slip.

Click on the Deposit / No Print to complete the deposit without printing a deposit slip. Review the Customer Payments > Cash Accounts, Deposits, and Reconciling Cash section for more details on deposits.