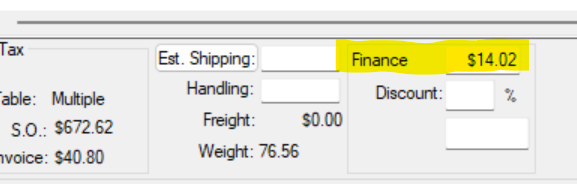

Remove (if any) the finance charges stored within each Invoice that will be written to bad debt.

Verify that finance charges are blank by printing statements for the customer. Review Customer Payments > Printing Customer Statements.

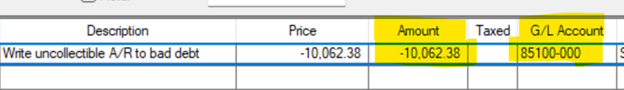

Identify per customer account the total amount of all invoices being written to bad debt. This total is shown on the statement generated in the previous step.

Create a credit invoice for the customer for the amount identified. Replace the sales G/L in the credit with your bad debt G/L expense account and click OK when prompted to remove sales tax. Process the credit sales

order to be an outstanding credit on the customer’s account.

Review Credits > Processing Customer Credits.

Open the customer in the Customer Payments dialog. Mark all outstanding invoices as paid using the bad debt credit. Review Customer Payments > Processing Customer Payments for more information.

Per your company policy, take any desired steps needed to lock down the customer account, restrict the customer from charging or change their due terms (terms tab), consider adding a message on the customer account that prompts users to collect from the customer before making new sales to the customer (messages tab), etc.