Paying Sales and Use Tax

EBMS includes a step by step payment wizard to pay sales tax that has been collected from customers and use tax for consumed items. The tools included with EBMS are convenient ways to calculate the tax payable, the taxable totals, and the gross total

required by most state tax agencies.

These tools can be used in connection with the optional TaxJar SmartCalc sales tax calculation tool. This section can be ignored if the TaxJar > AutoFile tool is used to pay sales taxes.

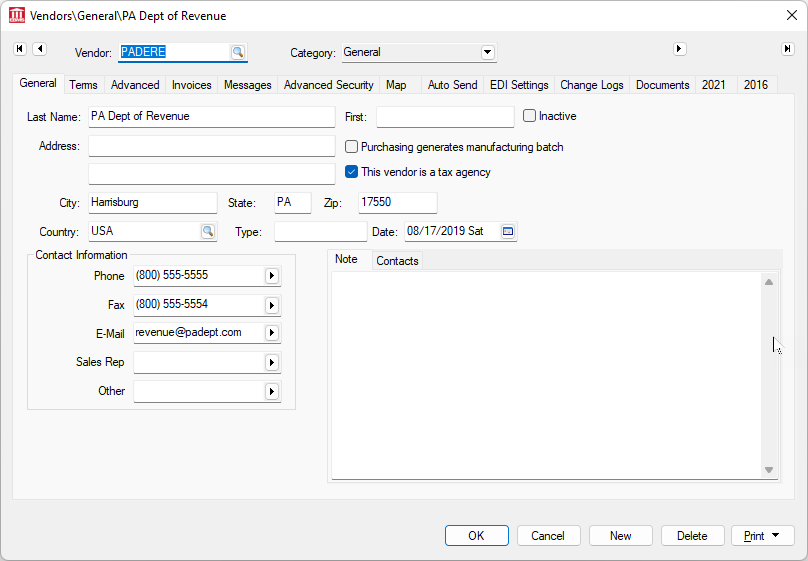

Create Tax Agency Vendor

Complete the following steps to create a vendor to pay sales tax:

-

Create a tax agency vendor. See [Financials] Vendors > Adding a New Vendor of the main documentation for more details on creating

a new vendor.

-

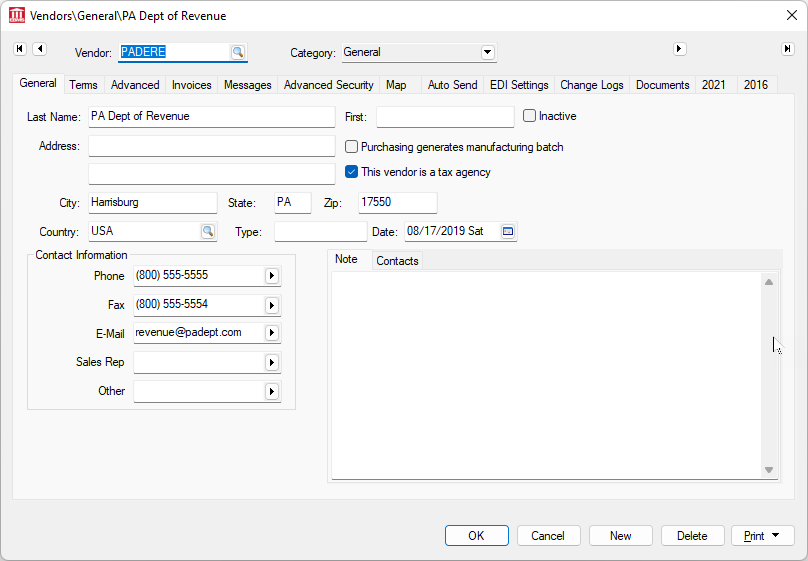

Click on the General tab and enable This vendor is a tax agency option.

-

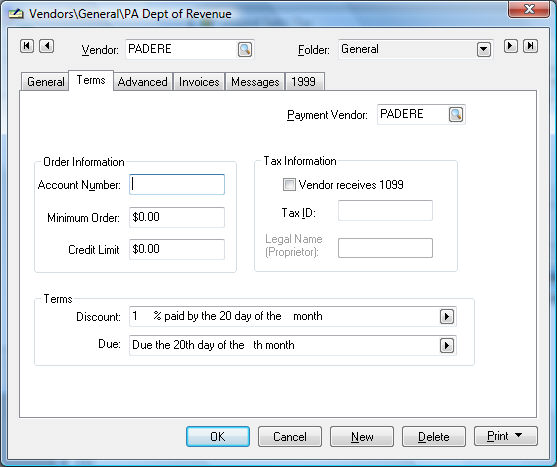

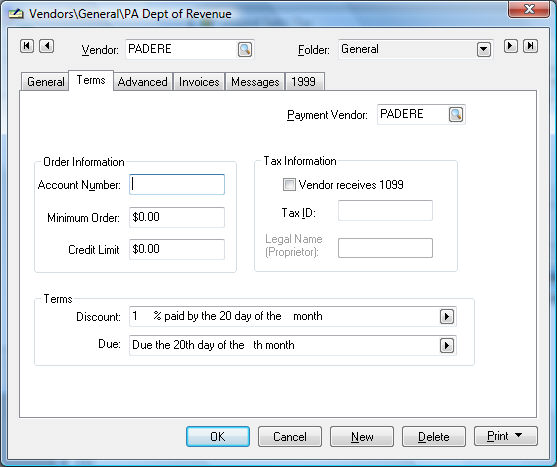

Click on the terms tab of the vendor and set the proper terms.

