Managing Credit Card Accounts

Managing and reconciling a business credit card account is an important

management procedure. Credit card statements are often entered into a

bookkeeping system as an expense invoice which is not the recommended

procedure. Creating a separate credit card bank account within EBMS is

a much better management method and is recommended whenever a business

credit card is being used. Complete the following steps to set up and

manage a business credit card account:

- Creating bank account. A general ledger account classified as a

Bank Account should be created

within the current liabilities section of the chart of accounts. Review

the Adding a Bank Account

section for detailed instructions on adding a credit card bank account.

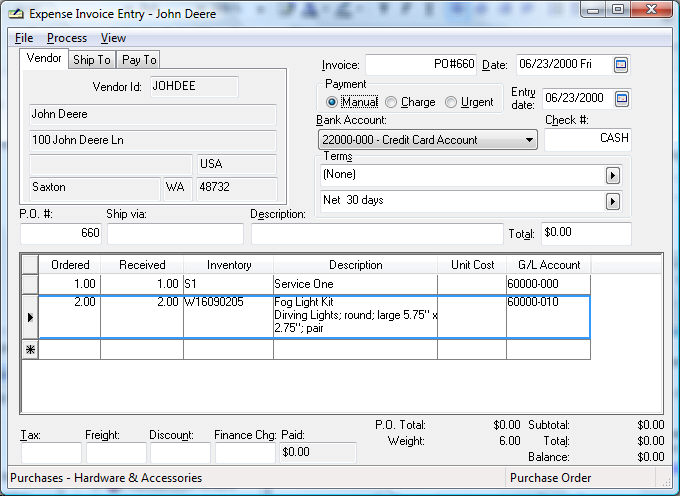

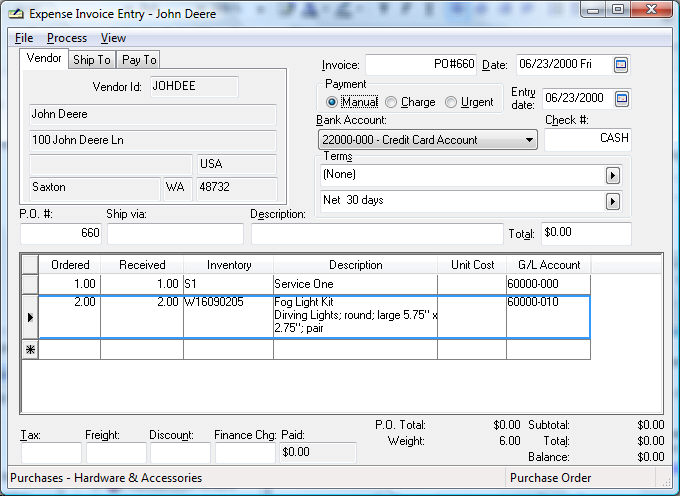

- Entering credit card purchases. Enter an expense invoice for the

vendor that was paid using the credit card. Go to

to open the invoice window as shown below:

- Enter the Vendor ID that was paid via credit

card. This expense invoice should be entered at the time of the

purchase rather than at the time the credit card statement is

received.

- Enter the purchase Invoice

number.

- Enter the Date of the

credit card purchase.

- Set the Payment option

to Manual and select the

credit card Bank Account.

Review the Adding a Bank Account

section for instructions if the credit card account does not show

within the bank account drop down list. Enter a date or other

transaction ID within the Check

# entry field.

- Enter expense invoice purchase detail. Review the Expenses

> Invoices > Entering a New Vendor Invoice section for

more details on expense invoice details.

- Process the expense invoice. Review Expenses

> Invoices > Processing an Invoice section for details

on processing an expense invoice.

- Repeat these steps for any additional expense invoices paid

with a credit card. The credit card account balance will increase

each time an expense invoice is processed.

