Go to Sales > Options and click on the Sales Person tab. The commission must be processed for each salesperson individually.

Highlight the salesperson and click the Properties

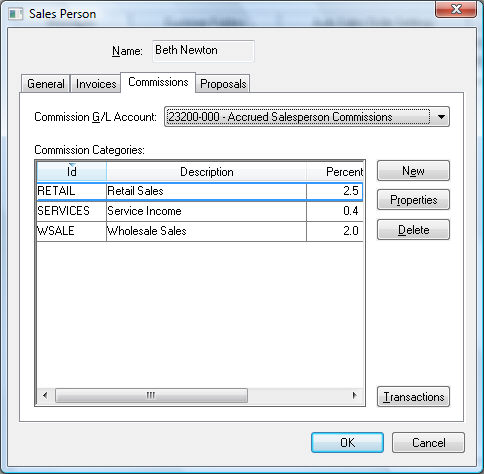

button to open the salesperson record. Click on the Commissions

tab as shown below

Click on the Transactions

button to view the commission list. The system will prompt the user

to post transactions if there are transactions that are not posted

within the sales file. General ledger transactions must be posted

before they are displayed on the transaction list displayed below

Set the commission Payment Date on the top of the transaction dialog. Only commission transactions from invoices dated on or before the Payment Date will be displayed on the list. This date is used to identify the commission payment when processing reports.

Select on of the methods to view transactions:

Show Detailed Transactions: Shows individual transaction that generates commission.

Summarize by Invoice: Summarize transactions by invoice.

Commission transactions should be selected and processed before the salesperson is paid. Select the transactions by clicking on the first column labeled Select. Commissions should be paid to the salesperson a) immediately after the sale or b) after the customer pays the invoice in full.

Click on the Select All button to select all the transactions. This option will process the salesperson’s commission after the invoice is processed.

Click on the Select Paid button to only select the commissions that were generated from sales invoices that are fully paid. Note that the Select Paid button will not select the commissions from partially paid invoices.

Voided Invoices and invoices that are unprocessed with show as a negative transaction. This feature will adjust the salesperson’s commission pay if the invoice is processed, commission is processed, and the invoice is un-processed and deleted.

Commissions can be adjusted using either of the following 2 methods:

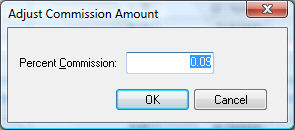

Individual transactions can be adjusted by right clicking on the transaction and selected Adjust Commissions from the context menu.

Enter the adjusted commission amount and click OK.

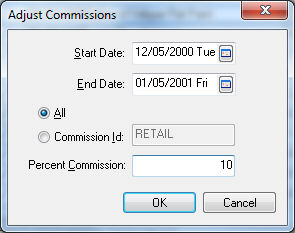

A group of transaction can be changed by clicking on the Adjust Commissions button on the bottom of the list. The following adjustment dialog will appear

:

Enter the range of dates (Start Date and End Date) for the transactions that need to be adjusted. Select the Commission Id of the transactions. Enter the new Percent Commission and click the Process button to complete the changes.

Click the OK button to process commissions when all the commissions are validated.

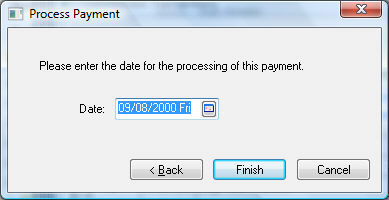

Click the Next

button to continue to the next wizard page:

Enter the commission payment Date and click the Finish button. All the transactions are grouped using this payment date. This date is required when commission reports are processed as shown below.

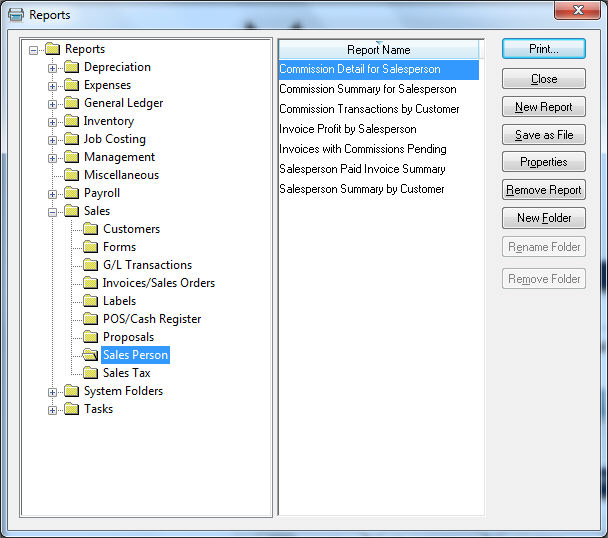

Complete the following steps to generate a transaction report to give to the salesperson or management:

Go to File > Reports and open the Reports > Sales > Salesperson group

.

The reports that are marked with a red check mark require the commission payment date entered during the process.Select a report such as the Commission Detail for Salesperson.

The Commission Date is the date entered during the transaction process. The Period Ending date is for reporting purposes only.