A timecard must be created for a salaried employee similarly to an hourly paid employee or the salaried employee will not be issued a paycheck. If you are not familiar with entering timecards, review the Salaried Pay > Entering Employee Time Card Information section before you continue with this section.

Go to Labor > Time Card Entry

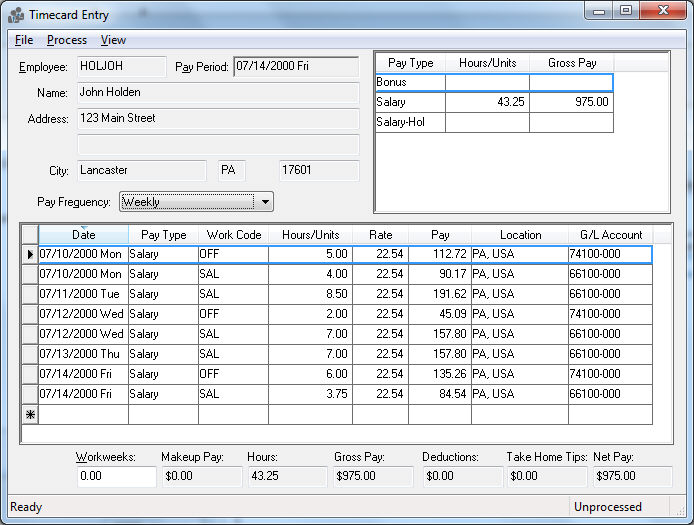

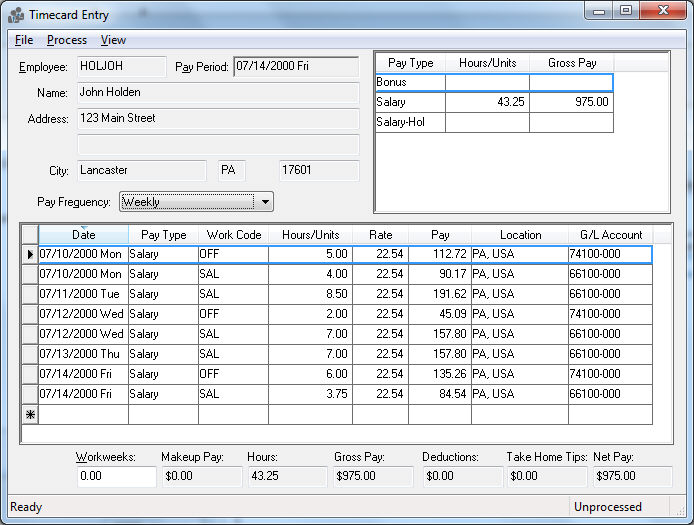

and the following window will appear::

If the salary wage total has not been set within the employee window, exit the timecard window and enter the salary information before the timecard information is entered. If the salary rate is changed within the employee window the timecard window must be closed and reopened to reflect the salary change.

Enter the Worker Id and Pay Period information the same way that a regular timecard is entered. Review the Salaried Pay > Entering Salaried Employee Information section for more details about creating a new time card.

The Pay Frequency field will default to the Pay Frequency setting within the Worker > Pay tab. If this setting is changed, the salary total will be calculated to reflect the change.

EXAMPLE: if the pay frequency within the Worker > Pay tab is set to Weekly and the timecard pay frequency is set to BI-Weekly the Salary amount will be doubled on the timecard. If you wish to permanently change the pay frequency for an employee close the timecard window and change within the Employee > Pay tab.

To properly expense the pay wage to the proper general ledger month it is recommended that you create a detail line for each day.

EXAMPLE: If a salaried employee worked Monday through Friday within a weekly pay period, enter a detail line for each day. A weekly timecard would consist of five detail lines if all salary pay consists of one work code. If multiple work codes are used, enter a detail line for each work code within a day.

Each detail line should consist of the following information:

Enter the Date the work was rendered.

Salary Pay Type - If no salary pay types are available for this employee, review the steps listed at the beginning of this section. Do not use any other pay type unless you wish to add to the employee’s salary. For example if you use the Overtime pay type, the employee will be paid the employee’s hourly time and a half rate (as entered in Worker > Pay tab) and this will be added to the employee’s salary pay.

Enter the appropriate Work Code.

The Hours entry does not need to reflect the employee’s exact hours since most salaried employees to not submit the hours worked and the pay amount is not derived from the number of hours worked. To evenly distribute the pay costs over the number of days at work, enter 8 hours per day to total 40 hours per week.

The Location will default from the employee setting. Change it if the work rendered on this line is in a different location. Review the Taxes and Deductions > Taxes for Multiple Locations section for more details.