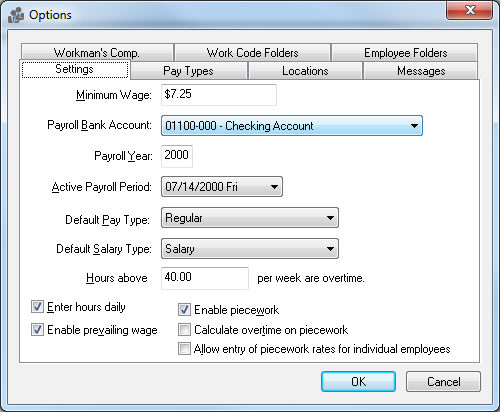

Minimum Wage should be set at the

current Federal rate.

Select the proper checking account to use for payroll from the drop down box in the Payroll Bank Account box. This bank account may be a separate checking account used only for payroll or a common checking account that is used also for paying expense invoices.

Enter the current payroll year in the Payroll Year block. This will automatically be updated when a Payroll Year is closed.

Active Payroll Period is the current, open payroll period. This can be changed here if there is more than one payroll period open. If only one payroll period is open, it will be listed as active. To enter new payroll periods review the Processing Payroll > Opening New Pay Period section.

Default Pay Type can be set at Regular, Vacation, Sick, or etc. This should normally be set to Regular unless your company has changed the standard pay types or added one of their own.

Default Salary Type is the pay type that will be the company default for salary, if different from hourly employees.

Enter Hours Daily enables the entry of dates in the employee advanced tab window for daily hours. Review the Time and Attendance > Daily Hours section for more details.