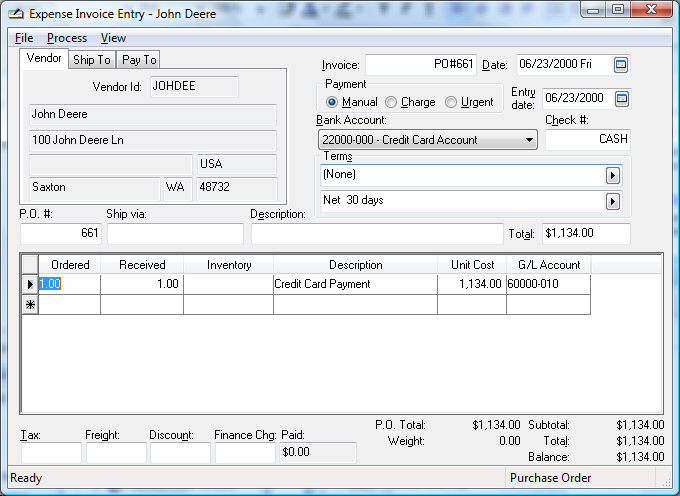

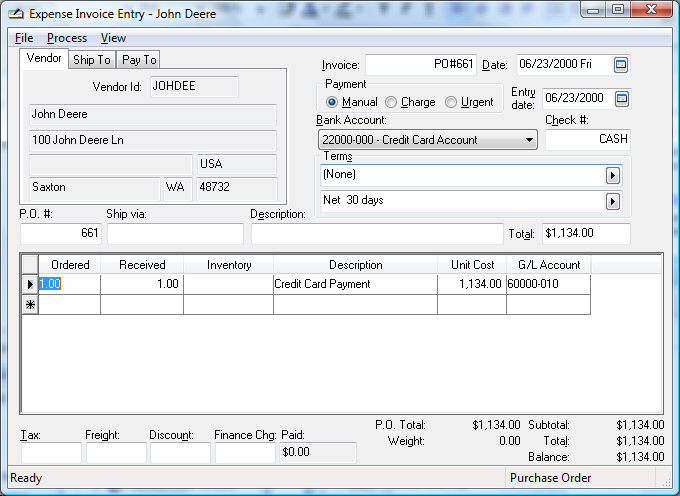

- Create a credit card payment by entering an expense invoice for

the credit card bank vendor as shown below:

- Enter the credit card bank vendor into the Vendor

Id field.

- Enter a date as a fictitious invoice number.

- The invoice Date should

be dated on the day the credit card is to be paid rather than

the credit card statement date. A credit card statement payment

should not show within general ledger as a receivable.

- Set the Payment option

and select the Bank Account

checking account that is used to make the credit card payment.

- Enter the detail and payment amount as shown above. Review

the Expenses >

Invoices > Entering a New Vendor Invoice section for invoice

entry details.

- The G/L Account on

the detail line must equal the credit card general ledger bank

account. Go to and select the credit card account.

Use the account numbers that prefix the credit card account description.

This account should be classified as a bank account and recorded

in the liability section of the general ledger.

- Process the credit card payment invoice. Review Expenses

> Invoices > Processing an Invoice section for details

on processing an expense invoice.

