Establishing Tax Rates

It is important that the sales tax accounts are properly configured

before the point-of-sale portion of EBMS is used to invoice customers.

The user should determine which sales tax rates apply to the business

before proceeding with this section. These rates must also be added

to calculate use tax.

A sales and use tax rate record should only be added to EBMS for applicable

states or provinces. Do not add rates into EBMS unless the company is

required to collect the tax for the specific tax jurisdiction (sales tax

nexus). A state sales tax table may require one or more sales tax rate

records for a specific state.

Identify if a state is origin-based or destination based. Review

Origin vs Destination

Sales Tax for an explanation.

Perform the following steps to setup the sales and use tax within EBMS.

Note that these accounts will be created by TaxJar if sales

tax is calculated by the TaxJar SmartCalc too. Review TaxJar

> Overview for details.

A liability G/L account(s) should be created for both sales

and use tax before the tax rate record is entered. Go to Financials

> Chart of Accounts and

create a sales and use tax liability account for each group of taxes.

For example, create a single general ledger account if the sales tax

collected includes both a state and county tax and both are

paid to the same vendor. Repeat a single account for the use tax as

well. Create multiple accounts if the tax is paid to different

vendors. Review the Financials

> Chart of Accounts > Adding General Ledger Accounts section

of the main documentation for details on adding both a sales and use

tax collected liability G/L account.

- Create a vendor record for the Tax

Agency for the new sales and use tax. Go to to create a new vendor as shown below. Review

[Financials]

Vendors > Adding a New Vendor of the main documentation for

details on how to create a new vendor

.

Go to Sales >

Sales Tax > Rates to view the tax rate table

as shown below. Steps #3 and #4 can be ignored if tax

rates are calculated by the TaxJar sales tax subscription. Review

TaxJar > Overview for details.

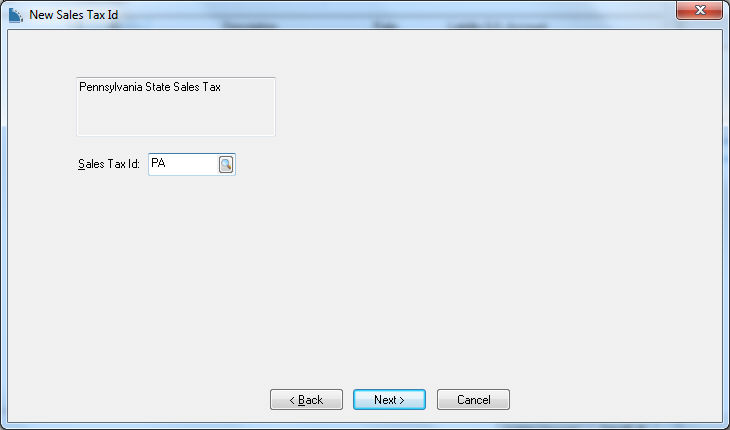

Click on the Edit

menu and select New

to create a new sales tax rates within EBMS and the following dialog

will appear:

Enter a Description of the sales/use tax

that is being entered identifying the state and type of tax. The

sales tax identification number can also be recorded within the

Description field.

Enable the Print

separately on invoice option to itemize this tax rather

than combining with another tax rate. This option should only

be disabled if multiple rates should be combined on the sales

order or invoice. Edit the sales tax Label

shown on the invoice if necessary.

Configure the Category

settings. The Applies to:

setting should be set to Country

for a national sales tax, State

if it is a state tax, County,

City, or Zip.

This setting will affect the other category entries. All category

entries must be populated. Use the two-character abbreviation

for the state entry. The county and city should not be abbreviated.

Configure the Rate Information.

Select the tax Rate

Type:

Select the Flat

Amount type for any tax that is based on quantity

such as a fuel or FET tax. Review the Sales

Tax > Calculating Fuel Taxes section for an example

of a flat tax setup.

Select the Percentage

type to calculate tax based on a percentage rate. This

is the standard Rate

Type for most sales tax settings.

Enter the Current

Rate.

The Effective

Date entry can be left blank unless the tax rate was

changed within the past two years or a new rate takes effect

in the future. Review the Changing

Rates and other Settings section for more details.

The Maximum

option only applies for percentage rate taxes. Review the

Luxury,

VAT and Sales Tax Minimums and Maximums for more details

on the Maximum setting.

Choose a Sales

Tax on Freight setting.

Select Tax

if there are any taxable items to charge sales tax

on freight, if any taxable items exist on the sales invoice.

Select Pro-rate

based on taxable items to pro-rate the sales tax calculation

on the freight amount, based on the percentage of taxable

items.

Select Never

Tax to make all freight charges tax exempt.

Configure the Payment

settings.

