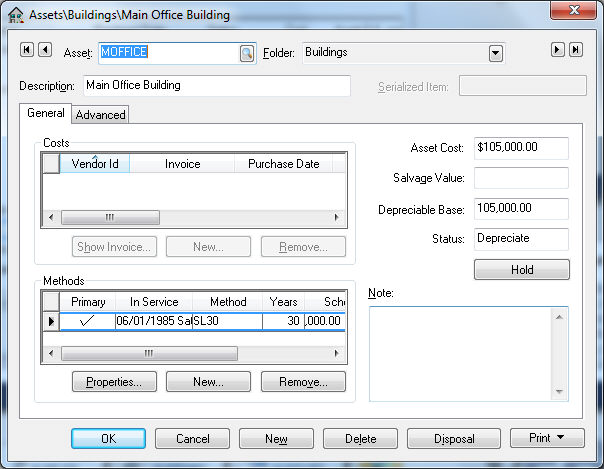

Go to Financials

> Depreciation

> Depreciable Assets and select an existing

asset.

The asset Description,

Folder, and Notes

can be changed at anytime.

Highlight an invoice within the Costs box and click on the View Invoice button to view the expense invoice for the depreciable asset. If the Vendor Id contains "($)DEPR" the cost was manually entered using the new asset wizard rather than generated from an expense invoice and cannot be viewed. See Purchasing Assets > Adding Fixed Assets for more details creating new asset records.

An asset can be assigned multiple methods. The primary method (identified by the check mark) is the method used during the monthly process. See Processing Depreciation > Depreciating Assets using a Monthly Process. All other methods are used to create adjustments within the general ledger for report purposes. See the Alternative Depreciation Methods for Reporting Purposes section for details on how to add or use alternate methods.

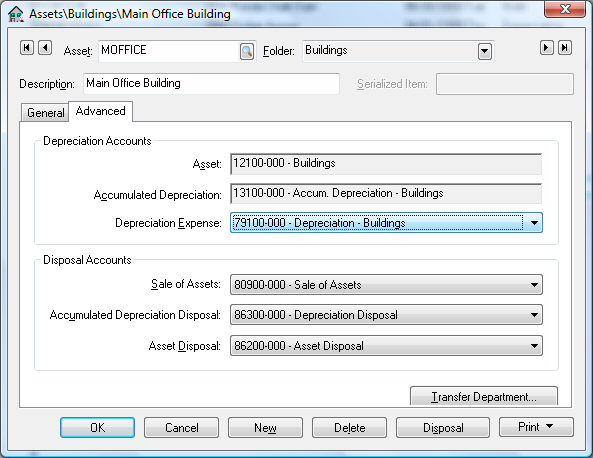

The general ledger account settings for an

asset can be seen by clicking on the Advanced

tab as shown below:

The Depreciation Accounts are general ledger accounts that must be classified with the following settings:

Asset: An asset account classified as Depreciable Asset

Accumulated Depreciation: Enter an asset account classified as Accumulated Depreciation. The monthly depreciation amounts will be credited to this account during process. See Managing and Processing Assets > Depreciating Assets using the Monthly Process section for details on the depreciation process.

Depreciation Expense: Enter an expense account classified as Depreciation Expense. The monthly depreciation amounts will be debited to this account during process. See Managing and Processing Assets > Depreciating Assets using the Monthly Process for details on the depreciation process.

The Disposal Accounts are general ledger accounts that must be classified with the following settings: These accounts will be used when an item is disposed or sold. See Disposing Assets for more details.

Sale of Assets: Enter a revenue account classified as Sales of Assets

Accumulated Depreciation Disposal: Enter an expense account classified as Depreciation Disposal

Asset Disposal: Enter an expense account classified as Depreciation Asset Disposal.

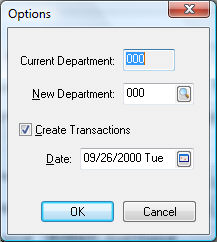

Click on the Transfer

Department button to move an asset from one department into another.

Enter the new Department code. The system will change all general ledger codes to match the new department if they exist. The general ledger account will not be changed if any of the Depreciation or Disposal Accounts do not contain the new department. General ledger transactions will be created if the Asset or Accumulated Depreciation accounts are changed. The new transactions will be created using the Process Date. Click OK to create the transactions.

Click on the OK button to save any changes to the asset.