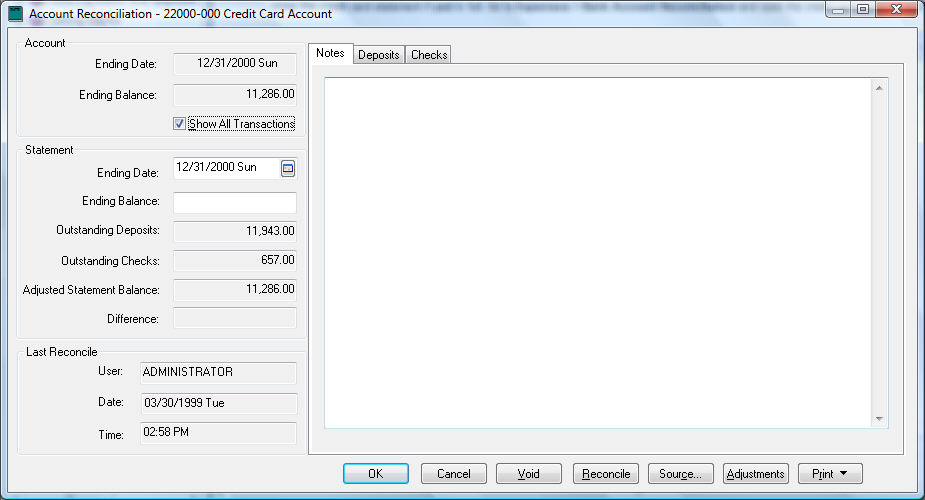

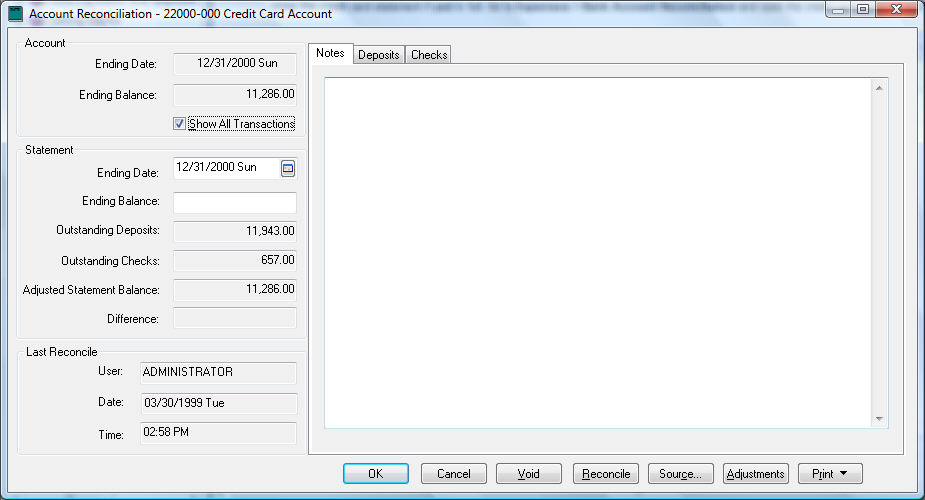

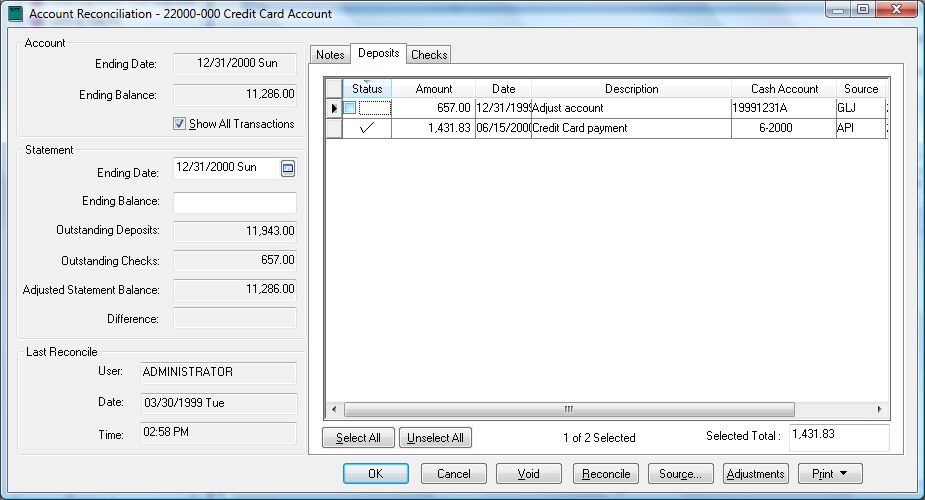

- Reconcile the credit card account. Step #3, processing the credit

card payment, should be completed before proceeding with this step.

This step should be completed when the credit card statement is paid

in full. Go to and open the credit

card account as shown below:

- The Statement value

should be blank rather than entering the bank account statement

balance. The balance of the statement after the payment is posted

can be entered if the credit card account was not paid in full.

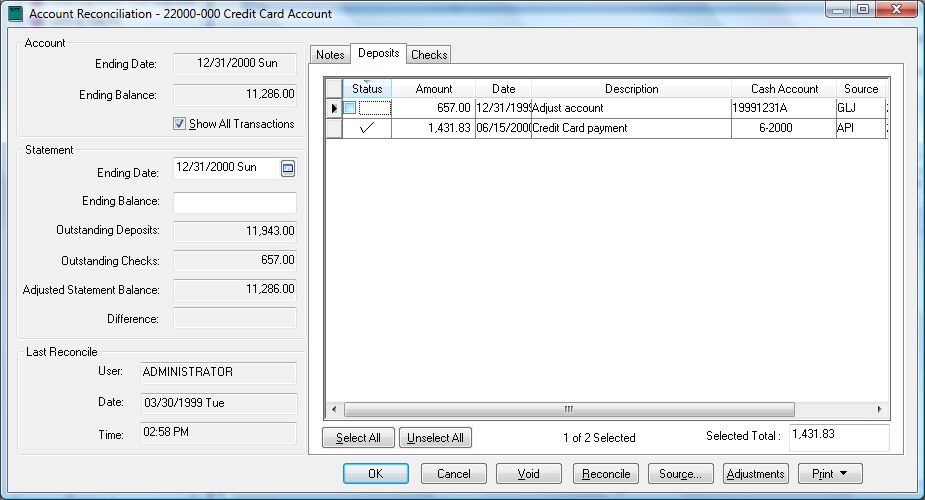

- Click on the Deposits

tab and select all the credit card payments. This tab lists all

the credit card payments made to the bank vendor.

