Work Codes

Work codes are an important component of the EBMS Payroll System. A

work code is required to identify the work category for each detail line.

The payroll expense general ledger account is identified by the work code.

The work code is a useful management tool for analyzing and managing payroll

costs. The payroll rates are associated with the work code when processing

piecework pay and prevailing wages. Review the Processing

Piecework Pay and Prevailing Wages

sections for more details. The work code can be associated with an employee

and pay type to conveniently default the code within the timecard. Work

codes must be setup before any payroll is processed because a work code

entry is required on each time card. To enter new work codes, edit existing

work codes, or to view work code history, take the following steps:

- Go to Labor > Work Codes,

and open work code and the following window will appear:

The

General Ledger Account identifies

the expense or cost of sales general ledger account into which

the payroll expenses are posted for this work code. To create

detailed work code history using a number of different work codes

without using a large number of different general ledger wage

accounts, it is possible to direct multiple work codes into a

single general ledger account.

The

Description of the work

code is used in search lists or reports to further describe the

work code.

Workman’s Compensation Classification: This setting

is used to generate workman’s compensation reports based on the

employee’s work class that is identified by the work code. If

employees are grouped within the Workman’s Comp

classifications rather than an employee having multiple classes

then set the Workman’s Comp. Classification to (Use Employee Class).

Review the Getting Started

> Workman's Compensation section for more details.

The

Wage Type options depend

on the available payroll modules and include Standard,

Piecework (if piecework

is enabled in the Labor >

Options > Settings tab) and Prevailing

Wage (if prevailing wage is enabled in the Payroll >

Options > Settings tab). Normally this setting is set to Standard.

Enter

an optional Associated Service

Item if the work code labor is being resold. This entry

should be kept blank for non-billable labor. This service item

is used for reporting purposes.

The

Note field can be used

to further explain the work code or to record details as needed.

To create a new work code, click the

New button and enter the information

described above.

Click Delete to delete the current work

code. A work code can not be deleted if wage history has been posted

to the year pages.

The Print button works like other print

buttons and can have reports linked to it to select or reports can

be added by selecting Add Report.

Work codes are added to a timecard in a variety of ways including the

following:

Entered by the user within the timecard:

Review the Processing Payroll >

Entering Timecards documentation for more details.

Populated by the task or work order:

Review the Tasks section for more

details.

Added to the timecard by the Time

Track App: Review Time Track > Microsoft

Store App > User Configuration for details on the Time Track

App configuration.

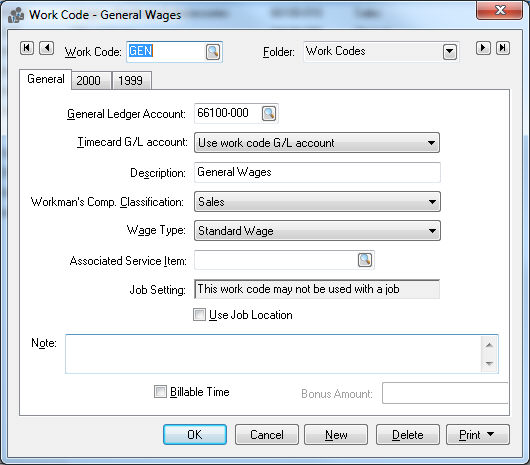

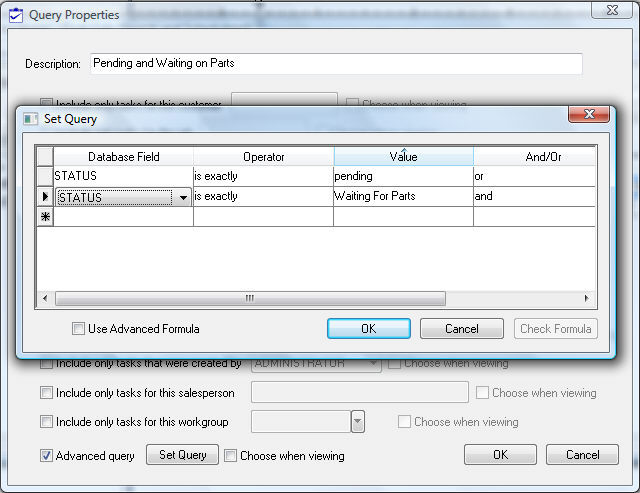

If any wages history have been posted using

the current work code, the history will show on the year history pages

shown below:

The columns Pay and Hours

list the gross pay and total hours posted to that work code for the corresponding

months. To view the detail, drill down on any month by right clicking

on a total and selecting Drill Down

on the context menu. It is also possible to drill down by double clicking

on the total with a mouse. The drill down list will open as shown below.

To locate the source of the detailed transactions, highlight the desired

line and click Source.

To return to work code history click on the Close

button.

To save any changes to the work code screen click OK.