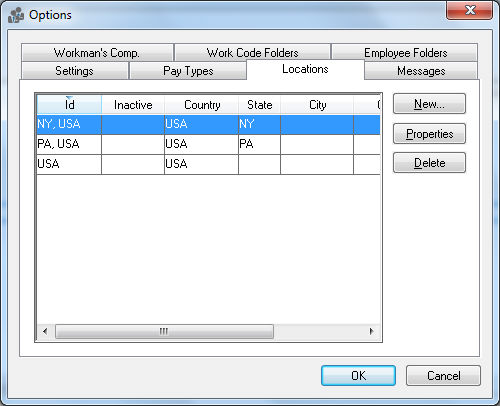

Go

to Labor > Options and

click on the Locations tab.

The

locations record should include a general Country

setting such as USA and the

primary State/Province location

of the business. Add any City, County,

Zip locations that require specific tax calculations. Also

Include any additional tax jurisdiction locations by clicking on the

New button, as shown below:

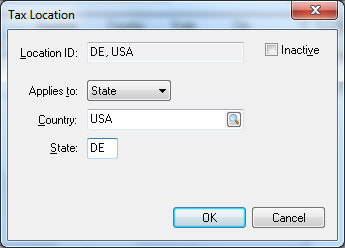

The Location ID is created by the system and cannot be changed by the user.

Set the appropriate Applies to setting:

Select Country for any federal tax.

Select State for any state or provincial tax.

Select City, County, or Zip for any local tax.

Set the appropriate Country, State, and/or local setting and click OK.

Repeat for each tax Location.

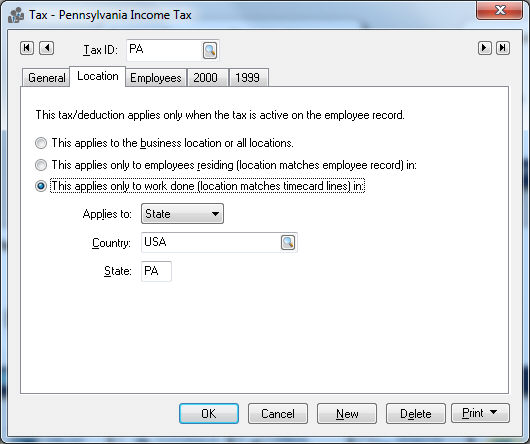

Set

the Location setting for each

tax. Go to Labor > Taxes/Deductions

and select the appropriate tax. Click on the Location

tab.

Select the This applies to business locations or all locations option if this tax or deductions always applies, no matter what location the work is done.

Select the This applies only to employees residing (location matches employee record) in option if the tax is based on the location setting within the employee record.

Select the This applies only to work done (location matches timecard lines) in if the tax is based on the location of where the labor is rendered. Set the appropriate Applies to and location settings and click OK.

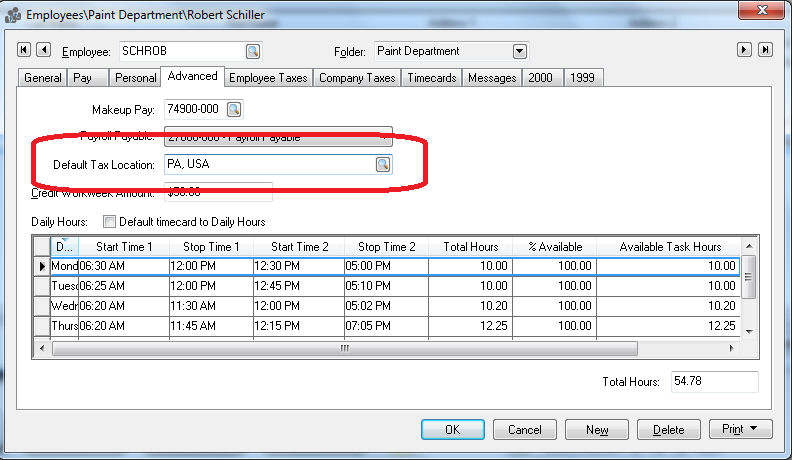

Set

the Default Tax Location for

each employee. Open the employee record (Labor

> Workers from the main EBMS menu) and click on the Advanced tab. The Default

Tax Location should reflect where the employee normally works.

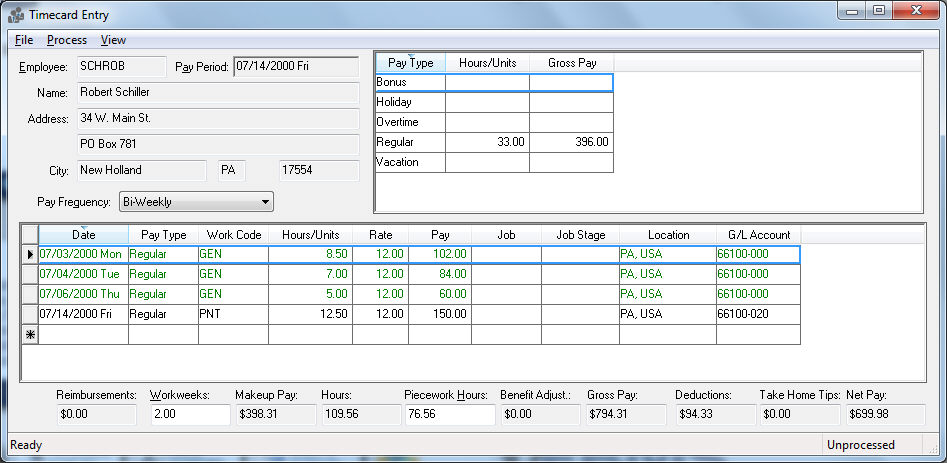

Open

an employees timecard by selecting Labor

> Timecard Entry.

The Location column will default to the employees Default Tax Location in the employees Advanced tab. Make sure the Location column is not hidden. Review the Features > Column Appearance section from the main EBMS documentation.

The Location setting should be changed if the employee labor for this detail line is rendered in a different location than the previous line.