Adjusting Landed Costs within a Purchase Order

The EBMS software includes the tools to adjust the purchase costs of

inventory items by adding costs such as freight or by subtracting value

for rebates, etc. The adjusting costs can be associated with an inventory

item if the landed costs are adjusted using a consistent formula. Review

the Assigning

Default Landed Costs to an Item section for setup instructions. The

landed cost can also be manually adjusted on the purchase order by using

the default landed cost type. Cost adjustment types must be setup before

adjusted landed costs can be entered within a purchase order. Review the

Cost Adjustment Types for cost

type setup instructions.

Complete the following steps to adjust landed costs:

- Open a purchase order to adjust landed costs. Review the

Entering a New Purchase

Order section for more details on opening or creating a purchase

order.

- Enter an inventory item that contains landed cost adjustments.

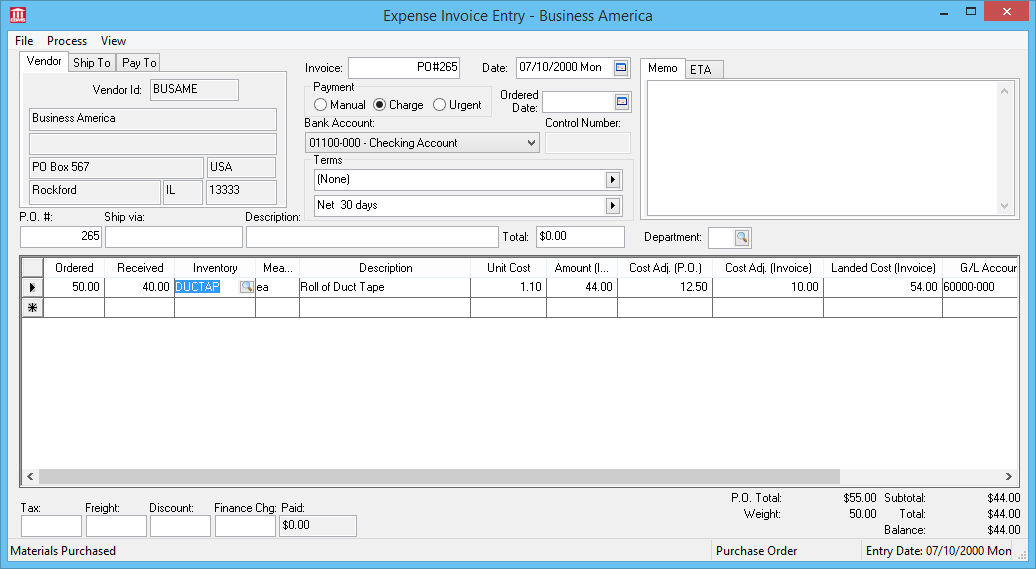

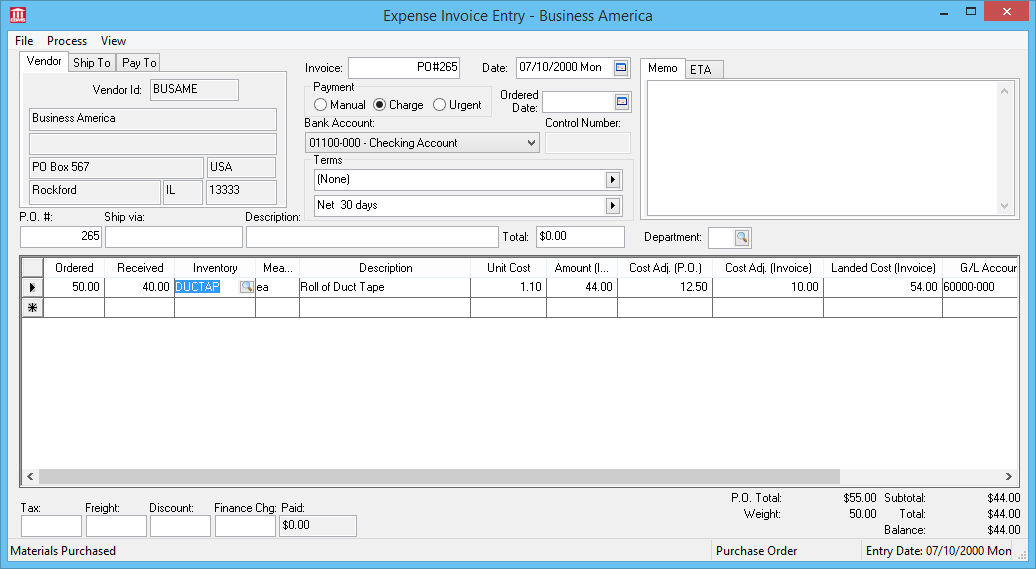

Note the inventory item - DUCTAP in the

example below:

- Verify that the following landed Cost

Adjustment columns are showing within the purchase order

as shown above. Review the Standard

Features > Column Appearance section for instructions on hiding

or showing columns within a purchase order or invoice.

- The Cost Adj.

(P.O) displays the total landed cost adjustment based

on the Ordered

quantity.

- The Cost Adj.

(Invoice) displays the total landed cost adjustment

based on the Received

quantity.

- The Landed Cost

(Invoice) lists the total cost of the product purchase

