Open the vendor list by selecting Vendors in the Expense menu ().

To create a new vendor, click the Edit

menu and select New. A new

vendor wizard will begin with the following steps.

Highlight the folder in which to place the new vendor.

Enable the Copy existing option

ON to copy information from another vendor. Review the Adding

and Deleting Vendor Folders section for more details on creating

new folders. Click Next to

continue.

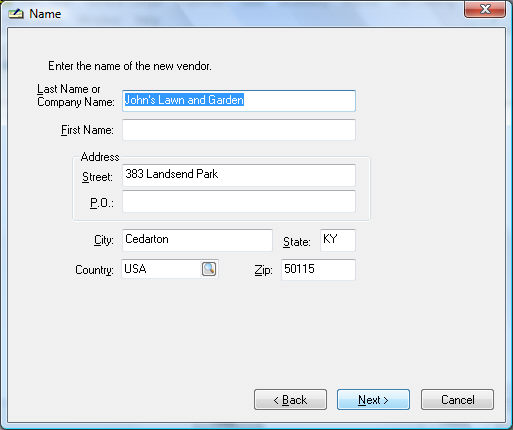

Enter the vendor's name and address information in

the appropriate fields. Enter a company name in the Last

Name entry field and let the First Name blank. EBMS searches a

postal code database when the user enters a Zip

code and populates the matching City,

State, and Country

settings. Review the [Main]

Features > Postal Code Database for more details. Click Next to continue to the next wizard

page.

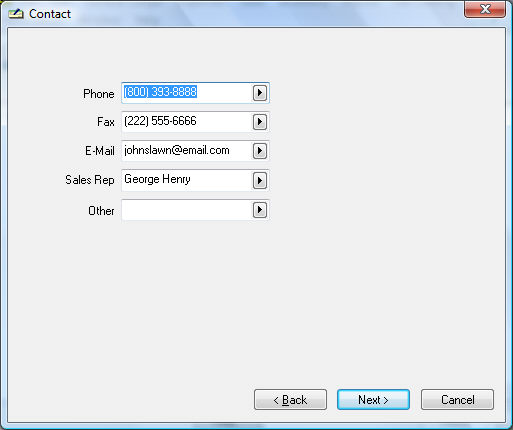

Enter the Contact

Information as requested. Clicking on the arrow key to the

right of the field and selecting the appropriate field name will change

the field label. Click Next.

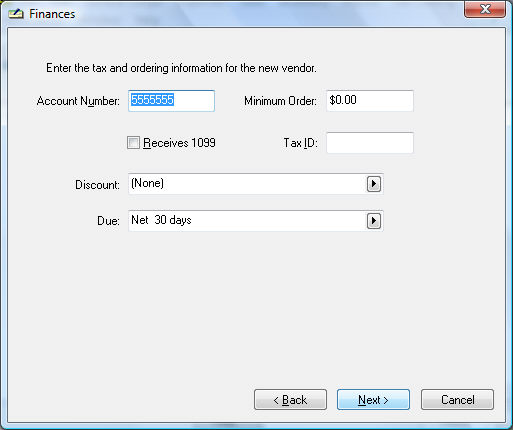

Enter the Finances information.

Account number: the numbers or letters entered in this field are the account number assigned to your company by the vendor.

Minimum order: if the vendor requires a minimum order amount, enter it in this field. Note: When a purchase order is processed and the dollar amount is less than the amount specified in this field, a message will be displayed stating that the invoice is below the minimum order.

1099: Indicates if this vendor gets a 1099 form by checking the box provided.

Tax ID: If this vendor gets a 1099, they must supply their tax ID number. This will be either a social security number or an Employer Identification Number.

Discount: Use this field to list the discount, if any, that the vendor allows to be taken on their invoices. To set the discount requires two steps:

Set the proper discount template by clicking on the right arrow button to the right of the discount field. A drop-down list will display all the discount options. If this vendor does not offer term discounts, set the entry field to (none) and ignore the second step.

If the discount template is set, you will need to enter the discount detail information. For example if you set the option to "__ % paid in __ days" you must enter the discount percentage and the number of days in which the vendor allows the discount to be taken. Review the Discounts and Finance Charges section for more details.

Due: Use this field to set the due date terms. Similar to the discount field, the due date requires two steps:

Select the template by clicking on the right arrow and selecting one of the options. If this field is set to (none), the system will not prompt the user that the invoice is due. If the due date of the vendor that is being edited is unknown, enter "Net __ days" which is the most common type of terms. Complete this entry by setting the days to 30 as shown in next step. Options: Cash, Collect on Delivery, and Due on receipt are all processed as due immediately.

Template may require term details such as a date or number of days. For example if Net __ days template is selected the exact number of days must be set to complete due date terms.

Click the Next button to continue to next page

of wizard.

Enter the Vendor ID. This ID is required to be unique to a specific vendor. This ID is used throughout the entire accounting system for all transactions associated with this vendor (changing the vendor ID is a lengthy process plan, so use an ID that is satisfactory). Review [Main] Standard Features > Creating IDs for details on automatically creating the ID code.

Click Finish to create a new vendor or Cancel to ignore new entries.