Process and Print W2s

W-2 Forms can be printed for the past year after the payroll year is

closed and payroll has been entered and processed within the new year.

To order preprinted W-2 forms fax an order sheet to Eagle Solutions listing

your company name and the number of forms that are needed. Order a few

extra forms in case any W-2 forms need to be reprinted.

The user should verify the employee’s general information as well as

tax deductions and gross pay before W-2 forms are printed. Proceed with

the following steps to verify payroll information.

Go to and verify the employee’s Name,

Address, and Social

security number.

Click on the Personal

tab and verify that the Head of household,

deceased, and Legal Representative

options are properly set. See W-2 instructions or contact your accountant

for detailed explanations of these options.

Print the Employee

Earnings Record report to list all gross pay, taxes, and deductions

withheld from a list of employees. Print

the from the

main EBMS menu.

Select the folder that includes

ALL employes but exclude any non-W2 employees.

Make sure the Include

subfolders option is enabled to include all employees.

Verify that the Include

Inactive option is enabled to include inactive employees

who were on payroll during this data range even if they are inactive

at the current time.

Select All

Workers.

Set the date range to 01-01-yyyy

to 12-31-yyyy.

Note that all workers with pay within the First

Pay Date and Last Pay

Date rage will be included in the list

Set the Payroll

Taxes option to Employee

Taxes.

Enable the Print

Summary Only option to only list annual totals.

Review an individual employee’s withholding

taxes and deductions recorded within the Employee

Taxes tab. Click

on the Properties button for

each tax to review the amount withheld, taxable gross, and gross amounts.

The history is found on individual year history tabs.

Adjusting W2 Values

The preferred method to adjust tax withholding and taxable pay amounts

to be edited using a journal entry. Review the Year

End Payroll Adjustments section to adjust an employee’s gross pay,

workweeks, amount of tax withheld, and taxable gross amounts.

Some deduction totals printed on the W-2 form can be manually adjusted

such as EIC payments, benefit adjustments, dependent

care benefits, etc. Any tax or deduction that is listed on the W-2 form

must be listed within the Employee Tax

tab of the employee window. For example, if benefit adjustments need to

be listed on the W-2 form but no benefit adjustments have been processed

for the employee, the user must complete the following steps:

A deduction must be created and classified

as a Benefit Adjustment if it has not already been created. The

benefit adjustment deduction must be listed in the employee’s Employee Taxes tab. Review

the Taxes and Deductions

> Adding New Taxes/Deductions section for details on creating

new taxes.

The amount can be entered or adjusted

by going to Labor > Workers >

(the year tab identifying the W-2 calendar year) and clicking on the

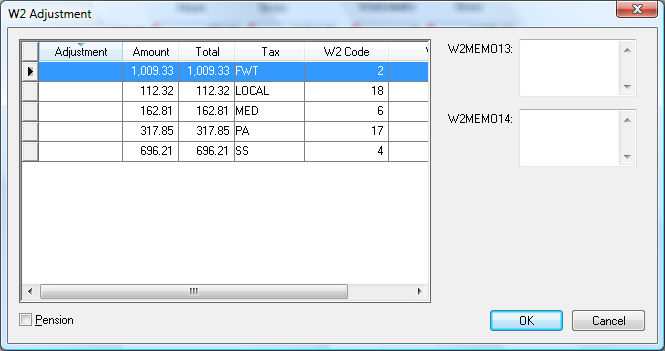

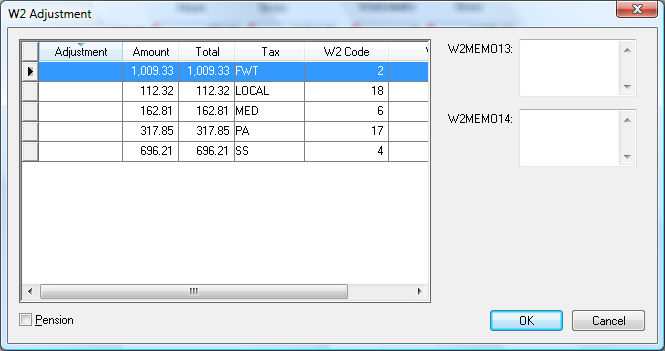

W-2 Adjustment button. The

following window will open:

Tax or deduction adjustments can be

entered into the Adjustment

column to adjust some taxes or deductions. Many taxes such as Federal

Withholding or Medicare cannot be adjusted directly in this screen.