.

-

Set the discount terms to the proper percentage if the tax agency gives the tax collector a percentage for the collection costs. The

Discount and

Due settings shown above are the appropriate settings if the state gives a 1% discount and the payment due date is the 20th of the month.

-

Set the proper terms so the sales tax is paid by the due date.

-

Click on the Advanced tab to set the Vendor Discounts financial account.

This account should be a miscellaneous revenue account. Review [Financials] Chart of Accounts > Adding General Ledger Accounts for instruction to create a new revenue account.

-

Save this vendor by clicking OK.

Create Invoice for Tax Payment

Complete the following steps to configure the tax agency, generate an expense invoice, and pay the tax liability.

-

Verify that all tax rate tables contain the proper tax agency vendor ID. Repeat for all sales tax rate tables that are paid to the specific tax agency. This step must be completed before launching the Pay Sales Tax wizard.

-

Launch the Pay Sales Tax wizard by selecting from the main EBMS menu. Note that this wizard will include applicable sales and use taxes.

-

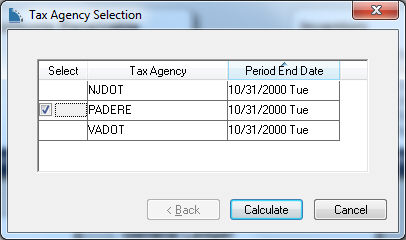

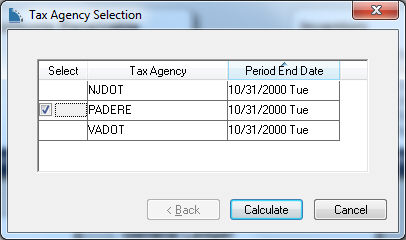

Select each Tax Agency that is to be paid by clicking on the Select column.

-

Click the Calculate button to open the following Unpaid Sales Tax list:

.

-

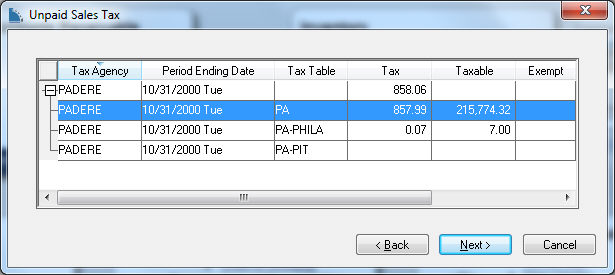

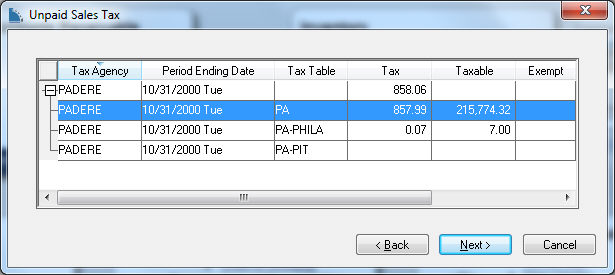

Review the tax values for each Tax Table associated with the selected Tax Agency. Click Next to open the following dialog:

-

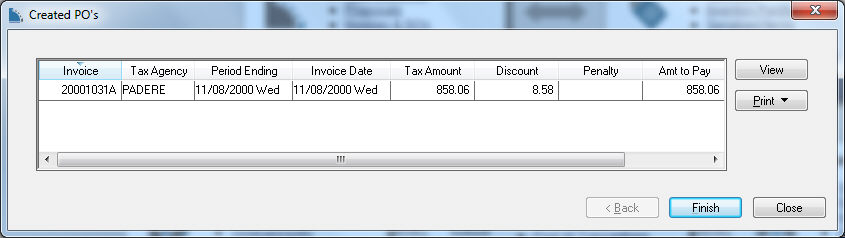

Enter any necessary Penalty fees.

-

Click Print to print the Sales Tax Detail report. Review the report documentation section below for details.

-

Click View to add any discount to the invoice as shown below:

NOTE: that the discount must be properly configured. If the user entered a credit line to the invoice the G/L Account MUST identify the discount income account and cannot use the same tax liability account as the tax lines.