including the landed cost adjustments.

- Individual landed Cost

Adjustments can be reviewed or changed for individual

purchase order lines by right clicking on the line and selecting the

Landed Cost option from

the context menu. The following dialog will appear:

- The following landed cost adjustments can be changed or reviewed:

- The Cost Type

ID can be changed by selecting from the Cost Type ID list. Review

the Cost Adjustment Types

section for details on changing the Cost

Type IDs.

- The Description

column is populated based on the Cost

Type ID section. The description can not be changed.

- The Per Unit

Adjustment is the unit value that will be added to

the unit cost within the purchase order.

- The Per Unit

Adjustment can be calculated using a percentage formula

by enabling the %

option. If the percentage (%)

option is disabled the Per

Unit Adjustment will be added to the unit price instead

of being calculated based on a percentage.

- The Cost Adj

(P.O.) and the Cost

Adj (Invoice) columns can be edited directly. The

system will disable the percentage (%)

option, calculate the Per

Unit Adj value, and calculate the other Cost Adj. value.

- An optional Note

can be added to the landed cost record.

- Repeat these steps for any additional landed cost types.

Multiple landed cost adjustments can be calculated within any

purchase order line.

- Repeat the landed cost adjustments for any additional purchase

order lines.

Landed costs can be added or changed for all lines within a purchase

order or a group of lines. Complete the following steps to change a group

of lines within a purchase order:

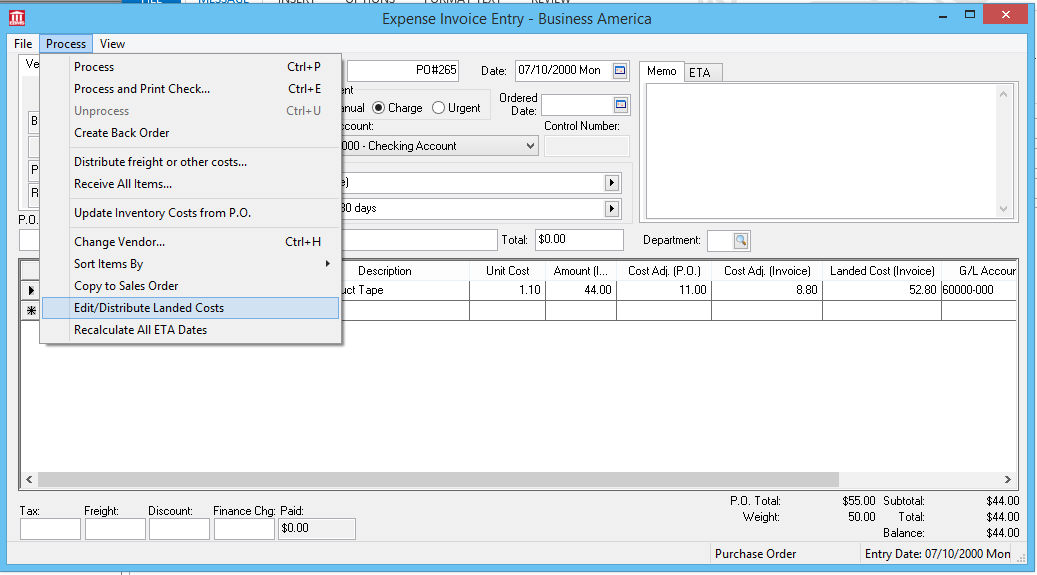

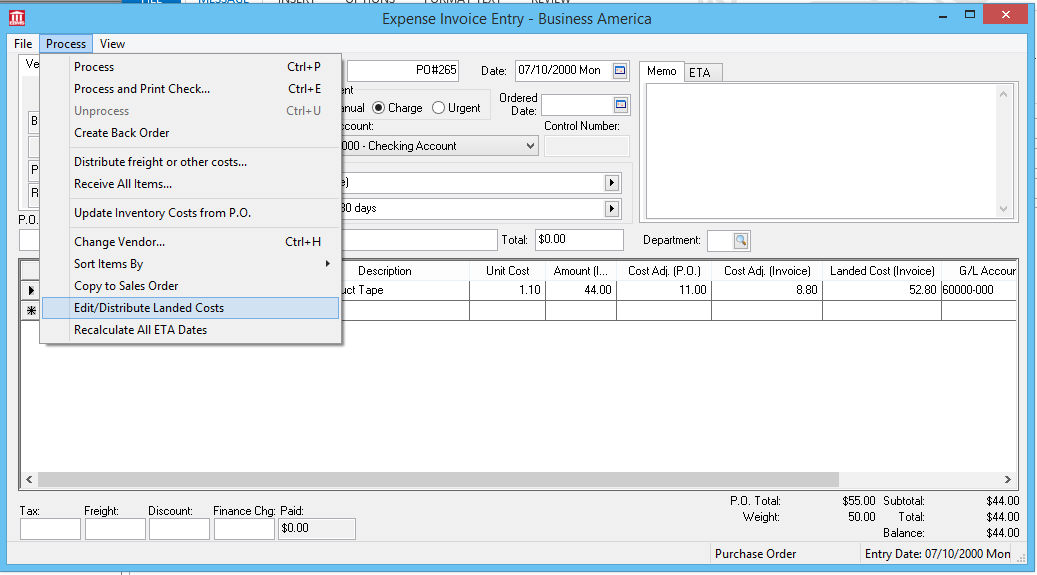

- Select the Process

> Edit/Distribute Landed Costs option from the purchase

order menu as shown below:

- The following dialog will appear:

- The Edit/Distribute

Landed Costs utility opens a dialog with the Cost Type IDs listed that

are listed within the inventory items contained in the purchase order.

Review the Assigning

Default Landed Costs to an Item section for details on adding

added cost adjustment to an inventory item. This utility gives the

user 2 options in distributing landed costs to one or more lines within

the purchase order.

- The Distribute

per current assignments option will distribute the

total amount listed within the Total

Cost (Invoice) column to only the purchase order

lines that contain the specific Cost

Type ID.

- The Distribute

to all lines (adds cost types) option will add the

Cost Type ID to

every line within the purchase order and distribute the

Total Cost (Invoice) to

every line as well. This option should be used if no landed cost

adjustments have been associated within the inventory items within

the PO.

- Click OK

to return to the purchase order.

- Process the purchase order. Review the Invoices

> Processing an Invoice section for details on processing the

PO. The purchase order process will add landed cost general ledger

adjustment transactions as described below:

Debit |

Credit |

Amount |

Notes |

Purchase GL on PO |

Accounts payable GL |

Cost on purchase order |

Standard purchase transactions |

Inventory Asset GL |

Inventory Variance GL |

Cost on purchase order |

Inventory asset account for track count items |

Purchase GL on PO |

Landed Cost G/L |

Amount of cost adjustment |

Landed Cost adjustment |