An adjustment journal must be entered for these taxes, which is explained

in a previous section - Year End

Payroll Adjustments. Additional information can be manually

typed into box 13 and 14 of the W-2 form by entering information within

the W2MEMO13 and the W2MEMO14 memo fields.

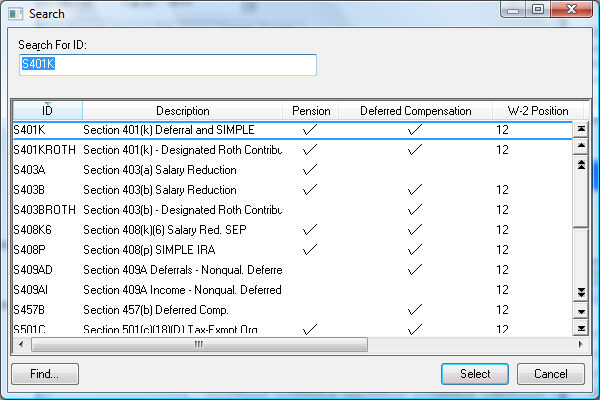

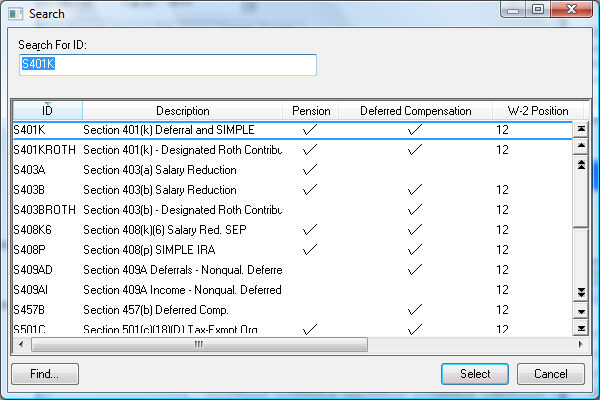

All taxes and deductions are placed

within the W-2 forms based on the deduction types. To view the position

of a specific tax amount on a W-2 form go to Labor

> Taxes/Deductions > General

tab and click on the lookup button to the right of the Type

field. The following list will appear:

The W-2 Position

column identifies the specific box within the W-2 form that will display

the tax total. For example, any deduction that has a tax type of Medicare

will be displayed within box 6 or the form. The W-2

Prefix code is displayed when a deduction total is listed within

box 13 or 14.

The W-2 Position, W-2

Prefix code, and the manual adjustment option are set within the

PYTXTYPE.DBF

file and must be changed with a dbase file

editor. Contact an EBMS consultant if you wish to change these options.

Verify W2 Information

The following company information should be verified before W-2s are

printed:

The

Company Name and Address

located in File > Company Information

> General tab.

The

SS/EMP.

ID# located in File > Company

Information > Advanced tab. The Employer’s Identification

number or social security number should be entered in this field.

The

Payroll Payer Type. Contact

your accountant or Eagle Solutions consultant if you are not familiar

with this setting.

All

states in which employees reside should be listed along with the State ID#. This information will

be listed at the bottom of the W-2 form. The State

column should reflect the 2 character abbreviation of the state.

NOTE: The state

income withholding tax ID code must equal the state abbreviation entered

in the State column. This is required

to properly print the W2 forms.

Printing W2 and W3 Forms

Review Electronic

W2 Filing for instructions to electronically file W2 forms.

Review Annual

Reports for yearend W2 and W3 printing instructions.