Most invoice information such as quantities, pricing, and IDs cannot be changed after the invoice is processed unless the invoice is un-processed. An invoice may need to be voided for the following reasons:

Invoice information was entered wrong and data needs to be changed such as a wrong G/L account, wrong invoice date, invalid pricing, wrong inventory item, etc. This can only be accomplished by un-processing the original invoice, changing the incorrect data and reprocessing it. After an invoice is processed, most of the information cannot be changed since the transactions were used to update history information.

The purchase order was accidentally processed into an invoice.

A processed invoice cannot be deleted directly but must be voided and then the unprocessed invoice (purchase order) can be deleted.

To undo an invoice, take the following steps:

View the invoice to be voided. Review the Viewing Vendor Invoices for further details.

Select Process > Unprocess from the invoice menu or press Ctrl + U on the keyboard.

When an expense invoice is voided or unprocessed, negative transactions are posted to the general ledger to reverse the previous transactions when the invoice was processed.

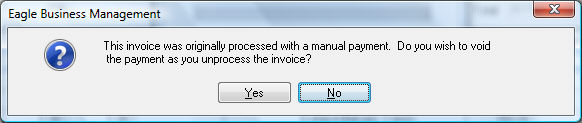

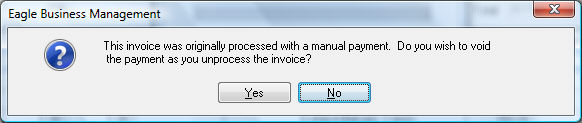

The following dialog will open if the invoice was originally processed as manual. The payment should be void if the invoice is being unprocessed and deleted. Do not void the payment if the invoice is to be altered and reprocessed.

Click Yes to void the payment or No to keep the payment associated to the purchase order. Review the Voiding a Check section for details in voiding payments.

Note: You will not be able to void an invoice that was processed within a fiscal year or month that has already been closed. If it is not possible to void the invoice, enter a credit to offset the transactions that were created by the original invoice.