Inventory Folders for Rental Items

The rental system requires two sets of rental inventory codes:

Rental service

codes - These inventory items are used with a rental contract. Grouping

these codes properly will enhance the user's ability to locate available

equipment. The rental service items record the rental pricing and

the general ledger codes for rental income.

Equipment

inventory codes - These inventory items are used to record the purchase

of the equipment and the eventual sale of the rental equipment. These

codes will NOT be used within the rental contract. The serial numbers

of individual equipment is associated with the Equipment inventory

codes.

Creating separate folders for rental service codes and the rental equipment

inventory is an important step in simplifying the process of creating

rental service codes to invoice the rental and inventory items that

contain the equipment value. Complete the following steps to create the

folders and set up default settings such as rental pricing periods, general

ledger codes, and other rental specific settings.

Creating Folders

Complete the following steps to create inventory folders for the two

sets of rental codes:

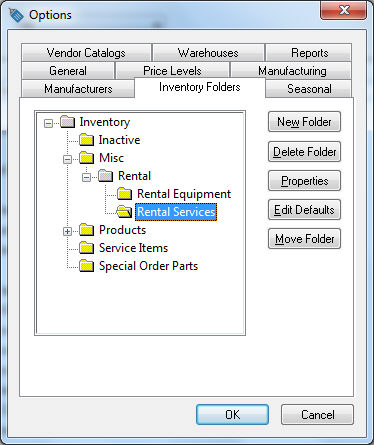

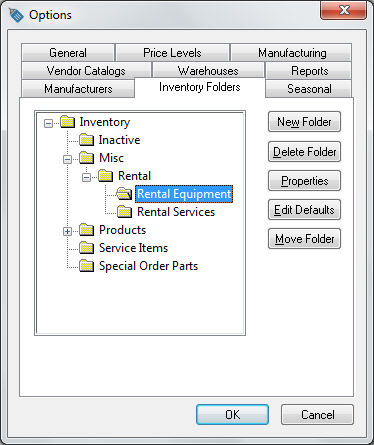

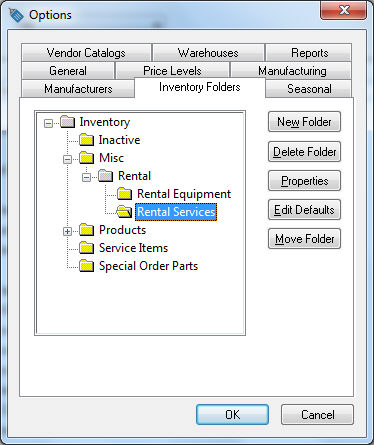

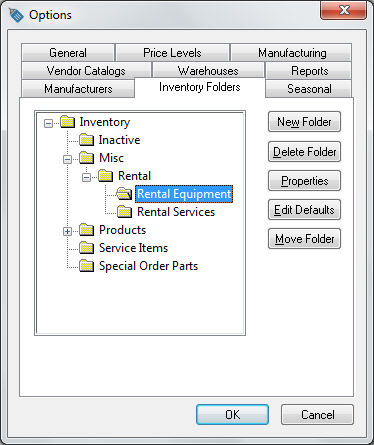

Select the Inventory > Options

from the EBMS menu.

Click on the Product Categories

tab as shown below.

The rental service codes and the rental equipment may be placed

in a rental folder as shown above. The two folders could also be placed

in different locations within the inventory item structure if desired.

Continue with the folder configuration for both the rental service

and rental equipment folders.

Rental Service Folder Defaults

Completed the following steps to configure the product categories for

rental service codes:

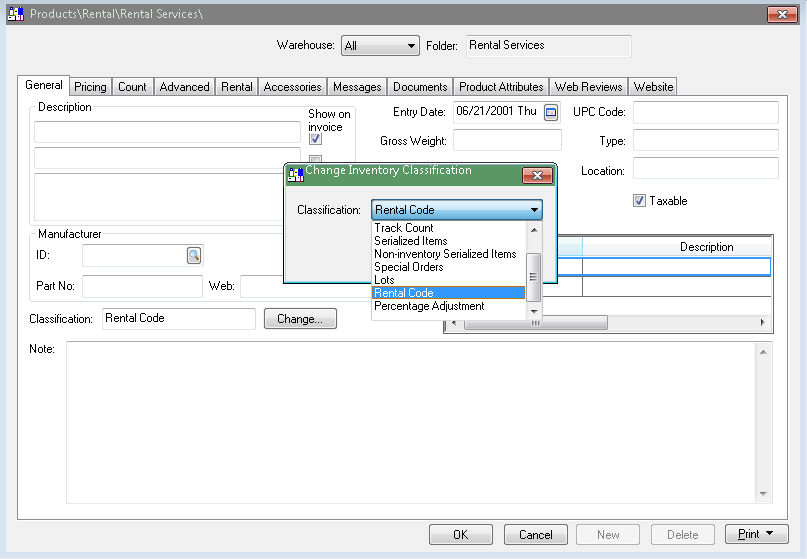

Create a Rental Services

folder as shown above.

