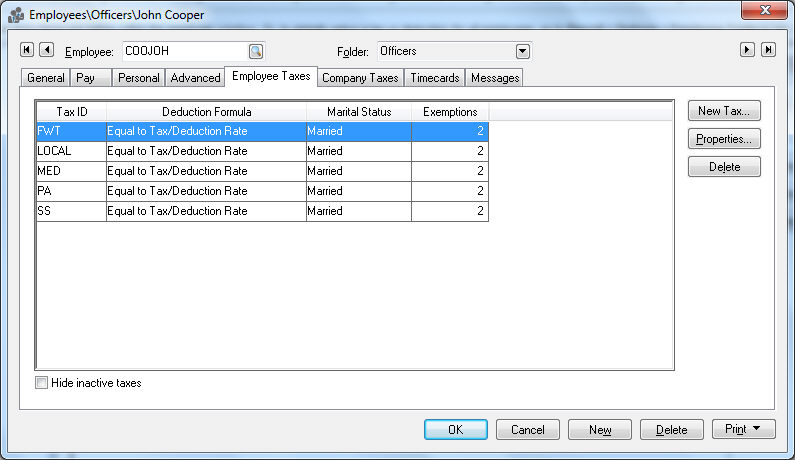

Employee taxes and deductions are setup within the employee window. Or, to globally setup a tax or deduction for all employees, go to Labor > Options > Worker Categories tab. Review the Workers > Setting Employee Defaults for details on globally changing employee information. Go to the employee window by selecting Workers on the Labor menu. Open an employee and click on the Employee Taxes tab.

This tab is used to identify any withholding tax or other employee deductions that are deducted from the employee’s paycheck. Any payroll taxes or deductions that are paid by the employer must be listed in the Company Taxes tab.

You must click on the Properties button to edit any existing tax information or click on the New Tax button to add taxes to the list.

Tax Adding

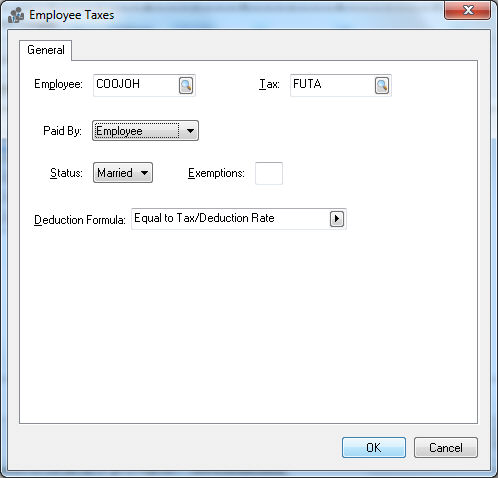

To add taxes to the tax list click on the New Tax button and the following window will open:

Select a valid tax or deduction from the tax list by clicking on the lookup button to the right of the tax field and selecting a valid tax from the tax list.

To create a new tax click on the New button on the tax list or go to Labor > Taxes/Deductions.

Review the Taxes and Deductions section for more details on entering or editing taxes or deductions. EBMS contains many of the common taxes, but verify that the correct rates are entered for each tax before you process any payroll.

Changing

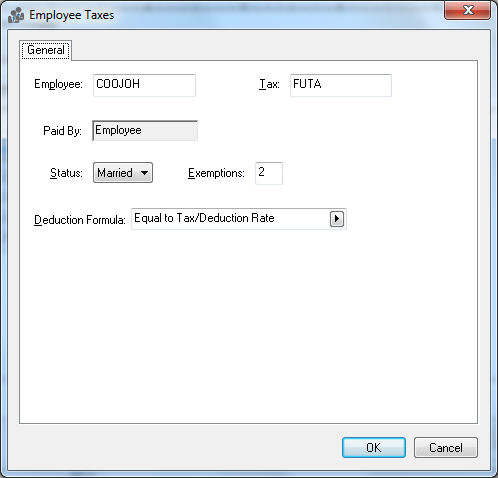

To edit Tax Properties select a tax from the tax list and click on the Properties button. The following window will open:

When editing tax Properties you cannot change the Tax identification code. If you wish to change the tax you must make the original tax inactive and then add the new tax line.

The marital Status will be copied from the employee’s Personal tab and should be kept the same unless this particular tax is to be calculated using a different marital status.

The number of Exemptions will be copied from the employee’s Personal tab and should be kept the same unless this particular tax is to be calculated using a different exemption number.

The Extra Deduction Formula is used to add an additional tax to the standard rate. This formula should be set to (none) or Equal to except for the following situations:

Set the Deduction Formula to Inactive (no taxable) to make the tax or deduction inactive. Note that a tax cannot be deleted if history is present. Review the Taxes and Deductions > Removing an Unused Tax Entry section for more details.

To add additional tax to the standard rate use the Add __ % template to add additional percentage for this employee or Add $__ template to add additional dollar amount. This feature is useful if an employee wishes to withhold an additional amount of Federal Withholding Tax, or if an additional amount is deducted from one employee compared to the other employees. It is best to set the appropriate rate within the Tax/Deduction window when possible, but the Deduction Formula can be used to do deductions that are more complex or variations.

To ignore Tax/Deduction rate and manually set the deduction amount use the Is $___ template to set the exact dollar amount of the deduction or use Is ___% template to set a percentage that is unique to this employee. These templates will ignore any rates set within the Tax/Deduction window.

Click OK to save changes.

Repeat the steps listed above for each tax that you wish to add or edit.

View Year

Select the appropriate tax and click on the Properties button. Go to the appropriate year tab to view the tax or deduction history for the entire year.

The history consists of 3 columns.

The Tax amount is the total that has been withheld from the employee.

The Taxable Gross amount is the employee’s total pay that was subject to the tax or deduction.

The Total Gross amount reflects the employee’s total gross including both the taxable and non-taxable totals.

To view the source detail for both the Tax and the Total Gross columns right click on the total you wish to view and select Drill down from the context menu. From the details list select the pay date that you wish to view and click Source to view the timecard from which the tax or deductions was withheld.

Click OK to return to the Employee Taxes tab.