Detailed history is recorded within the EBMS software. This information is used for sales reference and accounting reconciliation. Keeping accurate accounts receivable information is important for knowing who your reliable customers are. The customer window shows a history of their purchases. This aids in making decisions concerning credit limits, allowing or disallowing discounts, and other financing decisions. The customer year tabs will only be updated when sales have been posted to the general ledger. This aids in verifying that customer information agrees with the General Ledger. This is very important in reconciling customer totals to the General Ledger Accounts Receivable accounts.

There are two different access methods within the customer window. They are as follows:

Invoices tab

Year History tabs

To access the customer information window, go to Sales > Customers and select the customer you wish to access.

Click on the Invoices tab to display the following window:

To view all of a customer's past invoices, set the Status option to All. To only view Sales Orders, Outstanding invoices, or Paid invoices, set the appropriate Status option. To view or edit an invoice or sales order, open the document by double-clicking on the document.

Click on the New Invoice button to create a new sales order or invoice.

The date or invoice number columns can sort the list by clicking on either column heading. Move to the beginning of the list by pressing the top button on the scroll bar, or press Ctrl + Home on the keyboard. To move to the end of the list, press the Ctrl + End keys.

Click on any fiscal year tab to view the customer's annual history.

Year tabs will appear on the customer window for each year that any invoices or payments were processed for a specific customer. EBMS does not restrict the number of years or tabs that may exist. Each year's history page lists monthly invoice totals, monthly payments, and the end of month accounts receivable balance for the customer.

To drill down and view the detailed invoice or payment transactions, take the following steps:

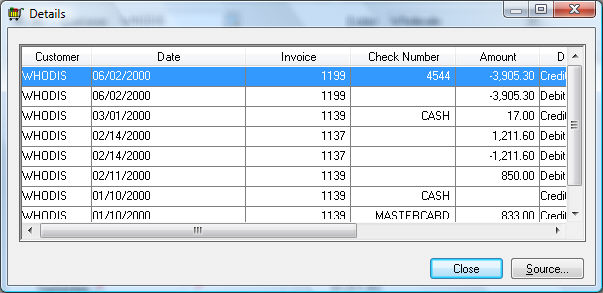

Right-click on any monthly invoice or payment total and select Drill Down from the context menu. The transaction Detail window will open.

To view a specific transaction, double-click on any

transaction or highlight the transaction and click on the Source

button and the source of the transaction will be displayed.

The example shown above includes three transactions that contain

an identical invoice number. The original $1473.40 was processed by

the administrator. The -$1473.40 transactions indicates that the invoice

was unprocessed. The invoice was changed and reprocessed with a total

of $1770.20. This set of transactions gives the user a complete audit

trail of the transactions created by invoice 1176.

Note that a transaction must be posted to the general ledger before

it will appear on the customer history year tabs.

3. Click the Close button when finished.

The Average Payment Days records the average time period in which the customer pays their invoices.

The Down Payment total reflects the balance of any prepayments or deposits made by a customer. A down payment is always connected to a sales order. The Down Payment total is reduced when the sales order is processed into an invoice. This balance field only reflects the outstanding down payments and does not total all the down payments made during the year.

Double-click on the Down Payment total to view all the customer's down payment transactions.

The credit transactions include the payment number (Check Number column) and are created when the down payment is processed. The debit transactions are created when the sales order is processed into an invoice. See the Down Payment on an Invoice or Sales Order section for more details. Click on the Close button to close the transaction detail window.

The Balance amount on the lower right side of the window reflects the outstanding balance including all the down payments.

All history transactions are retained until the user decides to remove them using the purge utilities. The year-end close procedure does not remove history transactions or invoices.

Review the Financials > Transactions > Account History Tabs section of the main documentation for more details on the history tab summary.