Highlight the folder

and click on the Edit Defaults

button to set the following details for a service code:

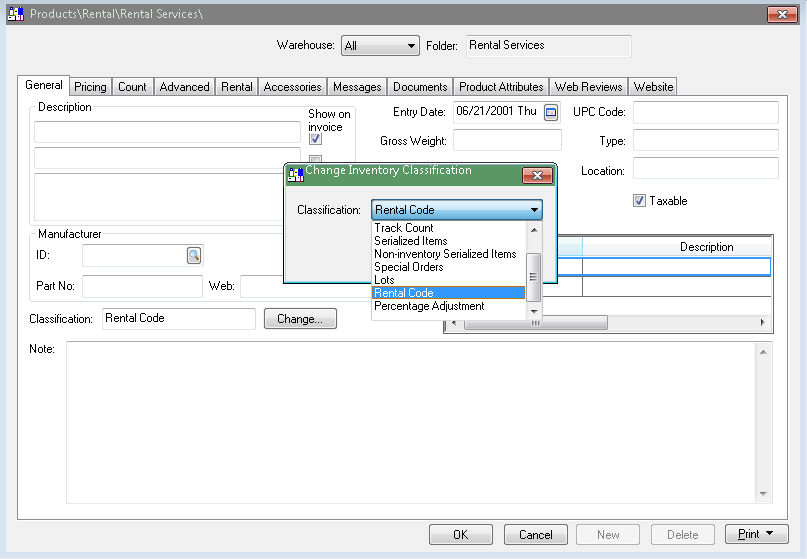

The Classification

setting should be set to Rental Code.

Click on the Change button

to change the Classification

as shown above.

Enable the Taxable

option if rental services are taxable.

Click on the Count

tab to create the standard unit of measure settings:

Enter Day

into the Main Unit entry.

Note that the Main Unit of

measure entry must be set as day. Click on the New

button and enter the standard unit of measure for each rental period

option. The unit of measure options can be ignored within the default

settings and entered into each item individually if the rental periods

(unit of measure) vary greatly. The following examples may be applicable

for rental service items:

Unit of Measure |

Smaller / larger |

Divisor / Multiplier of the main UOM

- Day |

2 Hour |

Smaller |

Hours in Day

/ 2

Hours in Day column

is found within the business hours table at Rental

> Options > General table.

Example: if the Hours in

Day setting is 10, the divisor is 5. |

1/2 Day |

Smaller |

2 |

Week |

Larger |

6 This multiplier affects history. Each time the item

is rented for a week, the total rentals (on history tabs)

will be incremented by this number. |

Month |

Larger |

25 (See note above) |

The other entries within the count tab should be kept blank.

Click on the

Advanced tab and set the general

ledger codes if all rental income is posted to the same general ledger

account.

.

Disable the

Use Price Level G/L Account

option and enter the rental income general ledger account into the

Sales account. The Purchase,

Inventory Variance, general

ledger codes can be ignored under normal circumstances. Review the

Inventory Items > Changing

Inventory Defaults section of the Inventory documentation for

more details on the Advanced

tab settings.

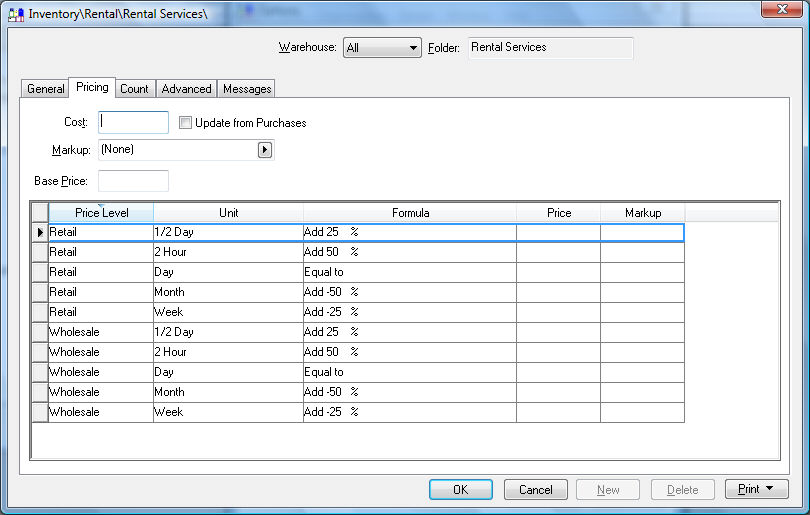

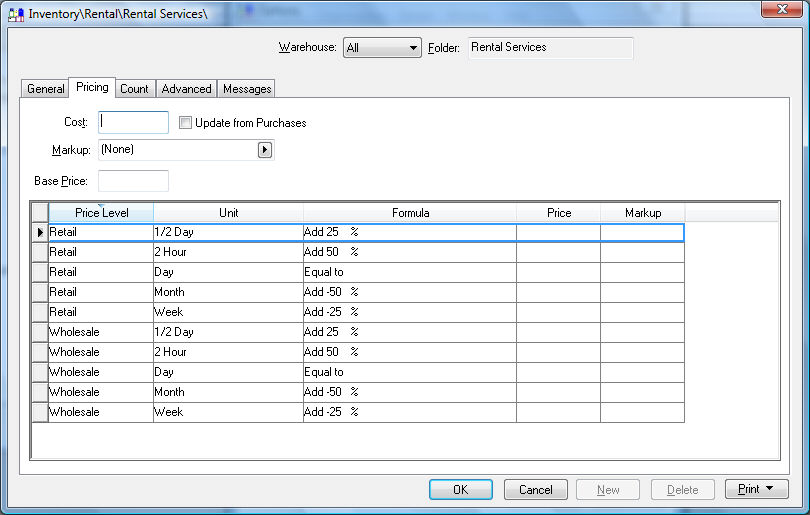

Click on the

Pricing tab as shown below:

The Markup/Margin

setting should be set to (None)

so Base Price can manually

be set within the item.

Set the pricing

Formulas accordingly. Review

the Creating

Rental Service Codes section for more details on pricing. All

the Cost and Prices

should be kept blank within the default setting dialog.

Save the inventory

defaults and return to the inventory folder tab of Sales

> Options > Product Categories by clicking on the OK button. Review the Creating Rental Service Codes

section for steps in creating the rental service codes.

Equipment Inventory Folder

Defaults

Create a folder for the rental equipment. This folder will contain the

equipment purchased for rental. These codes are not used within a rental

contract but are used when the equipment is purchased or sold.

Complete the following steps to configure the default settings for the

rental equipment folder:

Create a rental equipment

folder and complete the following steps to enter the equipment item

defaults:

Click on the Edit

Defaults button and select the General

tab.

Click on the Change

button to set the default Classification

for the rental equipment folder as Non-inventory

Serialized Items. Review the Entering

Rental Equipment section for more details on classification options.

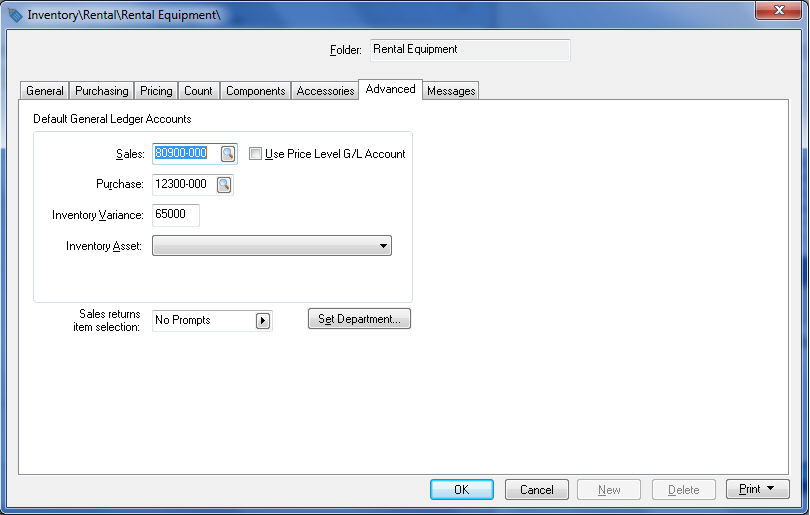

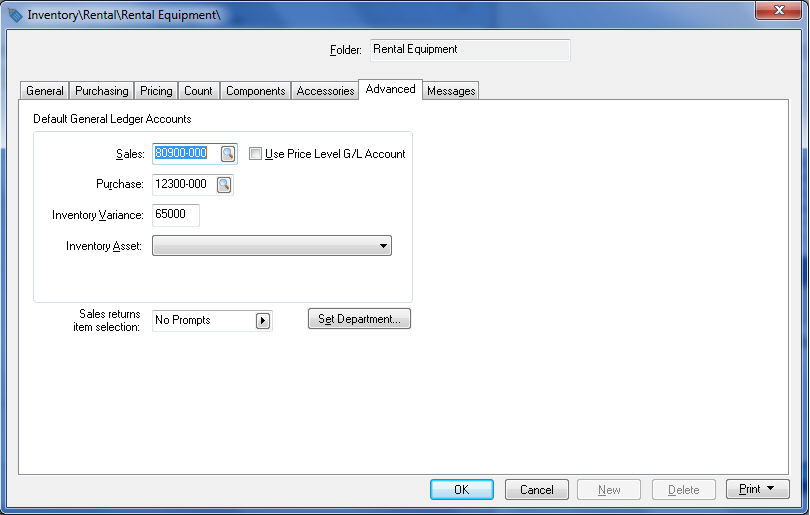

Click on the Advanced

tab of the item and set the following defaults:

The Sales general ledger account should

be set to the general ledger account classified as Sale

of Assets.

The Purchase general ledger account

should be set to the rental equipment asset G/L account. This account

will be found under Assets > Fixed Assets within the chart of accounts

instead of the purchase section. Review the depreciation

documentation for more details on the depreciable asset general

ledger accounts.

The Inventory Variance, Inventory Asset,

and the Sales returns item selection

accounts can be ignored.

Review the Product Catalog

> Changing Inventory Defaults section within the Inventory

documentation for more details on the inventory defaults.