Customer Finance Charges

Finance charges (overdue charges) should be calculated before statements are printed. these overdue charges can be calculated at any time and as often as the user wishes without any adverse effects. The entire finance charge amount is recalculated for each invoice every time the finance charge process is launched. The recalculation process will correct any charges based on any partial payments or date changes.

The finance charge is calculated and recorded for each invoice based on the invoice terms and the Finance Charge settings in the customer's Advanced tab. The following sections will explain the formula used to calculate finance charge for each invoice.

Days Overdue

The finance charge is calculated by determining the number of days that each invoice is overdue. The EBMS software will calculate the number of days overdue by calculating the beginning date from the end date. The end Date is entered on the Update Finance Charge dialog launched from Sales > Update Finance Charges menu option. The beginning date used to calculate the overdue period can be one of the following 3 options:

-

Invoice Date - This option calculates the finance charge based on the original invoice date. This option is the most common method of calculating finance charges. For example if an invoice was processed with an April 15th date with 30 day terms and no extra grace period, the system will use the following formula to calculate the overdue period:

35 Days overdue = End date (date finance charge was processed) of May 20th. - Beginning date (invoice date) of April 15th.

Some would state that this method does not give the customer any grace period. Note that the finance charge process is normally launched only once or twice a month. The customer would have a grace period between the time the finance charge process is launched and the customer pays the invoice.

-

Due Date - This option calculates the beginning date based on the Due Date rather than the Invoice Date. This option would calculate 5 days as the total overdue days rather than 35 days in the example above.

-

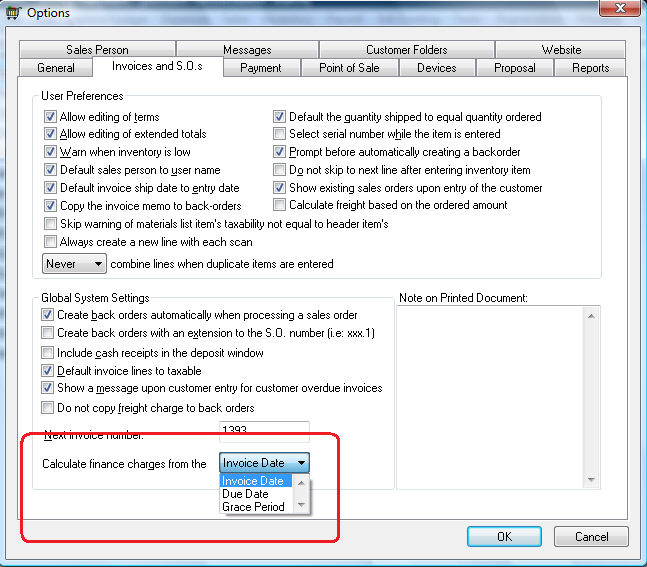

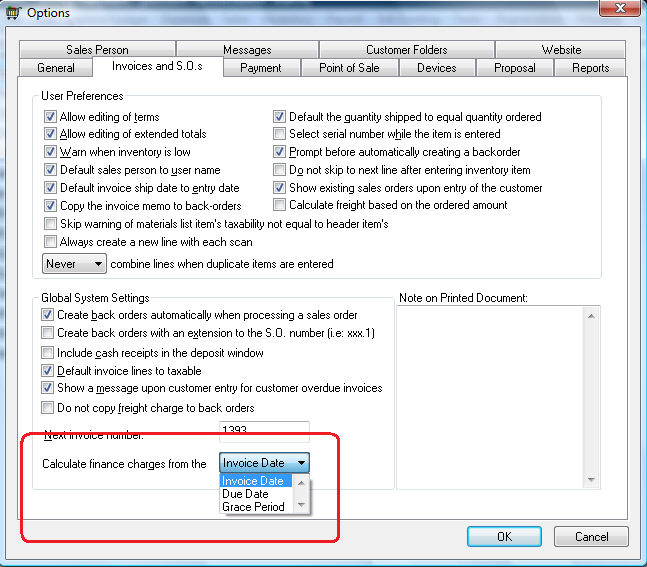

Grace Period - This option calculates the overdue days from the Grace Period setting within the customer's term record. Go to Sales > Options and click on the Invoices and S.O.s tab as shown below to view or change the begin date:

Grace Period

Finance charges will not be levied for an invoice if the process date is within the invoice's terms or within the grace period entered within the customer record. The due date and the grace period date for a specific invoice can be accessed by selecting View > Advanced Options from the sales invoice menu and clicking on the Options tab. Review the following section - Configuring Customer Terms for more instructions to change terms or grace period settings for a customer or group of customers.

Finance Charge Calculation

The finance charge amount is calculated using the Monthly Finance Charge Rate (RATE) entered in the Terms tab of the customer. Finance charge amount = RATE * 12 * balance * (Overdue days / 365). The system will adjust the finance charge amount based on partial payments made during the terms period.

The finance charge will equal the Minimum Finance Charge if the finance charge calculation for an invoice is less than the Minimum Finance Charge entry within the customer's terms record.

Finance Charges for Credits

Finance charges for invoices with credit balance (credit memos) will be zero unless the total finance charge due for all the customer's outstanding invoice is positive at the time the finance charge was calculated. The purpose of a negative finance charge on a credit memo is to offset the total finance charge in the following situation:

Invoice amount of $1000.00 that is overdue for 30 days with a finance charge of $20.

