EBMS gives the user a lot of flexibility to configure the type of pay used to reimburse workers. Pay is often based on an hourly rate but The Pay Type setting can multiply the hourly pay by 150% for overtime pay or 200% for after hours pay. Benefit pay such as vacation, sick, and personal, can be limited based on the amount of hours accrued by the worker. The options to accumulate hours or roll-over hours from one year to the next are all set within the Pay Type settings. Pay types can be based on a dollar commission, salary, tips, reimbursements, piecework, as well as various hourly pay types. Pay types are used to identify the type of pay added to a timecard and the type of pay listed on the worker’s history and pay stub. Pay types must be entered within the worker’s pay tab before a pay type can be used within the worker’s timecard. This ability to create and configure pay types based on the needs of the company gives the user maximum flexibility within the labor module of EBMS.

Complete the following steps to view, add, or change the standard pay types:

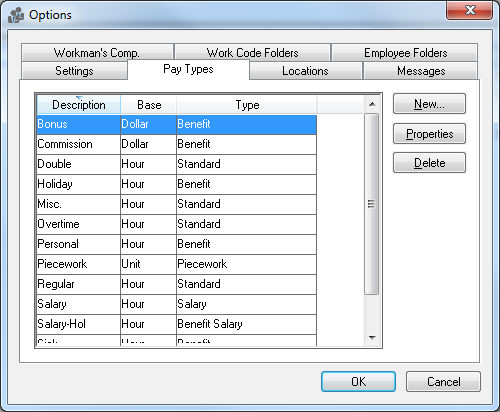

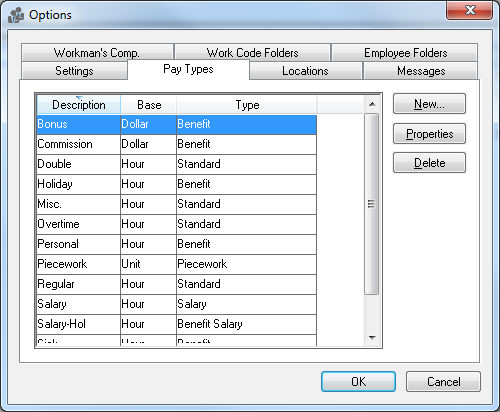

Go to and the following window will appear:

EBMS is installed with various Pay Types but additional types can be added or modified. Pay Types can also be deleted if the existing settings are not needed in the future.

Pay Types must be added to a worker's record before a pay type can be used in that worker's timecard.

Complete the following steps to add a pay type:

Enter a short Description of the new pay type.

Select a Base option of either:

Dollar based pay is used for pay such as bonuses, commissions, tips, or piece work.

Hour based pay is the most common type of pay. It is calculated by taking the number of hours worked and multiplying by the hourly rate.

Enter the Type of pay, which can be any of the following:

Benefit pay is normally hourly based. This type records the number of hours accumulated, number of hours used and the total available at the current time. Hours can be accumulated automatically in a number of different ways. Some common Benefit type pays are vacation, holiday, sick, or personal pay. See Workers > Benefit Pay section for more details on setting up Benefit pay types for an employee.

Employer Paid Tips type identifies tips that are paid through the payroll check. All tips that are recorded in payroll but are taken home as cash must be identified as Take Home Tips pay. Employer Paid Tips are always dollar based. Review the Workers > Processing Tips section for more details.

The Salary type is used to identify salary pay. Review the Salaried Pay > Salaried Pay Overview section for details on processing salary pay.

The Standard type is the most common used type. Use this type if none of the other types apply.

The Reimbursement option is useful when reimbursing an employee for miscellaneous expenses such as mileage or tolls that should not be taxed. Review the Workers > Reimbursements section for more details.

Take Home Tips is the pay type used to process tips that were paid to the employee as cash. Take Home Tips are always dollar based. Review the Workers > Processing Tips section for more details.

Benefit Salary is similar to the Benefit type except that the benefit pay is not added to the salaried employee’s pay, but rather the benefit time is included in the employee’s salary. This type is useful if the salaried employee does not get paid extra for vacation or holidays but the number of days needs be tracked within the benefit hour windows. Review the Salaried Pay > Entering Salaried Employee Information section for more details.

Piecework is used when paying an employee by the piece rather than by the hour. This option may not be available if the optional piecework feature is not included in your system. This type is always dollar based.

The Following options are only applicable if when the Base value is set to Hour and the Type setting is set to Benefit or Benefit Salary.

The Reset Hours Available setting identifies the method used to reset the annual benefit hours. Review the pay tab section of Workers > Changing Workers Information to setup pay types within an employee.

Turn the Carry unused hours to next year option ON to copy the balance of unused hours to the following year.

Click Ok to create new type or cancel to abort.

Review the Workers > Benefit Pay section for more details explaining the management of benefit hours.

Highlight the pay type to be edited.

Click the Properties button.

Change the Description if desired. Note that this description is used to identify the pay type throughout the system so if the description is changed the system must search through a number of databases and update the pay type description. This can be time consuming.

Change the Base if desired. Use with caution if the pay type has been used in previous timecards.

Warning: It is recommended that the user does not change the base from an hourly base to a dollar based if the pay type has already been used. This change can result skewed hour / pay reports especially

with benefit pay. It is recommended that the user create a new pay type for the new base and then remove the original pay type from the employee pay table.

Change the Type if desired. See list of types in section above. Use caution if the selected pay type has been used since the change will effect benefit hours and history.

Click OK to save or Cancel to abort.

Click Delete to remove an existing pay type. If this pay type is listed within any employee pay tab or within the employee folder defaults, the pay type will not be able to be deleted.