Adjusting Inventory Count and Value

Steps to Review before Counting Product

At times, it is necessary to adjust inventory counts. Review the following

items before creating an adjustment:

Review open unprocessed documents: Review all open, unprocessed

documents within EBMS containing Products to confirm Shipped

or Received quantities are valid and match

the true state of the open document. This may include sales

orders, purchase

orders, manufacturing

batches, serialized

added cost batches, and job

transfers.

Compare the date on the count report to the date the products

were counted. Note that product counts may be adjusted while

the count is in progress unless the business is closed or no inventory

is being purchased or sold.

Review product item classification: Adjustments only apply

to perpetual inventory items classified as Track

Count, Serialized Items, or Lot.

Review Product Catalog

> Item Classifications for a list of perpetual inventory classifications.

Making an Adjustment

Complete the following steps to make an adjustment:

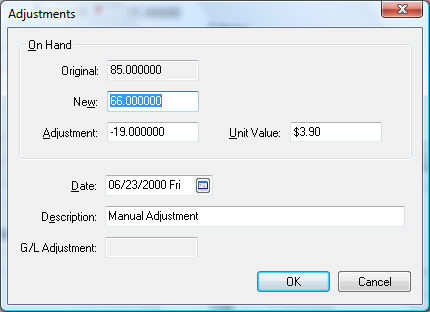

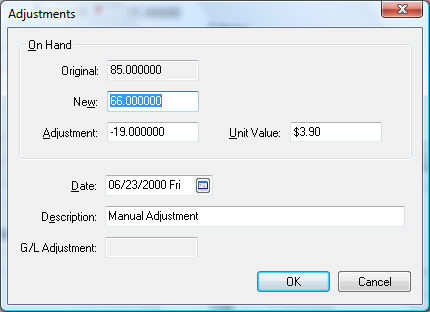

Go to and click on the

Adjustments button and the

following window will open:

The Inventory Adjustment dialog displays the Original

on-hand amount which should equal the amount on the shelf or display.

The on-hand counts are increased as soon as items are received on

the purchase order (Received quantity populated) or decreased when

the items are pulled for an order (Ship To quantity populated on the

sales order).

Enter either the New

on-hand amount or an Adjustment

amount.

Enter the unit value of the inventory on hand in the Unit

Value field. The inventory asset value will be incremented

by the cost value.

Enter the adjustment Date

of the inventory count. When entering the beginning amount of an item

on hand, use a date within the last fiscal year so the year-end balances

reflect the total value of the inventory on hand at the beginning

of the New Year.

Enter a Description

of why the adjustment is being made.

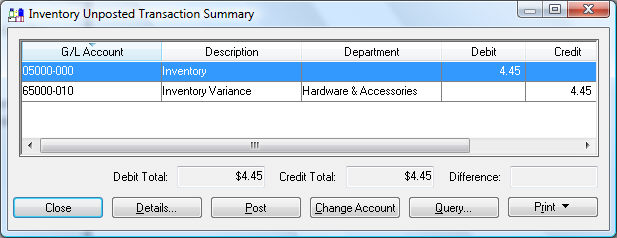

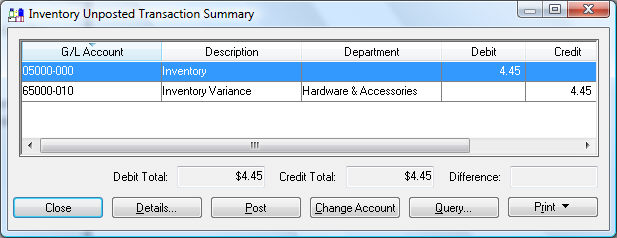

The following transaction will be created if the inventory item is classified

as Track Count or other perpetual inventory classification.

Debit |

Credit |

Amount |

Inventory Asset Account |

Inventory Variance |

Adjustment Value (The value will be negative if the count

has been reduced) |

The actual transactions can be viewed by clicking to open the following summary list:

The following transaction will be created if the inventory item is classified

as No Count or Service or other non-inventory item.

Debit |

Credit |

Amount |

Inventory Variance |

Inventory Variance |

Adjustment Value |

Since both the debit and credit transaction are posted to the same inventory

variance account, the general ledger will not be affected. These transactions

will adjust the inventory history value. Review the Inventory

> IProduct Catalog > Inventory History for more details on inventory

history.

Use the inventory adjustment screen sparingly. It is best to enter or

correct a sales order or purchase order if a known mistake was made. Adjust

the inventory count using the instructions above when the count does not

match the total inventory on hand or beginning inventory needs to be entered.

Inventory counts can be adjusted in a batch. Review Adjusting

Counts as a Batch for more details on the batch method.

Review the

Lots > Tracing Lots and Reporting Lots Information section for

more information on adjusting items classified as Lots.

Review the Serialized

Items > Purchasing or Manufacturing an Item > Viewing or Changing

Serialized Items from the Inventory Item. section for information

on adjusting serialized items.

Adjustment Report

Generate this report to list all adjustments between two dates.