-

Click one of the following to create the expense invoice:

-

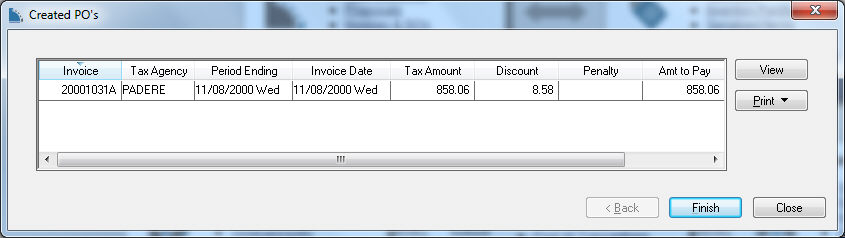

Click Finish to process the payment expense invoice. Review [Financials] Vendor Payments > Selecting Invoices to be Paid for steps to generate the payment.

-

Click Close to create a purchase order but not process the document into an expense invoice.

-

The sales tax payment invoice can be deleted and the payment wizard relaunched. Note that the system marks sales tax transactions paid when invoice is processed. Creating an invoice manually without using the payment wizard does not properly mark sales tax records paid.

Review [Financials] Expense Invoices > Processing an Invoice for instructions to process the invoice.

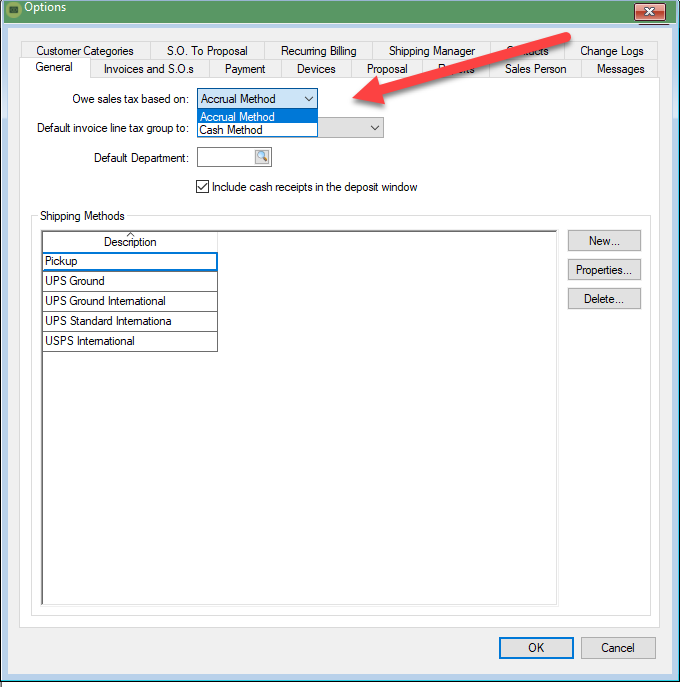

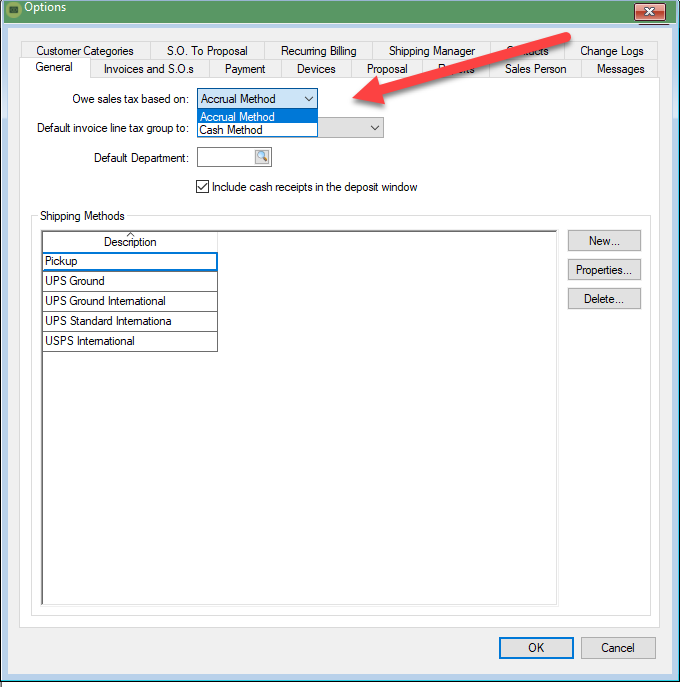

Pay Sales Tax using the Cash method instead of Accrual

This option allows a company to wait to pay sales until an invoice is paid. This option should not be used without careful consideration and approval from the company's accountant. This option should not be changed if sales tax payments have already

been made using the alternative method. The initial payment may require adjustments.

Open the from the main EBMS menu to change the Owe sales tax based on method.

The recommended method to calculate sales tax is the Accrual Method.

Note: The cash sales tax method does not list any sales orders with down payments. The sales invoice must be processed before any sales tax is reported. The cash method will report all sales invoices as soon as any payment is made on the invoice with

sales tax.

Continue with the Tax Report section below using the automatic report for cash-based sales tax reporting.

Tax Report

This report requires that the payment wizard to create the payment invoice (see Create Invoice for Tax Payment section above) has been completed. The automatic report rather than the manual report should be used for either the accrual

or cash methods.

Select from to list tax liability totals.

Reports can be printed to list the transaction detail by selecting the appropriate report from the Print button located on the tax rate dialog. Review [Main] Reports > Print Button for instructions to add specific sales tax reports to the Print button.