Create a reimbursement pay type if

one does not already exist. Go to . Click on the New

button to create a new pay type.

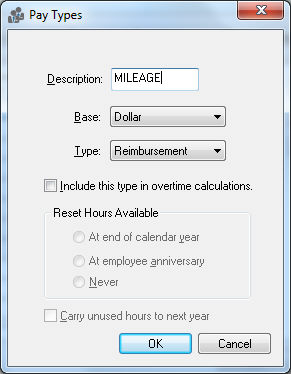

Enter a reimbursement Description such as Reimburse or Mileage to be more descriptive.

Enter the Base type as Dollar.

Set the Type option as Reimbursement and click OK to save and exit.

Enter the pay type into the employee’s pay rate list. Go to . Review the Workers > Changing Workers Information section of this manual for more details.

Enter an additional detail line within the employee’s timecard with a pay type as reimbursement pay (whatever the pay type description) and enter the reimbursement amount in the pay column.