A credit memo is issued for -500.00 s that is also "overdue" for 30 days with a credit of $10

Another invoice of $200.00 is overdue for 10 days with a finance charge of $12.

The total finance charge is only $22 for both overdue invoices since a credit of $10 was included in the finance charge calculation.

Note that the finance charges for all documents would be zero if the finance charge total is equal to or less than zero.

Configuring Customer Terms

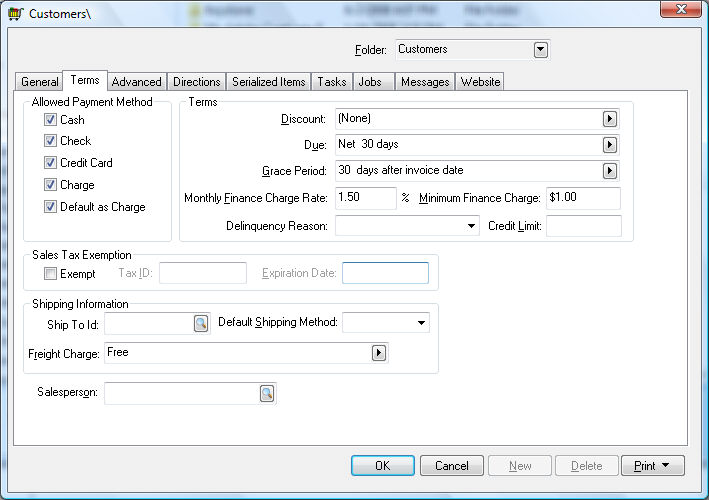

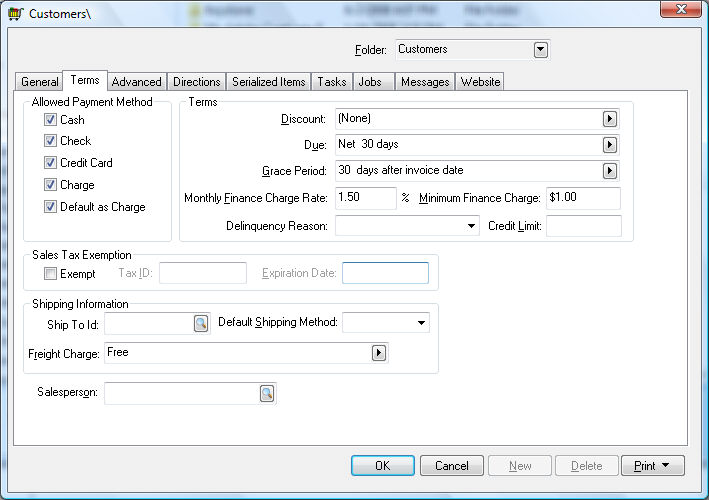

Go to Sales > Customers > Terms tab > Monthly

Finance Charge Rate settings to change a customer's finance charge rates.

Complete the following steps to change the finance charge rate for all customers:

-

Go to Sales > Options > Customer Folders tab.

-

Highlight the root folder titled Customers. Click on the Edit Defaults button.

-

Click on the Terms tab and the following window will appear:

-

Set the Grace Period option. The Grace Period setting affects the finance charge calculation by calculating the finance charge from the grace period date rather than the due date. The Grace Period options are as follows:

-

__ days after invoice date

-

__ days after due date

-

Select the (None) option to calculate finance charges from the due date.

The first two options require the user to enter the number of days of grace. Right-click on the Monthly Finance Charge Rate field and select Filter Down on the context menu.

-

Enter the desired M

onthly Finance Charge Rate.

-

Right-click on the Monthly Finance Charge Rate field and select Filter Down on the context menu.

-

Turn both switches ON and click OK to change all customer's finance charge rate. WARNING: this step overrides any unique rate entered in any customer's Advanced tab.

-

Enter the desired Minimum Finance Charge for all customers. This minimum charge is per overdue invoice and is not affected by the length of time that the payment was delinquent unless the calculated charge is greater than the Minimum Finance Charge. To not set any minimum charge set the Minimum Finance Charge field to zero.

-

Right-click and Filter Down in a similar way as the Monthly Finance Charge Rate entry explained above. For more details in filtering down information, review the Features > Change Defaults, Filter Down Data and Globally Change Data section of the main documentation for more details.

Launching the Update Finance Charge Process

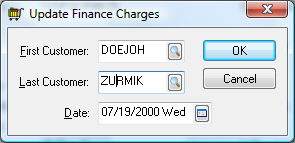

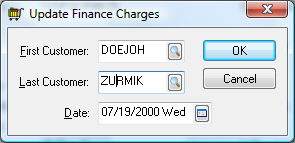

Each time customer statements are printed, the user will be prompted to run the finance charge process. Review the Printing Customer Statements section for details on processing statements. To run the finance charge process independently of printing statements, go to the Sales > Update Finance Charges and the following dialog will appear:

-

Enter the range of customers that you wish to charge finance charges on overdue invoices. The finance charge will be calculated on the time period between the specified Date and the invoice date.

-

Click OK to process the finance charges.

Sending Statements

Review Printing Customer Statements to configure and print customer statements

Review E-commerce > Customer Portal > Online Statements to configure and post the statement online on a customer portal.