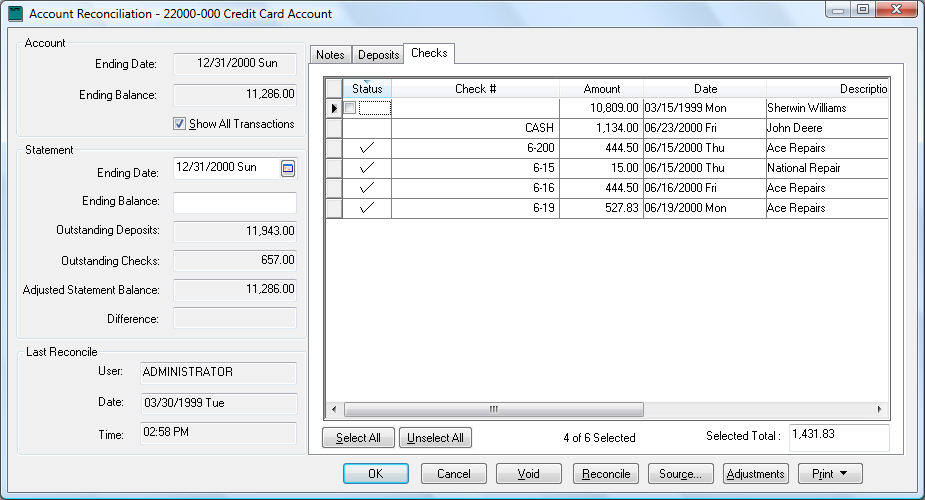

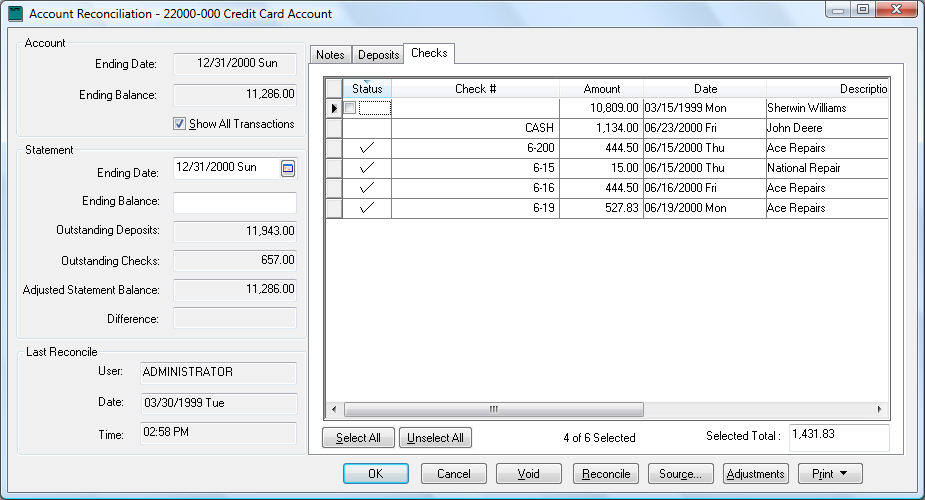

- Click on the Checks

tab to view all the credit card purchases as shown below:

- Select all the purchases listed on the credit card statement.

All purchases that are listed on any credit card statement should

be toggled ON with all the more recent purchases disabled.

- Review the Difference

value. This amount should be zero. If this value is non-zero,

the payment or purchases are not properly selected or the statement

balance is not set properly. Note that all payments in the Deposits tab including the current

payment should be selected. The purchases within the Checks

tab should be selected if they show on the current or previous

credit card statement. The Statement

balance value on the Controls

tab should be zero if the statement is paid in full or reflect

the balance after the current payment is posted. Review the Financials > Account

Reconciliation > Account Reconciliation Overview section

for more details on reconciling bank accounts.

- Click the Reconcile

button to complete the reconciliation.