Process Payments

EBMS contains the tools to process labor payments using a variety of

methods including pay checks, direct

deposit, 1099 subcontractor payments, 3rd

party payroll payments, and no

payments at all. The following steps contain instructions to

make payroll payments. Click the hyperlink for instructions on alternative

payments.

Take the following steps after all timecards have been entered and verified

and it is time to calculate and process worker payments:

- Go to Labor > Worker Payments

and the following window will open:

- Select the appropriate Pay Period

to show all timecards within a specific pay period.

- Click the switch in front of View

All to show all the timecards.

- Make sure the proper Bank Account

is selected. It can be changed using the drop down box to the right

of the Bank Account Field.

- The Pay Date is the date

printed on the paycheck and is the same for all paychecks within a

pay period. The Pay Date is set when the Pay Period is created. EBMS

allows the user to generate a paycheck for an employee before all

other timecards are entered but the check date for both the employee

that was paid early and the other employees is the same. Review the

Open New Pay Period section

for more details.

- To select all the timecards for payment hit the Select

All button at the bottom of the window. To select each employee

timecard individually, click on the timecard with a mouse, which will

put a check mark in the first, or Pay

column.

- The Payment Method column

determines if employee payment processing will generate a paycheck

or a direct deposit notice for the employee. This column can be ignored

if payroll is not processed using the direct deposit option. Review

the Direct Deposits > Worker

Configuration for more details on ACH

direct deposit processing.

- Processing payments consists of the following steps:

- Calculate Overtime: Review Calculating

Overtime for instructions to calculate weekly or daily overtime

for hourly and piecework workers.

- Calculate Taxes: Review Calculating Taxes to options

when processing or view taxes and other deductions.

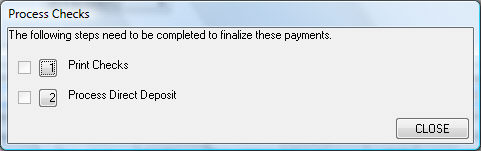

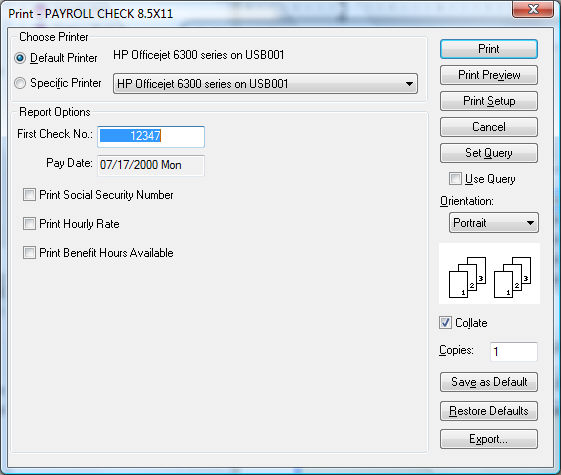

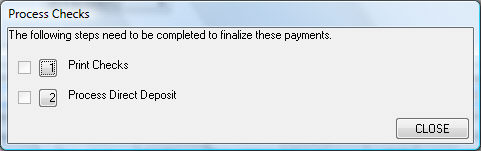

- Process Checks - Click on the Process Checks option of the

Process button menu again after all taxes have been calculated.

The following dialog will only appear if the Payment Method setting

for any employee is set to Direct Deposit:

- Click on the Print Checks option if the dialog shown above

appears. Review the Direct

Deposit > Processing Direct Deposit Pay section for more

details on processing direct deposits.

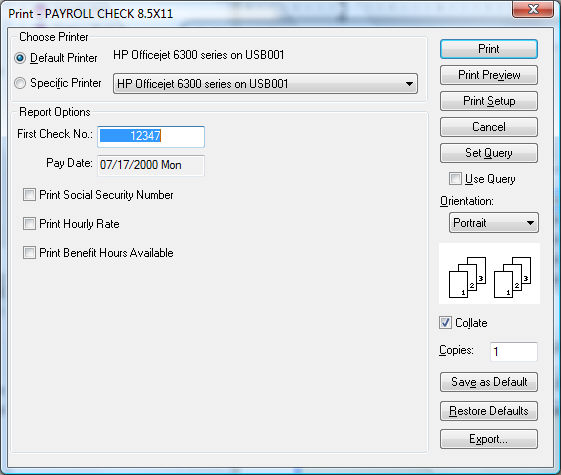

- Verify the First Check No and click print to generate paychecks.

The user will be prompted to verify that the first check printed

properly and again when all checks have printed. Do not click

Yes to confirm that all checks have printed correctly until the

paychecks have all successfully printed.

- If you click Yes all

the timecards will be processed and the general ledger transactions

will be created. If the checks did not print properly click No and a Check

Confirmation list will appear:

- Remove check marks in the Printed

column for all paychecks that did NOT print properly by double

clicking on appropriate check. All paychecks that have a check

mark in the printed column will be processed and the timecards

will be marked paid. By removing the check mark, the timecard

will not be marked paid and transactions will not be made. To

reprint paychecks return to Employee

Payment screen and start over with step one.

- Click OK when only

the checks that printed properly are checked. Click the Cancel button to cancel the

entire check run.

Note: All payroll transactions

should be posted before processing payroll. The user will be prompted

during the process step to post transactions. Employee payment

and tax history is updated during the post procedure.

Financial Transactions

Payroll transactions can be reported based on the pay period ending

date or the pay date. Review report options by selecting

Reports > Labor > G/L Transactions

from the main EBMS menu. A recommended report

to generate various transaction information generated by the Payroll

Process is the Payroll Transaction

Details.

Select the workers or employees to include. Select

All Workers to include all

financial transactions.

The Date Select can

be set by Pay Period or Pay Date.

Select the range of pay period or pay dates.

Transactions can be grouped using various options by setting

the Group By drop down option.

Enable the Summarize by G/L

to only show totals or disable this option to show all transactions.