Enter the Sales Tax Liability Account.

Click on the drop-down button to the right of the field to

list all available sales tax general ledger accounts. These

accounts are identified within the general ledger as accounts

with a classification of Sales Tax. Review the Financials

> Chart of Accounts > Chart of Account Folders section

for more details.

Enter the Use Tax Liability Account.

Click on the drop-down button to the right of the field to

list all available use tax general ledger accounts. These

accounts are identified within the general ledger as accounts

with a classification of Use Tax.

Enter a vendor ID in the Tax

Agency entry. The system will use this vendor ID when

the sales tax is paid to the tax agency. The vendor ID should

be the same for sales tax rates that are paid to a common

tax agency. Review [Financials]

Vendors > Changing Vendor Information within the main

documentation for vendor details.

Choose a Payment

Frequency.

Enable the Report

gross sales from sales in states with no presence option

to add gross sales from states with no sales tax liability.

This option should only be enabled for the main tax table

if recommended by your accountant. Do not enable this option

for multiple tax rate records.

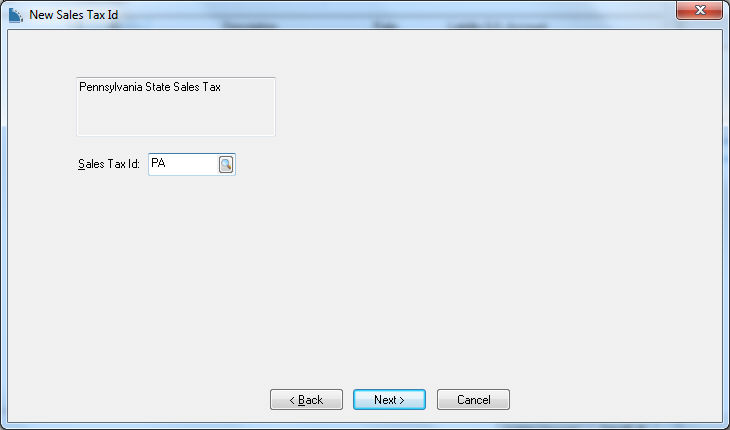

Click the Next button to continue and enter

a unique Sales

Tax ID.

Click the Next

button to continue.

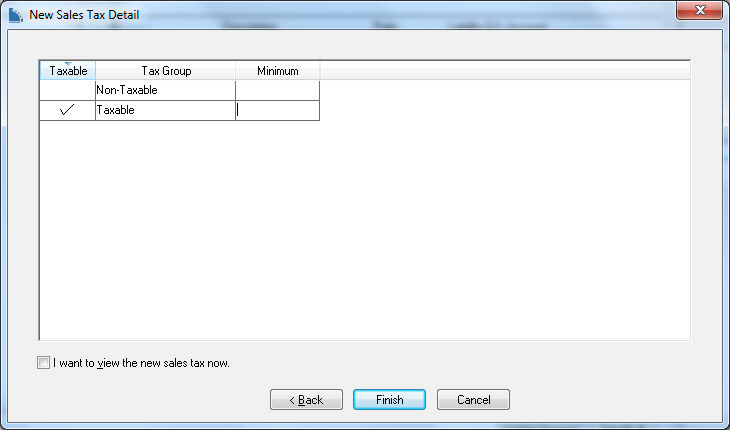

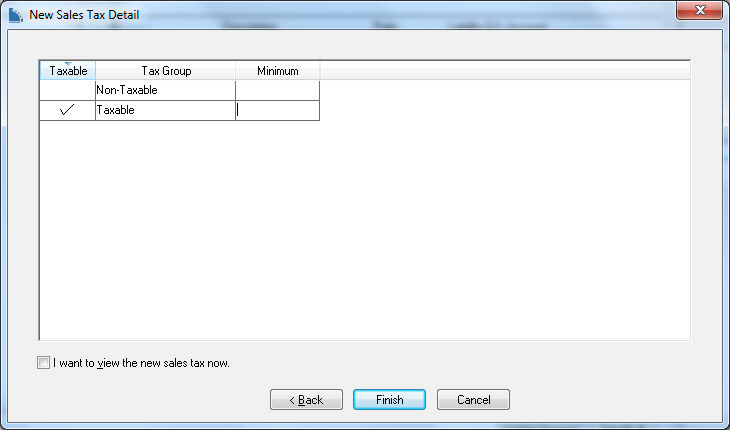

Each tax group must be identified as taxable or non-taxable.

Enable the Taxable option

to charge tax for the specific tax

Group. Review Inventory

Tax Group for more details on creating tax groups.

Click on the Finish button to complete the new

wizard.

Review TaxJar > Overview

for a cloud based service to manage sales and use tax rates.